Recently, the Ministry of Commerce clearly mentioned at a press conference,Cross-border e-commerce is one of the new driving forces of foreign trade.

In 2023, China's cross-border e-commerce imports and exports reached 2.38 trillion yuan, an increase of 15.6%, 15.4 percentage points higher than the national import and export growth rate.

In a context where domestic internet traffic dividends are peaking and consumer consumption is under pressure, e-commerce platforms can only deepen their internal volume in the domestic stock market, but in fact, there are huge development opportunities in a market with low e-commerce penetration. In recent years, industry giants such as Pinduoduo and Ali have also accelerated the pace of going overseas as a result.

In fact, there is no shortage of pioneers in the market focusing on cross-border e-commerce tracks. As the first group to realize the huge opportunities in overseas markets, they took advantage of the early dividends of going overseas.

In fact, there is no shortage of pioneers in the market focusing on cross-border e-commerce tracks. As the first group to realize the huge opportunities in overseas markets, they took advantage of the early dividends of going overseas.

For example, Yoshihong shares, which are currently sprinting to the Hong Kong Stock Exchange.

Jihong Co., Ltd. was listed on A-shares in 2016, but at the time, it mainly drove growth through the printing and packaging business, and there was no e-commerce business. Time has changed. Eight years later, the biggest label on Jihong Co., Ltd. is cross-border e-commerce. This Hong Kong stock listing trip can also be viewed as a test of its e-commerce assets.

1) Rapid growth in core performance data

Since entering cross-border e-commerce in 2017, Jihong Co., Ltd. has entered the fast track. The company's total revenue increased from 2,269 billion yuan in 2018 to 5.376 billion yuan in 2022, with a compound growth rate of 24.07%. The first three quarters of 2023 continued the rapid growth trend, reaching 4.916 billion yuan with a year-on-year increase of 24.88%.

Generally speaking, the fourth quarter is the traditional peak season for cross-border e-commerce business, which means that the annual growth rate of Jihong Co., Ltd. is likely to increase in addition to this.

According to the performance forecast issued by Jihong Co., Ltd., this was also confirmed side by side. The company expects to achieve net profit attributable to shareholders of listed companies of 331 million yuan to 368 million yuan for the full year of 2023, an increase of 80% to 100% over the same period of the previous year, and net profit after deducting non-recurring profit and loss of 302 million yuan to 339 million yuan, an increase of 78.46% to 100.19% over the same period last year.

Among them, the share of cross-border social e-commerce business continued to increase, surpassing the original packaging business for a long time. The revenue scale reached 3.101 billion yuan in the first three quarters of 2023, accounting for 63.1%. Obviously, the cross-border social e-commerce business is the core driving force for Jihong to achieve continuous high growth over the past few years, and it is also an important support for its continued growth in the future.

Looking at the breakdown, many countries and regions in Asia are the main sources of Jihong Co., Ltd.'s cross-border e-commerce business. In 2021, 2022, and the nine months ended September 30, 2023, Asia (including Northeast Asia, Southeast Asia and the Middle East) accounted for 97.9%, 92.8% and 90.2% of cross-border social e-commerce business revenue, respectively.

In particular, in the Southeast Asian market, Jihong Co., Ltd. became the leading cross-border social e-commerce company in Southeast Asia in 2022, ranking first in the social e-commerce market share in the region.

