KO Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Motive.

Position: Wave 2 of (1).

Direction: Upside in wave 3.

Details: We have been monitoring KO for a while now, but the count seems to be evolving continuously. At this point we are still looking for further upside into wave 3, not before we’ll complete the correction in wave 2.

KO Elliott Wave technical analysis – Daily chart

Our analysis indicates a trending function characterized by impulsive mode and motive structure, positioned in Wave 2 of (1). The direction points to upside momentum in wave 3. Despite continuous evolution in the count, we remain focused on anticipating further upside into wave 3, awaiting the completion of the correction in wave 2.

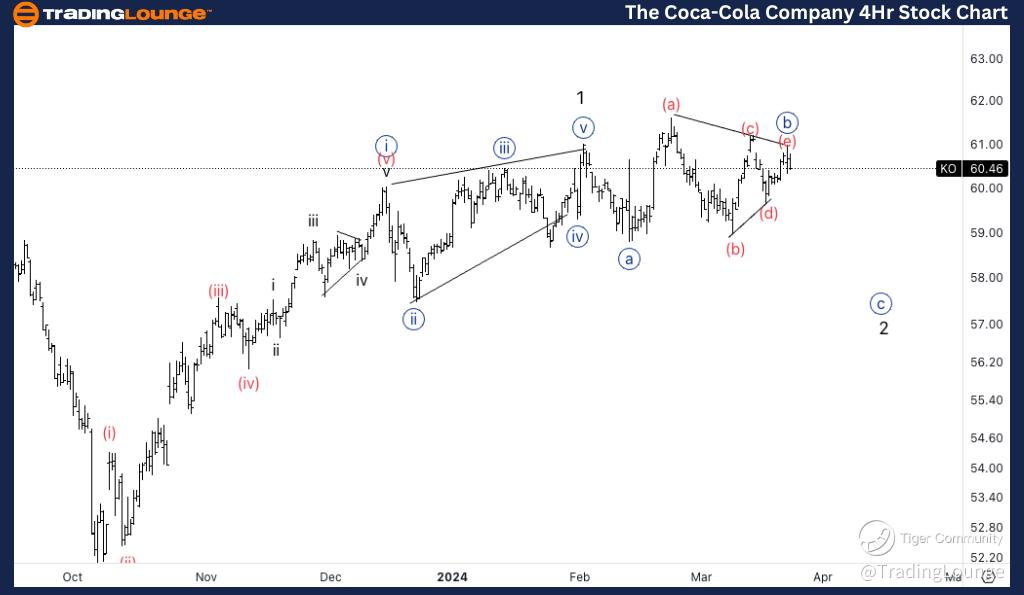

KO Elliott Wave technical analysis

Function: Counter Trend.

Mode: Corrective.

Structure: Flat.

Position: Minute wave {b}.

Direction: Looking for upside in wave {b}.

Details: At this point we are considering a triangle in wave {b} to then continue lower into wave {c} towards 58$ where wave {ii} of the diagonal stands, which is a very common target for a wave 2 after a diagonal in wave 1.

KO Elliott Wave technical analysis – Four-hour chart

Here, we identify a counter trend function marked by corrective mode and flat structure, positioned in Minute wave {b}. The direction suggests potential upside movement in wave {b}. We are currently considering the formation of a triangle in wave {b}, anticipating a subsequent move lower into wave {c} towards $58, coinciding with the location of wave {ii} of the diagonal. This target aligns with common patterns observed after a diagonal in wave 1.

The Coca-Cola Company (KO) Elliott Wave technical forecast [Video]

As with any investment opportunity there is a risk of making losses on investments that Trading Lounge expresses opinions on.

Historical results are no guarantee of future returns. Some investments are inherently riskier than others. At worst, you could lose your entire investment. TradingLounge™ uses a range of technical analysis tools, software and basic fundamental analysis as well as economic forecasts aimed at minimizing the potential for loss.

The advice we provide through our TradingLounge™ websites and our TradingLounge™ Membership has been prepared without considering your objectives, financial situation or needs. Reliance on such advice, information or data is at your own risk. The decision to trade and the method of trading is for you alone to decide. This information is of a general nature only, so you should, before acting upon any of the information or advice provided by us, consider the appropriateness of the advice considering your own objectives, financial situation or needs. Therefore, you should consult your financial advisor or accountant to determine whether trading in securities and derivatives products is appropriate for you considering your financial circumstances.

Recommended content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.