Here's Why You Should Retain Charles River (CRL) Stock Now

Charles River Laboratories International, Inc. CRL is well-poised to grow in the coming quarters, backed by the strong growth of the RMS (Research Models and Services) segment. The robust performance of the safety assessment business is contributing to the DSA (Discovery and Safety Assessment) arm’s growth. Favorable solvency also generates optimism.

However, headwinds related to foreign exchange fluctuations and the impacts of stiff competition s are concerning for CRL’s operations.

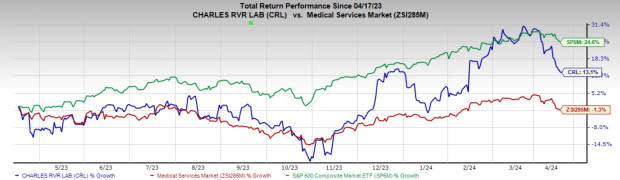

In the past year, this Zacks Rank #3 (Hold) stock has increased 13.1% compared with the 1.3% fall of the industry and 24.6% growth of the S&P 500 composite.

Operating as a full-service, early-stage contract research organization, Charles River has a market capitalization of $12.15 billion. CRL surpassed estimates in each of the trailing four quarters, delivering an average earnings surprise of 7.07%.

Let’s delve deeper.

Upsides

RMS Business Continues to Grow: According to Charles River, in 2024, RMS organic revenue will register flat to low single-digit growth. The current demand environment will likely limit unit volume growth this year in the research model business in North America and Europe. Accordingly, the company expects to drive most of the growth from modest price increases. In China, the company expects continued healthy demand for small models and associated services. In November 2023, the company gained 90% controlling interest in Noveprim, a NHP provider of Mauritius. Noveprim sale of NHP to third-party external clients has been included in the RMS segment, which is expected to drive meaningful margin improvement in the RMS segment.

DSA Arm Thrives: At present, Charles River is the largest provider of outsourced drug discovery, non-clinical development and regulated safety testing services worldwide. In 2023, DSA revenue increased 7.9% on an organic basis, banking on continued strong performance within the safety assessment business. The company expects flat to low single-digit organic revenue growth in the DSA in 2024.

Image Source: Zacks Investment Research

Stable Solvency Structure: Charles River exited Q4 2023 with cash and cash equivalents of $277 million compared with $234 million at the end of 2022. Meanwhile, total debt was $2.65 billion, compared to $2.71 billion at the end of 2022. Although the year's total debt was much higher than the corresponding cash and cash equivalent level, the company has no short-term payable debt on its balance sheet. This is good news in terms of the company’s solvency position, particularly during the time of economic downturn.

Downsides

Foreign Exchange Translation Impacts Sales: Foreign exchange is a major headwind for Charles River as a considerable percentage of its revenues comes from outside the United States. The strengthening of the Euro and some other developed market currencies has been constantly hampering the company’s performance in the international markets.

Competitive Landscape: Charles River competes in the marketplace on the basis of its therapeutic and scientific expertise in early-stage drug research, quality, reputation, flexibility, responsiveness, pricing, innovation and global capabilities. The company primarily faces a broad range of competitors of different sizes and capabilities in each of its three business segments. RMS has five main competitors, of which one is a government-funded, not-for-profit entity, one is privately held in Europe, and three are privately held in the United States.

Estimate Trend

The Zacks Consensus Estimate for Charles River’s 2024 earnings has moved up from $10.94 to $11.01 in the past 90 days.

The Zacks Consensus Estimate for the company’s 2024 revenues is pegged at $4.22 billion, which suggests a 2.1% increase from the year-ago reported number.

Key Picks

Some better-ranked stocks from the broader medical space are Stryker Corporation SYK, Cencora, Inc. COR and Cardinal Health CAH.

Stryker, carrying a Zacks Rank #2 (Buy), reported a fourth-quarter 2023 adjusted EPS of $3.46, beating the Zacks Consensus Estimate by 5.8%. Revenues of $5.8 billion outpaced the consensus estimate by 3.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker has an estimated earnings growth rate of 11.5% for 2025 compared with the S&P 500’s 9.9%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 5.1%.

Cencora, carrying a Zacks Rank #2, reported a first-quarter fiscal 2024 adjusted EPS of $3.28, which beat the Zacks Consensus Estimate by 14.7%. Revenues of $72.3 billion outpaced the Zacks Consensus Estimate by 5.1%.

COR has an earnings yield of 5.75% compared with the industry’s 1.85%. The company’s earnings surpassed estimates in each of the trailing four quarters, the average being 6.7%.

Cardinal Health, carrying a Zacks Rank #2, reported second-quarter fiscal 2024 adjusted earnings of $1.82, which beat the Zacks Consensus Estimate by 16.7%. Revenues of $57.45 billion improved 11.6% on a year-over-year basis and also topped the Zacks Consensus Estimate by 1.1%.

CAH has a long-term estimated earnings growth rate of 15.3% compared with the industry’s 11.8% growth. The company’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 15.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Charles River Laboratories International, Inc. (CRL) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance