Fewer Investors Than Expected Jumping On Asia Poly Holdings Berhad (KLSE:ASIAPLY)

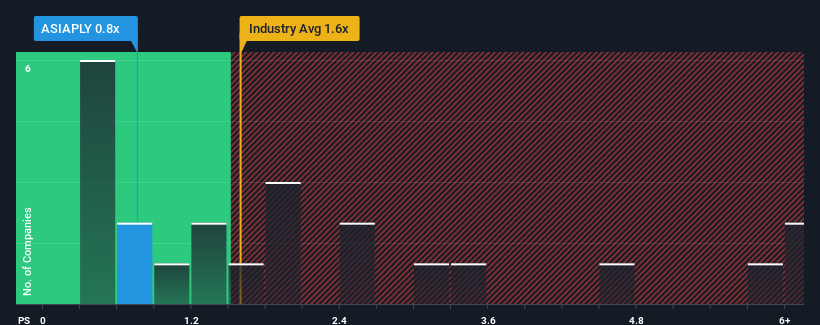

When you see that almost half of the companies in the Chemicals industry in Malaysia have price-to-sales ratios (or "P/S") above 1.6x, Asia Poly Holdings Berhad (KLSE:ASIAPLY) looks to be giving off some buy signals with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Asia Poly Holdings Berhad

What Does Asia Poly Holdings Berhad's P/S Mean For Shareholders?

Asia Poly Holdings Berhad has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Asia Poly Holdings Berhad's earnings, revenue and cash flow.

What Are Revenue Growth Metrics Telling Us About The Low P/S?

Asia Poly Holdings Berhad's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. The latest three year period has also seen an excellent 33% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 0.6% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Asia Poly Holdings Berhad is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Asia Poly Holdings Berhad's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Asia Poly Holdings Berhad currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Having said that, be aware Asia Poly Holdings Berhad is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If you're unsure about the strength of Asia Poly Holdings Berhad's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance