Parnassus Value Equity Fund's Strategic Moves: Spotlight on Amdocs Ltd with a -1.7% Impact

Insight into Parnassus Value Equity Fund (Trades, Portfolio)'s Q1 2024 Investment Decisions

The Parnassus Value Equity Fund (Trades, Portfolio), a segment of Jerome Dodson (Trades, Portfolio)'s Parnassus Investments, is known for its unique investment approach that combines value investing with environmental, social, and governance (ESG) criteria. The fund, which avoids fossil fuels and invests in companies with positive workplace environments, underwent a name change from Parnassus Endeavor Fund to Parnassus Value Equity Fund (Trades, Portfolio) on December 30, 2022. With Billy Hwan at the helm as the portfolio manager since the end of 2020, the fund continues to target deeply discounted U.S. large-cap companies that exhibit long-term competitive advantages, quality management, and strong ESG performance. The fund's strategy aims to outperform the S&P 500 Index by capitalizing on quality stocks at temporarily low prices, accepting a wider range of outcomes in pursuit of value.

Summary of New Buys

Parnassus Value Equity Fund (Trades, Portfolio) expanded its portfolio with 3 new stock additions:

Pfizer Inc (NYSE:PFE) emerged as the most significant new holding, with 3,185,839 shares valued at $88.41 million, making up 1.69% of the portfolio.

Charter Communications Inc (NASDAQ:CHTR) was the second-largest addition, comprising 256,096 shares, or 1.43% of the portfolio, valued at $74.43 million.

NICE Ltd (NASDAQ:NICE) rounded out the top three new buys with 235,097 shares, accounting for 1.17% of the portfolio, valued at $61.27 million.

Key Position Increases

The fund also bolstered its stake in existing holdings:

A notable increase was seen in CBRE Group Inc (NYSE:CBRE), with an additional 182,388 shares, bringing the total to 676,252 shares. This adjustment represents a 36.93% increase in share count, a 0.34% impact on the current portfolio, and a total value of $65.76 million.

Summary of Sold Out Positions

Parnassus Value Equity Fund (Trades, Portfolio) exited positions in 2 holdings during the first quarter of 2024:

Amdocs Ltd (NASDAQ:DOX) saw the fund selling all 950,620 shares, resulting in a -1.7% impact on the portfolio.

The fund also liquidated its stake in Biomarin Pharmaceutical Inc (NASDAQ:BMRN), disposing of all 832,295 shares, which had a -1.64% impact on the portfolio.

Key Position Reductions

The fund reduced its positions in 11 stocks, with significant changes in:

Comcast Corp (NASDAQ:CMCSA) shares were cut by 1,195,114, a -45% decrease, impacting the portfolio by -1.07%. The stock traded at an average price of $43.14 during the quarter and has seen a -6.60% return over the past 3 months and -7.22% year-to-date.

Progressive Corp (NYSE:PGR) was reduced by 248,652 shares, a -25.02% reduction, with a -0.81% impact on the portfolio. The stock's average trading price was $185.54 during the quarter, with a return of 21.23% over the past 3 months and 27.88% year-to-date.

Portfolio Overview

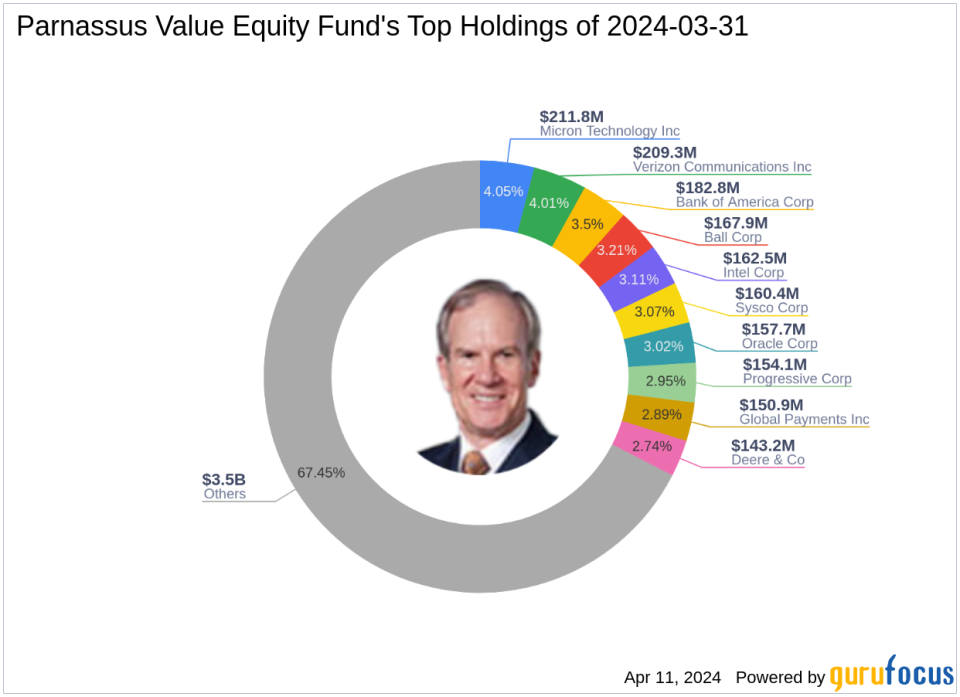

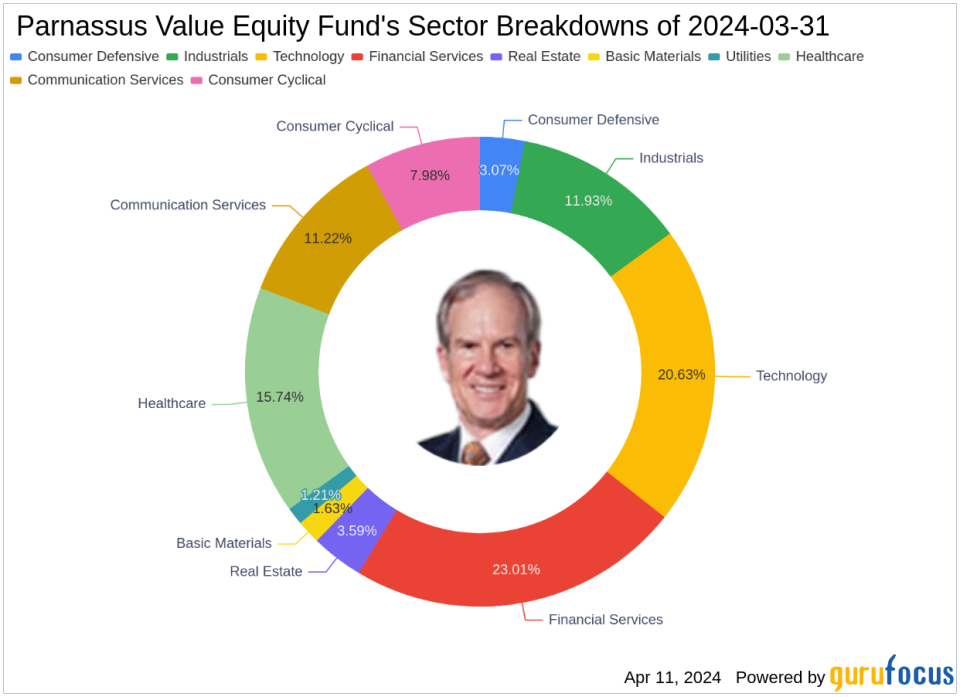

As of the first quarter of 2024, Parnassus Value Equity Fund (Trades, Portfolio)'s portfolio comprised 44 stocks. The top holdings included 4.05% in Micron Technology Inc (NASDAQ:MU), 4.01% in Verizon Communications Inc (NYSE:VZ), 3.5% in Bank of America Corp (NYSE:BAC), 3.21% in Ball Corp (NYSE:BALL), and 3.11% in Intel Corp (NASDAQ:INTC). The fund's investments are primarily concentrated across 10 industries, including Financial Services, Technology, Healthcare, Industrials, Communication Services, Consumer Cyclical, Real Estate, Consumer Defensive, Basic Materials, and Utilities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance