Tripadvisor (NASDAQ:TRIP) investors are sitting on a loss of 51% if they invested three years ago

It is doubtless a positive to see that the Tripadvisor, Inc. (NASDAQ:TRIP) share price has gained some 32% in the last three months. But over the last three years we've seen a quite serious decline. Tragically, the share price declined 51% in that time. So the improvement may be a real relief to some. The rise has some hopeful, but turnarounds are often precarious.

Since shareholders are down over the longer term, lets look at the underlying fundamentals over the that time and see if they've been consistent with returns.

Check out our latest analysis for Tripadvisor

We don't think that Tripadvisor's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, Tripadvisor saw its revenue grow by 41% per year, compound. That is faster than most pre-profit companies. In contrast, the share price is down 15% compound, over three years - disappointing by most standards. This could mean hype has come out of the stock because the losses are concerning investors. When we see revenue growth, paired with a falling share price, we can't help wonder if there is an opportunity for those who are willing to dig deeper.

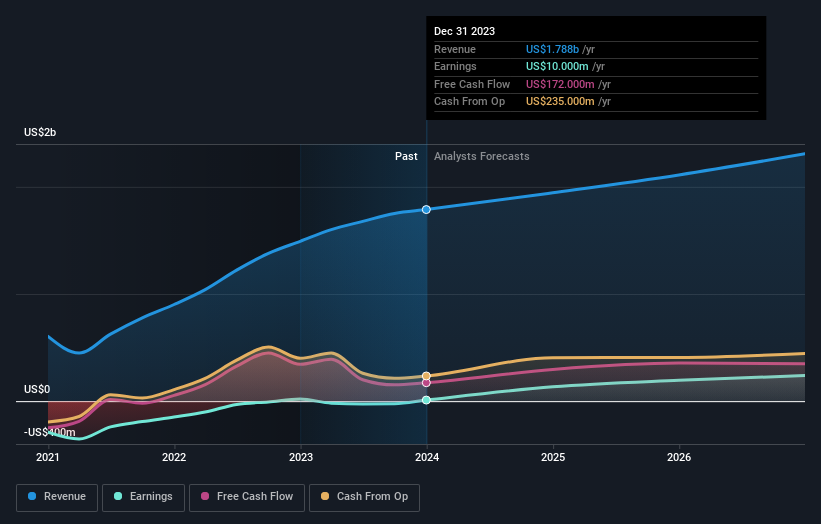

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Tripadvisor is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Tripadvisor in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Tripadvisor shareholders have received a total shareholder return of 40% over one year. That certainly beats the loss of about 7% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Tripadvisor that you should be aware of.

Of course Tripadvisor may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.