Warren Buffett Ignores Buy-And-Hold Strategy With This Home Builder: Are Other Stocks At Risk?

Warren Buffett Ignores Buy-And-Hold Strategy With This Home Builder: Are Other Stocks At Risk?

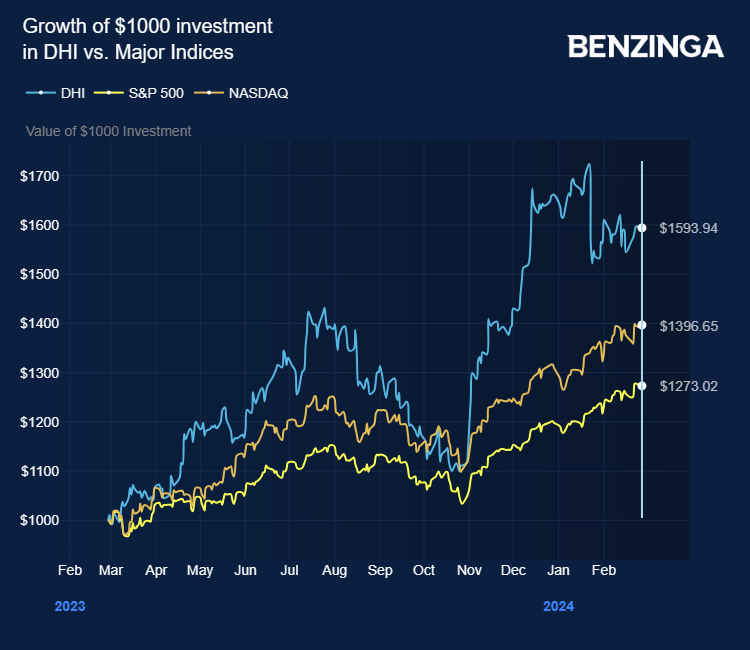

Has Warren Buffett abandoned his investment thesis? Perhaps he couldn't resist the allure of profits from home builder D.R. Horton Inc (NYSE:DHI), whose price popped 70% in 2023.

禾倫·巴菲特是否放棄了他的投資論點?也許他無法抗拒房屋建築商霍頓公司(紐約證券交易所代碼:DHI)利潤的誘惑,該公司的價格在2023年上漲了70%。

The Oracle of Omaha jettisoned his stake in D.R. Horton after holding it for less than a year.

奧馬哈甲骨文在持有D.R. Horton的股份不到一年後就放棄了該股份。

That's according to a filing with the U.S. Securities and Exchange Commission, in which Buffett's company, Berkshire Hathaway Inc (NYSE:BRK), disclosed that it sold its entire holding in D.R. Horton during the three months between October and December.

這是根據向美國證券交易委員會提交的一份文件得出的,巴菲特的公司伯克希爾·哈撒韋公司(紐約證券交易所代碼:BRK)在該文件中透露,它在10月至12月的三個月中出售了其在D.R. Horton的全部股份。

The shares ended December at around $152. See chart below.

截至12月,該股價格約爲152美元。見下圖。

Also Read: 'Hallelujah' For Shale: Why Warren Buffett Likes American Oil Companies

另請閱讀:頁岩的 “哈利路亞”:禾倫·巴菲特爲何喜歡美國石油公司

In August, Berkshire revealed that it had invested in D.R. Horton as well as two other U.S. home builders, Lennar Corporation (NYSE:LEN) and NVR Inc (NYSE:NVR) during the April-June quarter.

8月,伯克希爾透露,在4月至6月的季度中,它已投資了D.R. Horton以及另外兩家美國房屋建築商——倫納爾公司(紐約證券交易所代碼:LEN)和NVR Inc(紐約證券交易所代碼:NVR)。

At this point, shares in D.R. Horton — of which Berkshire Hathaway acquired 5,969,714 — were trading somewhere between around $95-$115 each.

目前,D.R. Horton的股票——伯克希爾·哈撒韋收購了其中5,969,714股——每股交易價格約爲95至115美元。

This kind of move is uncharacteristic of Buffett's investment behavior.

這種舉動在巴菲特的投資行爲中並不常見。

The Berkshire Hathaway way, as so often cited by both Buffett and his late business partner Charlie Munger, is to buy and hold.

正如巴菲特及其已故商業夥伴查理·芒格經常提到的那樣,伯克希爾·哈撒韋公司的方法是買入並持有。

Munger's take on it was: "The big money is not in the buying or selling, but in the waiting."

芒格的看法是:“大筆資金不在於買入或賣出,而在於等待。”

And Buffett has already been pulled up on this by commentators at ResiClub, a U.S. housing market research company.

美國房地產市場研究公司ResiClub的評論員已經對巴菲特進行了報道。

ResiClub analyst Lance Lambert said: "It's interesting that Warren Buffett would so quickly sell off his D.R. Horton stake and exit the home builder bet.

ResiClub分析師蘭斯·蘭伯特表示:“有趣的是,禾倫·巴菲特會如此迅速地出售他在D.R. Horton的股份並退出房屋建築商的賭注。

"After all, the Oracle of Omaha wrote in his 1996 letter to shareholders that: 'If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes.'"

“畢竟,奧馬哈甲骨文在1996年給股東的信中寫道:'如果你不願意在十年內擁有股票,甚至不要考慮在十分鐘內擁有股票。'”

Are Other Sell-Offs From the BH Portfolio Likely?

BH投資組合可能出現其他拋售嗎?

Perhaps investors shouldn't worry too much about whether Berkshire Hathaway will jettison other stocks from its portfolio.

也許投資者不應該太擔心伯克希爾·哈撒韋公司是否會從其投資組合中拋棄其他股票。

In his annual letter from earlier this week, Buffett remained effusive about many of the company's long-term holdings.

在本週早些時候的年度信函中,巴菲特對公司的許多長期持股仍然熱情洋溢。

On Coca-Cola Co (NYSE:KO) and American Express Company (NYSE:AXP) he said: "We did not buy or sell a share of either Amex or Coke — extending our Rip Van Winkle slumber that has lasted well over two decades."

關於可口可樂公司(紐約證券交易所代碼:KO)和美國運通公司(紐約證券交易所代碼:AXP),他說:“我們沒有買入或賣出美國運通或可口可樂的股份,這延長了我們持續了二十多年的Rip Van Winkle的沉睡。”

He was similarly enthusiastic about the U.S. oil companies in the portfolio, including Occidental Petroleum Corporation (NYSE:OXY) and Chevron Corp (NYSE:CVX).

他同樣對投資組合中的美國石油公司充滿熱情,包括西方石油公司(紐約證券交易所代碼:OXY)和雪佛龍公司(紐約證券交易所代碼:CVX)。

Now Read: Berkshire Hathaway Report, Shareholder Letter Released: What's Going On With The Stock?

立即閱讀:伯克希爾·哈撒韋公司報告,股東信函發佈:股票怎麼了?

Image: Shutterstock

圖片:Shutterstock

譯文內容由第三人軟體翻譯。