Investors Continue Waiting On Sidelines For Big Rock Brewery Inc. (TSE:BR)

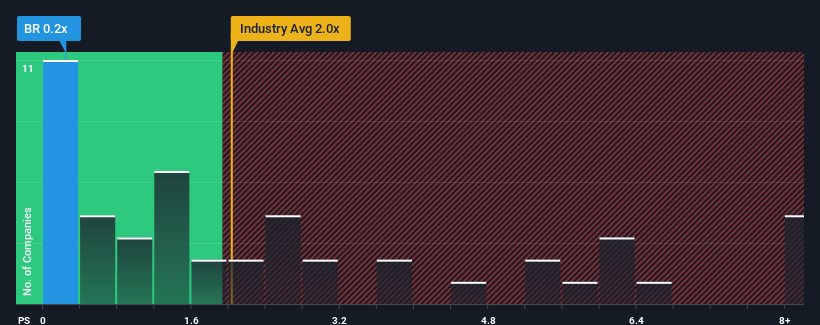

When close to half the companies operating in the Beverage industry in Canada have price-to-sales ratios (or "P/S") above 1.4x, you may consider Big Rock Brewery Inc. (TSE:BR) as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Big Rock Brewery

How Big Rock Brewery Has Been Performing

For example, consider that Big Rock Brewery's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If not, then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Big Rock Brewery, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

Is There Any Revenue Growth Forecasted For Big Rock Brewery?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Big Rock Brewery's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Likewise, not much has changed from three years ago as revenue have been stuck during that whole time. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 4.1% shows it's a great look while it lasts.

In light of this, it's quite peculiar that Big Rock Brewery's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Big Rock Brewery revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

Having said that, be aware Big Rock Brewery is showing 3 warning signs in our investment analysis, you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.