Volato Group Inc (SOAR) Navigates Market Turbulence with Strategic Fleet Expansion Despite ...

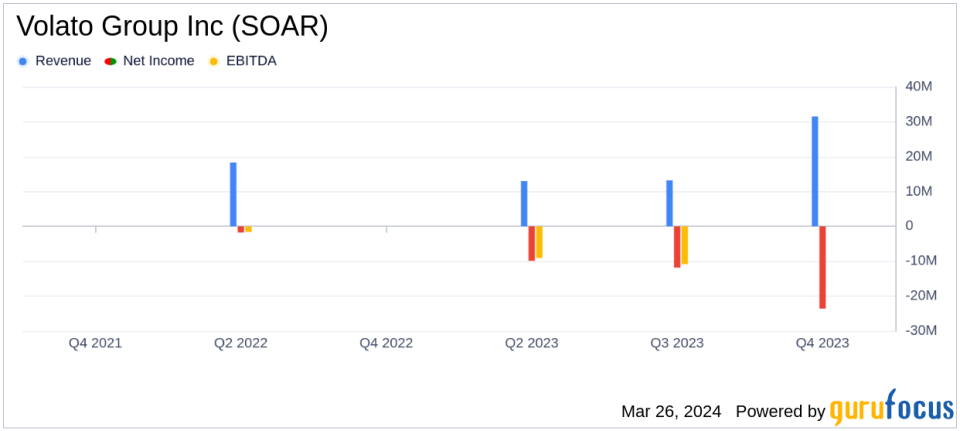

Total Revenue: $73.3 million in FY 2023, a decrease from $96.7 million in FY 2022.

Net Loss: Expanded to $52.8 million in FY 2023, including a significant non-cash charge.

Aircraft Usage Revenue: Increased by 162% year-over-year, benefiting from fleet size growth.

Adjusted EBITDA: Reported a loss of $32.1 million in FY 2023, reflecting operational challenges.

Fleet Expansion: Grew to 24 HondaJet IIs, with expectations to receive 10-14 new aircraft in FY 2024.

On March 26, 2024, Volato Group Inc (SOAR) released its 8-K filing, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. Despite a challenging year marked by industry-wide production and supply chain issues, the company strategically expanded its fleet and enhanced service offerings to position itself for future growth.

Volato Group Inc operates within the private aviation sector, offering aircraft ownership programs, charter flights, and aircraft management services. The company is known for its HondaJet fleet, which is the largest in the United States, and has recently increased its floating fleet to 24 HondaJet IIs.

Financial Performance and Challenges

The company's total revenue for FY 2023 was $73.3 million, a 24% decrease from the previous year's $96.7 million. This decline was primarily attributed to lower aircraft sales, which fell significantly from $67.7 million in FY 2022 to $21.4 million in FY 2023. However, Volato experienced a substantial increase in aircraft usage revenue by 162%, boosted by the expansion of its floating fleet.

The net loss widened to $52.8 million for the full year, exacerbated by a $13.4 million non-cash charge related to the change in fair value of the company's forward purchase agreement. Adjusted EBITDA also reflected a loss of $32.1 million, indicating the financial pressure from lower aircraft sales and increased operational expenses.

Strategic Growth and Operational Highlights

Despite the financial headwinds, Volato Group Inc achieved several operational milestones. The company completed a business combination that led to its public listing and raised over $40 million of new capital. Partnerships to expand maintenance capabilities and the launch of luxury experience programs for members were among the strategic initiatives undertaken to enhance Volato's service offerings.

CEO Matt Liotta emphasized the company's success in scaling the fleet and expanding market share, while CFO Mark Heinen highlighted the sequential improvement in gross profit margins through disciplined cost management. Both executives expressed optimism about the company's growth trajectory and path to profitability, anticipating increased aircraft sales and operational efficiency with the upcoming fleet expansion.

Financial Statements Insights

The balance sheet shows a healthy cash position of $14.5 million, suggesting that Volato is well-positioned to continue its operations and achieve profitability. The growth in the floating fleet resulted in a 105% increase in fourth-quarter flight hours year-over-year, and a 124% increase for the full year. The demand mix also improved, with non-owner flights contributing to a higher blended yield, indicating a strategic shift towards more profitable operations.

Volato Group Inc's financial achievements, particularly in aircraft usage revenue, underscore the importance of fleet size and service diversification in the transportation industry. The company's ability to adapt its business model and capitalize on non-owner flight hours suggests a forward-thinking approach to navigating the competitive private aviation market.

Investors and stakeholders can access the conference call discussing the fourth quarter and full year 2023 results on Volato's Investor Relations website, providing an opportunity to gain deeper insights into the company's performance and strategic plans.

For value investors interested in the transportation and private aviation sectors, Volato Group Inc's earnings report offers a comprehensive view of the company's financial health and strategic direction. The company's focus on fleet expansion and enhanced service offerings, despite the revenue decline, highlights its commitment to long-term growth and market leadership.

For more detailed information on Volato Group Inc's financial performance, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Volato Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance