來源:格隆匯

市場已達歷史底部?

繼昨日大反攻之後,週三港股繼續高開。

不過截至發稿,三大指數震盪下行,$恒生科技指數 (800700.HK)$漲1.51%,$恒生指數 (800000.HK)$漲1.22%,$國企指數 (800100.HK)$漲1.49%。大型科技股紛紛走強,$網易-S (09999.HK)$、$阿里巴巴-SW (09988.HK)$一度漲超5%。

不過截至發稿,三大指數震盪下行,$恒生科技指數 (800700.HK)$漲1.51%,$恒生指數 (800000.HK)$漲1.22%,$國企指數 (800100.HK)$漲1.49%。大型科技股紛紛走強,$網易-S (09999.HK)$、$阿里巴巴-SW (09988.HK)$一度漲超5%。

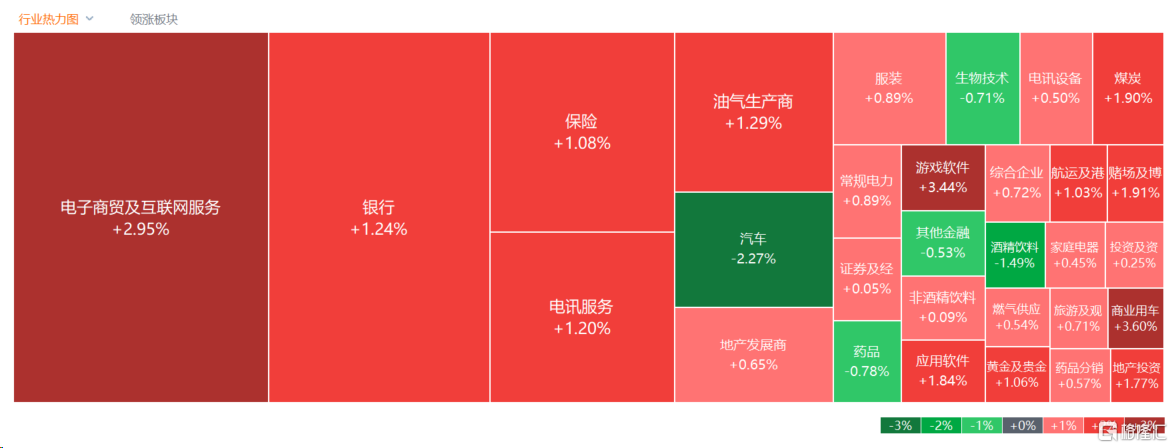

盤面上,遊戲股繼續猛攻,銀行、保險等金融股上漲,黃金及貴金屬、航運、博彩、煤炭等板塊漲幅居前,汽車、藥品等概念走低。

未來三年,四大策略重點

今日(1月24日),香港證監會發表2024至2026年的策略重點,闡述其發展香港證券市場、應對風險及保障投資者的方針。

面對資本市場的轉變,以及全球格局演化和科技進步所帶來的挑戰,證監會致力於持續推動市場發展,並同時維護香港市場的廉潔穩健和質素。

未來三年,香港證監會的四大策略重點是:維持市場韌力,減輕對市場的嚴重損害;提升香港資本市場的全球競爭力和吸引力;以科技和ESG(即環境、社會及管治)引領金融市場轉型;提高機構韌力及營運效率。

香港證監會表示,這四項重點工作將加強本港資本市場的核心優勢,助力市場可持續發展,並提升競爭力。

在維持市場韌性方面,香港證監會就市場韌力、有效調查及執法、加緊合作、警惕及教育公衆四個方面提出具體要求。其中指出,將監測上市公司和中介機構的市場失當行爲,打擊跨境市場失當行爲等。

在提升香港資本市場的全球競爭力和吸引力方面,香港證監會提出,香港需要在多方面維持競爭力,尤其應堅守其國際資產和財富管理樞紐及全球集資中心的地位,全面發揮其優勢,支持香港及內地市場發展。

接下來,香港證監會將以科技與ESG引領金融市場轉型作爲策略重點之一。

在科技方面,香港證監會在維持市場廉潔穩健的同時將擁抱金融創新。在ESG方面,將持續鞏固香港作爲領先可持續金融樞紐的地位;其中提到遏制漂綠行爲,培育可持續金融的人才等。

此外,香港證監會將竭力提高機構韌力及營運效率,並透過嚴格的預算編制和內部監控措施,確保財政資源足以支撐日常營運。

對此,證監會主席雷添良表示:“這份路線圖令本會較以往更具優勢,以堅定和創新的方式應對香港和其他地方的監管新挑戰,並勾勒出市場發展的路向。我們尤其致力發揮更積極的作用,以進一步加強香港作爲聯通內地的獨特橋樑角色,將香港定位爲人民幣業務及風險管理的離岸樞紐,以及支持國家發展和維護金融安全。”

行政總裁梁鳳儀表示:“即使現時的金融罪行手法層出不窮,但證監會將在更堅實的基礎上保護投資者免受損害,將違規者繩之於法,以及靈活地運用一系列資源和工具,藉此取得正面的監管成效。”

“與此同時,在瞬息萬變的全球環境下,清晰和明確的訊息格外重要,策略重點將使公衆及持份者更加了解證監會的監管目標和政策。”

市場已達歷史底部階段?

近兩日來,港股市場利好不斷。

今天,國資委最新表示,將聚焦“五個着力”抓好工作,着力推動提高央企控股上市公司的質量,強化投資者回報。將着力深化國資國企改革,加快建設現代新國企;鼓勵企業進一步強化科技創新主體地位 加快關鍵核心技術攻關。

國家金融監督管理總局局長李雲澤在第十七屆亞洲金融論壇上也表示,國家金融監管總局將加強與香港方面的雙邊監管合作 不斷鞏固提升香港國際金融中心地位。

香港特區行政長官李家超最新稱,目前,中國香港正在計劃發行第二批代幣化綠色債券,中國香港有能力把債券市場和綠色可持續金融、金融科技相結合。同時金融監管部門也將適當通過監管手段防範相關風險。

稍早前,國常會指出,要採取“強有力的”措施穩定資本市場。

對於港股市場,高盛首席中國股票策略分析師劉勁津表示,中國內地及中國香港股市的估值,已幾乎跌至金融海嘯後新低,其認爲已充分反映投資者對宏觀環境、地緣政局等的擔憂,據該行測算,今年中國內地企業盈利或增長8%至10%,股市估值有反彈空間。

劉勁津預計,今年或有約150億美元資金經互聯互通淨流入A股,約450億元經南向通淨流入H股。未來或有更多中東資金買入中國股票,雖然最近兩年相關流入規模只有約100多億元,但相信未來中國股市的投資者結構或會逐漸轉變。

此前,中金也提到,當前市場點位已達歷史底部階段,在暴跌後可能會出現短暫反彈。

從外部環境來看,從目前到美聯儲降息,不排除美債利率“折返跑”,但仍有下行空間(中樞3.5~3.8%),意味着外部環境對我們仍有政策寬鬆空間和窗口,如果屆時政策也再度發力,那麼一定程度的修復反彈依然可以期待。但要迎來真正的反彈“拐點”,需要依賴積極的政策發力。

編輯/jayden

不过截至发稿,三大指数震荡下行,

不过截至发稿,三大指数震荡下行,