Discovery Alaska Ltd (ASX:DAF, OTC:DRVYF) has signed an agreement to conduct mineral exploration, mineral development and production activities at the advanced 6,500 hectare Vinasale Gold Project in Alaska.

The landmark binding Vinasale Project mining lease agreement with Doyon Ltd, an Alaska Native Regional Corporation, significantly advances Discovery Alaska’s growth strategy.

Over the past decade the project has been inactive, during which time the gold price has increased significantly to its current price of around US$2,000 per ounce.

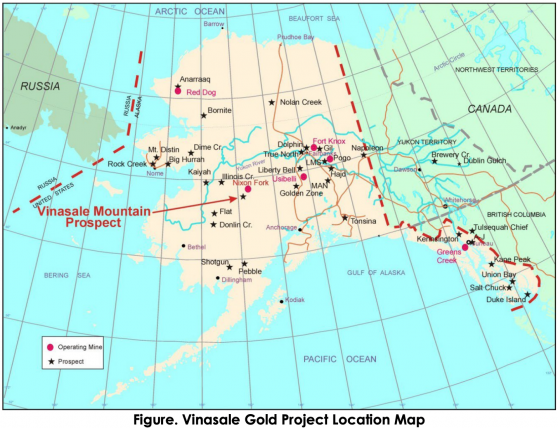

This increase in the gold price since the last exploration works, by then owner Freegold Ventures Ltd, presents a multiplier opportunity for potential success at the project, which is around 310-kilometres northwest of Alaska's largest city, Anchorage and 26-kilometres south of McGrath.

The project hosts a reported historical (NI 43-101) inferred resource of 22 million tonnes averaging 1.53g/t of gold for 1.08 million ounces of gold and indicated resources of 2.29 million tonnes at 1.84g/t for 135,000 ounces (using a 1g/t cut-off grade) at the Central Zone prospect.

Using a potential open pit cut-off value of 0.5g/t, indicated resources measure 3.41 million tonnes at 1.48g/t gold for 162,000 ounces of gold, and inferred resources of 53.25 million tonnes at 1.05g/t gold for 1,799,000 ounces.

“A significant period of growth”

The company intends to commence exploration planning works to define a comprehensive exploration and development program for the project. Mineralisation in the Central Zone extends over a strike length of 400 metres and remains open to the south and to depth.

Discovery Alaska director Jerko Zuvela said: “The company is delighted to execute the Mining Lease Agreement with Doyon, following a sustained and determined effort to secure the substantial Vinasale Gold Project to our portfolio.

“We are excited to progress the project development in a world-class jurisdiction, unlock unrealised value and establish a platform for a significant period of growth for the company.

“This is a significant opportunity to rapidly develop an advanced gold project at an exciting time for the gold sector with record gold prices and within a proven high-quality gold district.”

Potential works outlined

The company says that additional diamond drilling is warranted at the project and is primarily designed to expand the current resource in the Central Zone, and to test additional targets that may represent separate zones of mineralisation.

Supporting these targets is previous drill and geophysical information, primarily induced polarisation chargeability features.

In the Central Zone, drilling is recommended to the south and east of previous drilling to determine the limits of mineralisation. Several drill holes are also recommended across the central portion of the zone to better define the mineralisation and to test the zone to depth.

Further drilling is also warranted in the northern part of the intrusive, where previous shallow drilling in the area intersected mineralisation over encouraging intervals.

The potential drill holes are supported by chargeability and resistivity data, with most drill holes projected to be drilled to a depth of around 200 metres, with some to 300 metres. The proposed program totals around 5,000 metres of drilling.

Project consideration

Under the mining lease agreement, Discovery Alaska will make the following lease payments:

- US$15,000 upon executing the mining lease agreement;

- US$40,000 annual payment from the 2025 lease year through to 2027. This will increase to US$70,000 for the 2028 lease year through 2033, to US$225,000 from the 2034 lease year and an annual payment of US$300,000 for subsequent year if hte lease is extended;

- US$200,000 upon completion of a feasibility study by the company on any part of the project; and

- US$600,000 upon the company approving a decision to mine.

The agreement also outlines mandatory minimum annual expenditures on the project and production royalties to Doyon for both precious and base minerals production.