Snail (SNAL) Q4 Earnings & Revenues Miss Estimates, Stock Down

Snail, Inc. SNAL reported mixed fourth-quarter 2023 results, with earnings and revenues missing the Zacks Consensus Estimate. However, the top and the bottom line increased on a year-over-year basis.

Following the results, SNAL’s shares dropped 8.6% in the after-hour trading session on Apr 1, 2024.

Earnings & Revenue Discussion

During fourth-quarter 2023, SNAL reported adjusted earnings per share (EPS) of 7 cents, missing the Zacks Consensus Estimate of 27 cents. The company reported an adjusted loss per share of 6 cents in the prior-year quarter.

Quarterly revenues of $28.6 million lagged the consensus mark of $31.6 million. The top line rose 86.9% from $15.3 million reported in the year-ago quarter. The upside was backed by the release of ARK: Survival Ascended.

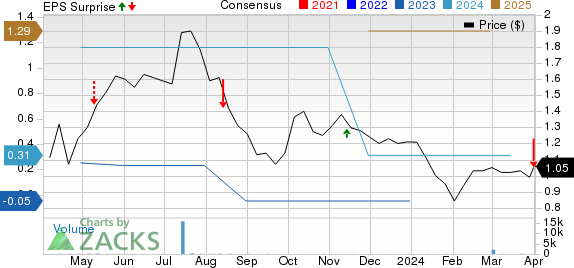

Snail, Inc. Price, Consensus and EPS Surprise

Snail, Inc. price-consensus-eps-surprise-chart | Snail, Inc. Quote

During the quarter, bookings totaled $52.6 million compared with $11.9 million reported in the prior-year quarter, driven by the strong release of ARK: Survival Ascended on Steam, PlayStation and Xbox platforms.

Operating Highlights

During fourth-quarter 2023, gross profit came in at 9.9 million compared with $2.6 million reported in the prior-year quarter.

Net income in the fourth quarter totaled $2.4 million against a net loss of $2.3 million reported in the prior-year quarter. The upside was driven by reduced general and administrative expenses and lower professional expenses related to compliance with public company requirements and litigation-related expenses. This was partially offset by a rise in advertising and marketing costs and a decline in the income tax benefit for the period.

EBITDA totaled $3.6 million against a loss of $5.2 million reported in the prior-year quarter.

2023 Highlights

Net revenues in 2023 came in at $60.9 million compared with $74.4 million in 2022.

Bookings in 2023 amounted to $85.7 million compared with $63.7 million in 2022.

Net loss in 2023 came in at $9.1 million against a net income of $1 million reported in 2022.

EBITDA loss totaled $9.7 million compared with $0.7 million a year ago.

In 2023, loss per share came in at 25 cents against a diluted EPS of 3 cents reported in the previous year.

Balance Sheet

As of Dec 31, 2023, cash and cash equivalents amounted to $15.2 million compared with $4.9 million in the previous quarter. Operating lease liability, net of the current portion, was $1.4 million, slightly down from $1.8 million in the prior quarter.

Zacks Rank and Stocks to Consider

Snail currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Consumer Discretionary sector are as follows:

Trip.com Group Limited TCOM sports a Zacks Rank #1 (Strong Buy). TCOM has a trailing four-quarter earnings surprise of 53.1%, on average. Shares of TCOM have gained 25.7% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TCOM’s 2024 sales and EPS indicates a rise of 18.2% and 8%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL carries a Zacks Rank #1. RCL has a trailing four-quarter earnings surprise of 26.4% on average. Shares of RCL have surged 118.8% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS indicates a rise of 14.7% and 47.9%, respectively, from the year-ago levels.

Hyatt Hotels Corporation H carries a Zacks Rank #2 (Buy). It has a trailing four-quarter earnings surprise of 17.8% on average. Shares of H have increased 43.5% in the past year.

The Zacks Consensus Estimate for H’s 2024 sales and EPS indicates a rise of 3.5% and 27%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Snail, Inc. (SNAL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance