Sachem Capital Corp (SACH) Earnings: Revenue Grows Amidst Rising Interest Rates and Real Estate ...

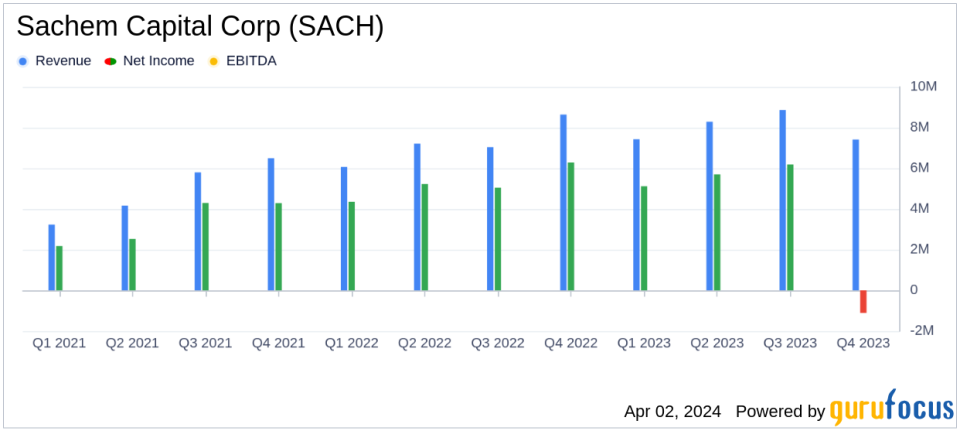

Revenue: Grew by 25.5% to $65.6 million, compared to $52.3 million in the previous year.

Net Income: Declined by 29.4% to $12.1 million, falling short of the estimated $40.4976 million.

Earnings Per Share (EPS): Dropped by 40.1% to $0.27, missing the estimated EPS of $0.11.

Total Assets: Increased by almost 11% to $625.5 million from $565.7 million in the prior year.

Dividends: Declared a quarterly dividend of $0.11 per share, consistent with analyst projections.

Interest Income: Rose to $49.3 million from $42.6 million in 2022.

Balance Sheet: Total liabilities increased to $395.5 million from $348.0 million at the end of 2022.

Sachem Capital Corp (SACH) released its 8-K filing on April 2, 2024, detailing the financial results for the year ended December 31, 2023. The company, a US-based real estate investment trust specializing in short-term loans secured by first mortgage liens, reported a significant increase in revenue, which grew by 25.5% to $65.6 million. This growth was primarily attributed to the expansion of the company's mortgage portfolio and higher rates charged to borrowers.

Despite the revenue growth, Sachem Capital faced macroeconomic headwinds, including rising interest rates and weakness in commercial real estate, particularly office spaces, which impacted earnings. Net income attributable to common shareholders saw a decrease of 29.4% to $12.1 million, or $0.27 per share, compared to $17.2 million, or $0.46 per share for the previous year. This decline was notably below the estimated net income of $40.4976 million and an estimated EPS of $0.11.

John Villano, CPA, CEO of Sachem Capital, remarked on the challenges faced by the company, stating,

While we remained disciplined and focused as we grew 2023 revenue nearly 26% over the prior year, we were met with a difficult macroeconomic backdrop including rising interest rates, weakness in commercial real estate, specifically office, and banking sector challenges."

The company's balance sheet reflected an increase in total assets, which rose nearly 11% to $625.5 million, driven by growth in the mortgage loan portfolio, investment securities holdings, and investments in partnerships. However, this was offset by an allowance for credit losses of $7.5 million, largely attributable to commercial real estate.

On the liabilities side, total liabilities increased to $395.5 million from $348.0 million at the end of 2022. The company's total indebtedness stood at $377.7 million, including various forms of unsecured notes payable and credit facilities.

Regarding shareholder returns, Sachem Capital declared a quarterly dividend of $0.11 per share, aligning with analyst projections and maintaining its commitment to distributing at least 90% of its taxable income to shareholders as required for REIT status.

The company's performance in the face of economic challenges underscores the importance of disciplined growth and risk management in the REIT industry. While Sachem Capital has demonstrated its ability to grow revenue, the impact of external economic factors on net income and EPS highlights the volatile nature of the real estate market and the need for strategic agility.

Investors and stakeholders can look forward to more detailed discussions during the company's webcast and conference call scheduled for April 1, 2024, where Sachem Capital will delve deeper into its financial results and strategic outlook.

Explore the complete 8-K earnings release (here) from Sachem Capital Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance