Finance and HR Software Q4 Earnings: Marqeta (NASDAQ:MQ) Simply the Best

As the Q4 earnings season wraps, let's dig into this quarter's best and worst performers in the finance and HR software industry, including Marqeta (NASDAQ:MQ) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 14 finance and HR software stocks we track reported a slower Q4; on average, revenues beat analyst consensus estimates by 2.5%. while next quarter's revenue guidance was 1% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and finance and HR software stocks have had a rough stretch, with share prices down 7.4% on average since the previous earnings results.

Best Q4: Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

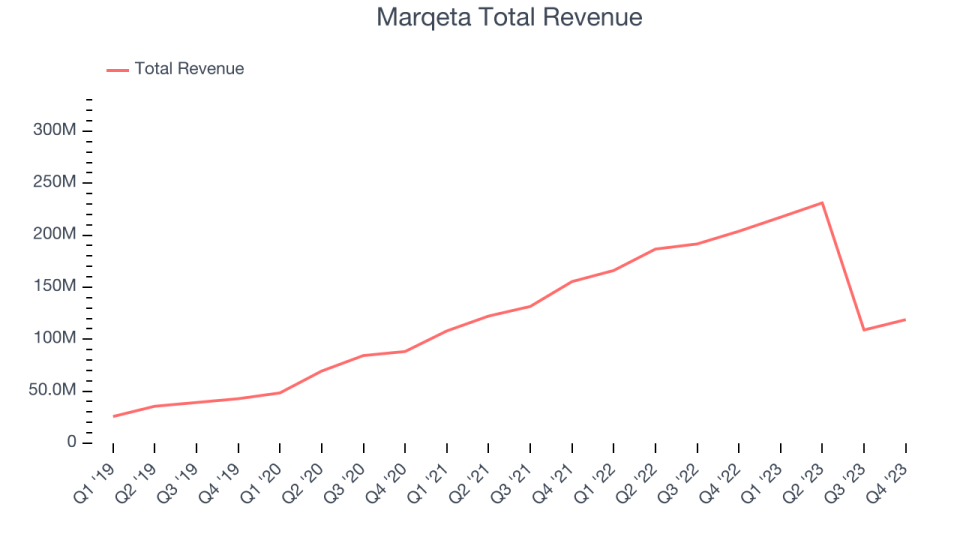

Marqeta reported revenues of $118.8 million, down 41.7% year on year, topping analyst expectations by 7.7%. It was an impressive quarter for the company, with a significant improvement in its gross margin and a solid beat of analysts' revenue estimates.

"2023 was transformative for Marqeta, as we enhanced our platform with new credit card program management capabilities, renewed the large majority of our processing volume to longer term deals, and delivered on operating efficiency," said Simon Khalaf, CEO at Marqeta.

Marqeta delivered the slowest revenue growth of the whole group. The stock is down 20.5% since the results and currently trades at $5.84.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it's free.

Bill.com (NYSE:BILL)

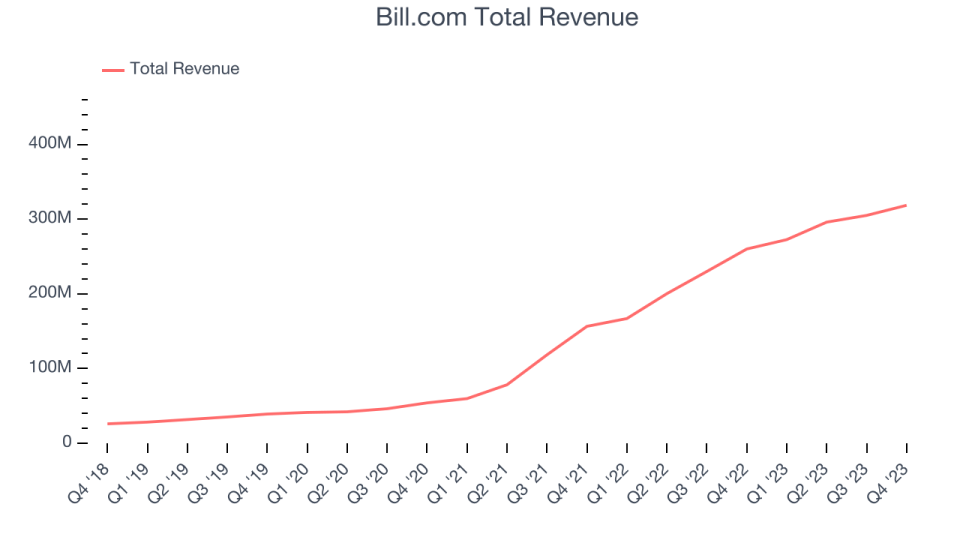

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE:BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Bill.com reported revenues of $318.5 million, up 22.5% year on year, outperforming analyst expectations by 6.8%. It was a very strong quarter for the company, with an impressive beat of analysts' billings estimates and a solid beat of analysts' revenue estimates.

The stock is down 15.3% since the results and currently trades at $64.12.

Is now the time to buy Bill.com? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Paychex (NASDAQ:PAYX)

One of the oldest service providers in the industry, Paychex (NASDAQ:PAYX) offers its customers payroll and HR software solutions.

Paychex reported revenues of $1.44 billion, up 4.2% year on year, falling short of analyst expectations by 1.2%. It was a weak quarter for the company, with a miss of analysts' revenue estimates.

Paychex had the weakest performance against analyst estimates in the group. The stock is up 2.3% since the results and currently trades at $124.33.

Read our full analysis of Paychex's results here.

BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

BlackLine reported revenues of $155.7 million, up 11.3% year on year, surpassing analyst expectations by 1.1%. It was a slower quarter for the company, with full-year revenue guidance missing analysts' expectations and decelerating customer growth.

The company added 30 customers to reach a total of 4,398. The stock is up 11% since the results and currently trades at $64.71.

Read our full, actionable report on BlackLine here, it's free.

Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $110.7 million, up 7.4% year on year, falling short of analyst expectations by 0.1%. It was a weaker quarter for the company, with full-year revenue guidance missing analysts' expectations and management forecasting growth to slow.

Zuora had the weakest full-year guidance update among its peers. The stock is up 2.4% since the results and currently trades at $8.8.

Read our full, actionable report on Zuora here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.