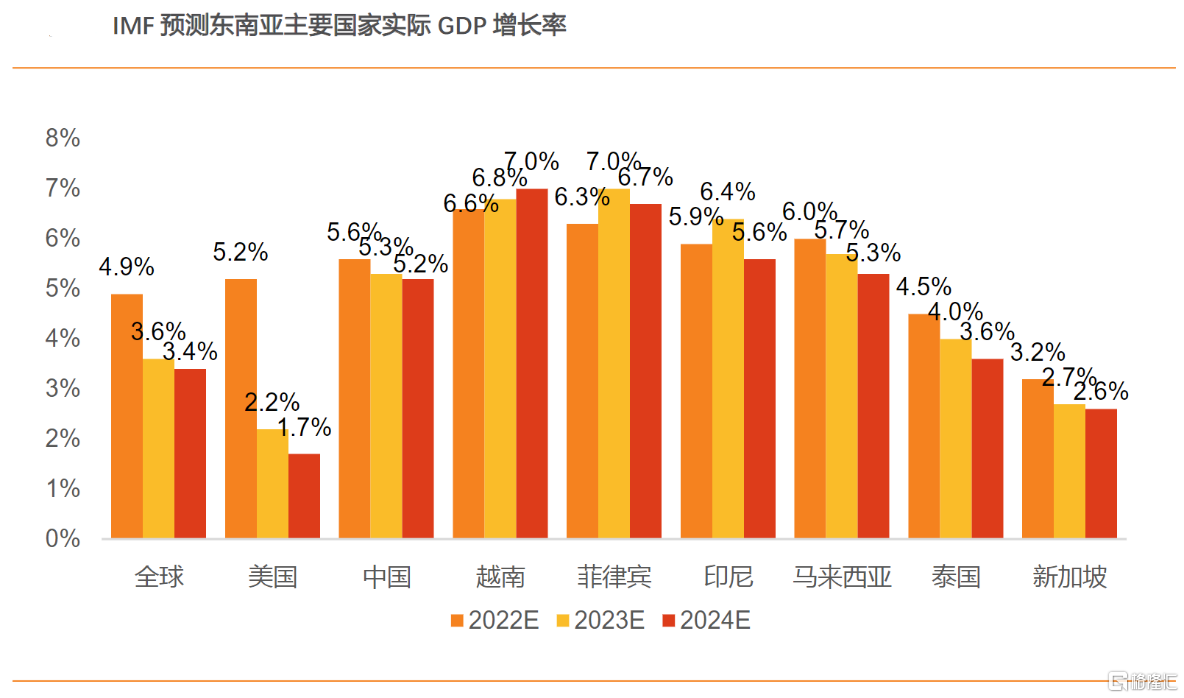

With a young population structure and a high GDP growth rate, Southeast Asia's potential is gradually being revealed. In 2022, the total population of Southeast Asia reached 670 million, with more than 50% of the population under 35 in Indonesia, Vietnam, Malaysia, and the Philippines. The IMF predicts that Vietnam, the Philippines, Indonesia, and Malaysia will continue to lead the world in real GDP growth.

(Source: IMF, Tianfeng Securities)

More importantly, compared with the Internet penetration rate of 76%, the e-commerce penetration rate in Southeast Asia is only 5%. A huge e-commerce market of nearly 700 million people is yet to be developed, and Jihong Co., Ltd., which has already formed a scale advantage in Southeast Asia, will clearly be the core beneficiary.

2) The “goods to find people” model brings efficient operation

Jihong's e-commerce business is inseparable from its unique operating model to achieve such good results.

Unlike the passive operation model of “people looking for goods” on traditional e-commerce platforms, Jihong Co., Ltd. focuses on the “find people” active model, that is, integrating social media with online shopping, making full use of the information advantages of social media and the operational advantages of e-commerce platforms, thereby forming strong competitiveness in various aspects such as marketing, operation, and supply chain management.

Specifically, this model uses AI algorithms to analyze markets and users to achieve intelligent product selection, accurate positioning of customer groups and targeted marketing, and push advertisements through mainstream foreign social platforms such as Facebook, TikTok, Google, Line, YouTube, and Instagram to amplify sales potential, and obtain orders from users before purchasing and delivering.

Through this model, the platform can actively push products with clear labels to the user's eyes, and only push one or two products that best meet the user's needs each time, which not only does not excessively disturb users, but also efficiently promotes consumption conversion. The whole process is more efficient than users' active search behavior under the traditional model.

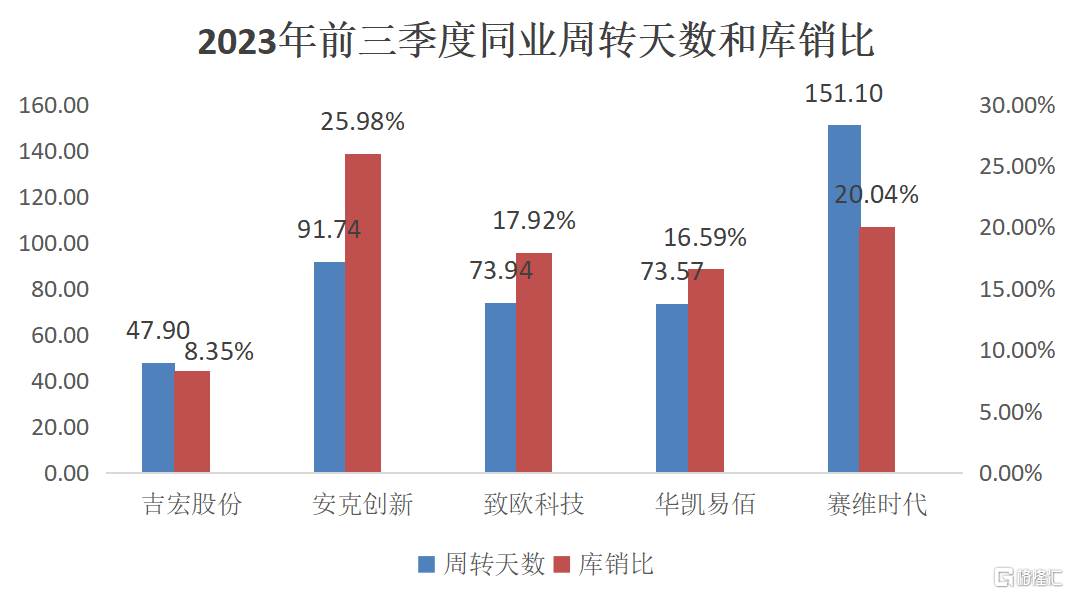

The efficient operating model puts less operating pressure on Jihong Co., Ltd. Compared with peers, Jihong Co., Ltd. has a faster inventory turnover speed and a lower inventory sales ratio (inventory/operating income). It should be noted that considering that Jihong Co., Ltd. also has a packaging business on a certain scale, it will actually increase the inventory sales ratio. Excluding the impact of the packaging business, in 2021, 2022, and the first three quarters of 2023, Jihong Co., Ltd.'s cross-border social e-commerce business deposit and sales ratios were 3.0%, 3.7%, and 3.0%, respectively, which is also low in the industry.

(Source: Choice, company prospectus)

3) Technical strength forms underlying support

Following the business logic of “finding people for goods”, it is easy to find that digital technology runs through the entire business chain. It is the core of reducing costs and increasing the efficiency of the entire business system. It is also the core competitiveness formed by Jihong Co., Ltd.'s long-term foundry.

Giikin, an operation management system independently innovated and developed by Jihong Co., Ltd., is the “brain” of the entire cross-border social e-commerce business system. It covers all aspects of product selection, landing page generation, advertisement development, advertisement placement, procurement, and after-sales service. This is inseparable from continuous R&D investment of over 100 million yuan per year.

Empowered by AI technology, Jihong Co., Ltd. can effectively use the Giikin system to better use in business operations. For example, in August 2023, the e-commerce text vertical model Chatgiikin-6b was launched. By the end of September of that year, it had created more than 120,000 ad copies; G-King, an intelligent advertising assistant, was embedded in the Giikin system and connected to platforms such as Facebook, TikTok, and Google through an API, which can provide the company with advertising suggestions and ad production budget decisions.

Furthermore, since Jihong Co., Ltd. entered cross-border social e-commerce early, the first-mover advantage brought about huge data accumulation. As of September 30, 2023, the Giikin system of Jihong Co., Ltd. has data on more than 550,000 SKUs, including price and popularity. As of September 30, 2023, more than 3.8 million advertising materials were stored in its database and advertising material library.

It can be said that technology research and data advantages have jointly built a strong digital moat for Jihong Co., Ltd., and it is also a symbol of its “soft power” that is rapidly breaking ground in overseas markets and taking the lead.

epilogue

The success of Jihong Co., Ltd. is actually a microcosm of the wave of Chinese companies going overseas.

On the one hand, in an environment where domestic demand is weak and stocks are competitive, it is necessary for enterprises to seek market growth from the outside to enhance their profitability; on the other hand, thanks to the dividends of globalization brought about by more than 40 years of reform and opening-up, China has a complete supply chain. “Affordable” Chinese manufacturing can easily have an advantage over overseas markets, and enterprises have the foundation to expand overseas.

Today, when going overseas seems to have become a necessary option for Chinese companies to open up a new growth curve, Jihong Co., Ltd. has created a model for cross-border social e-commerce, but this is not the end; an e-commerce platform that is growing rapidly is worth looking forward to.

其实,市场上不乏有一些专注于跨境电商赛道的先行者,它们作为最早一批意识到海外市场的巨大机会,早早地布局吃到了出海早期红利。

其实,市场上不乏有一些专注于跨境电商赛道的先行者,它们作为最早一批意识到海外市场的巨大机会,早早地布局吃到了出海早期红利。