Producer Inflation Preview: The Hidden Factor That Could Tame CPI Enthusiasm

Producer Inflation Preview: The Hidden Factor That Could Tame CPI Enthusiasm

In the grand stage of economic ups and downs, there's a saying that echoes like a mantra: "The last mile is the toughest." This adage, it seems, finds a perfect resonance when it comes to understanding the inflation dynamics in the U.S.

在經濟大起大落的大舞臺上,有一句話響徹心頭,就像一句口頭禪:最後一英里是最艱難的。在理解美國的通脹動態時,這句格言似乎找到了完美的共鳴。

After the twist in July's consumer price index (CPI) report, in which the annual inflation rate ticked up to 3.2%, albeit slightly below the anticipated 3.3%, the spotlight now shifts to the impending release of the producer price index (PPI) inflation gauge on Friday.

在7月份消費者價格指數(CPI)報告出現轉折後,儘管略低於預期的3.3%,但年通貨膨脹率上升至3.2%,現在焦點轉移到週五即將發佈的生產者價格指數(PPI)通脹指標上。

As the Federal Reserve steadily aims for a return to the 2% consumer inflation target, the prices faced by producers must not sprint ahead once again, lest a domino effect hits the end consumer products.

隨著美聯儲穩步將目標恢復到2%的消費者通脹目標,生產者面臨的價格絕不能再次衝刺,以免多米諾骨牌效應沖擊最終消費產品。

Yet, a chilling revelation might be on the horizon.

然而,一個令人不寒而慄的發現可能即將出現。

July's PPI Report: What Do Economists Foresee?

7月份的PPI報告:經濟學家們預計會發生什麼?

- The median economists' consensus projects a noticeable bump in the annual PPI for final demand, moving from a marginal 0.1% uptick in June to a more substantial 0.7% climb in July. That would snap a series of 12 consecutive declines in the annual PPI inflation rate.

- 經濟學家的共識中值預測,最終需求的年度PPI將明顯上升,從6月份的0.1%小幅上升到7月份更大的0.7%。這將結束PPI年通脹率連續12年的下降。

- On a monthly basis, the PPI index is expected to have accelerated by 0.2% in July, leaving behind the 0.1% from June.

- The core PPI index is anticipated to show a year-on-year increase of 2.3% for July, just a tad lower than June's 2.4%.

- On a monthly scale, the core PPI is also slated to advance at a 0.2% pace, edging up from the 0.1% witnessed in June.

- 按月計算,預計7月份PPI指數將加速上漲0.2%,較6月份的0.1%有所回落。

- 核心PPI指數預計將顯示7月份同比增長2.3%,略低於6月份的2.4%。

- 在月度範圍內,核心PPI預計也將上漲0.2%,略高於6月份的0.1%。

Read Also: Disinflation Talk Grows, Rate Hike Bets Plummet: Top 5 ETFs Rallying On CPI Miss

另請閱讀:關於抑制通脹的討論越來越多,加息押注暴跌:前5大ETF因CPI未達預期而上漲

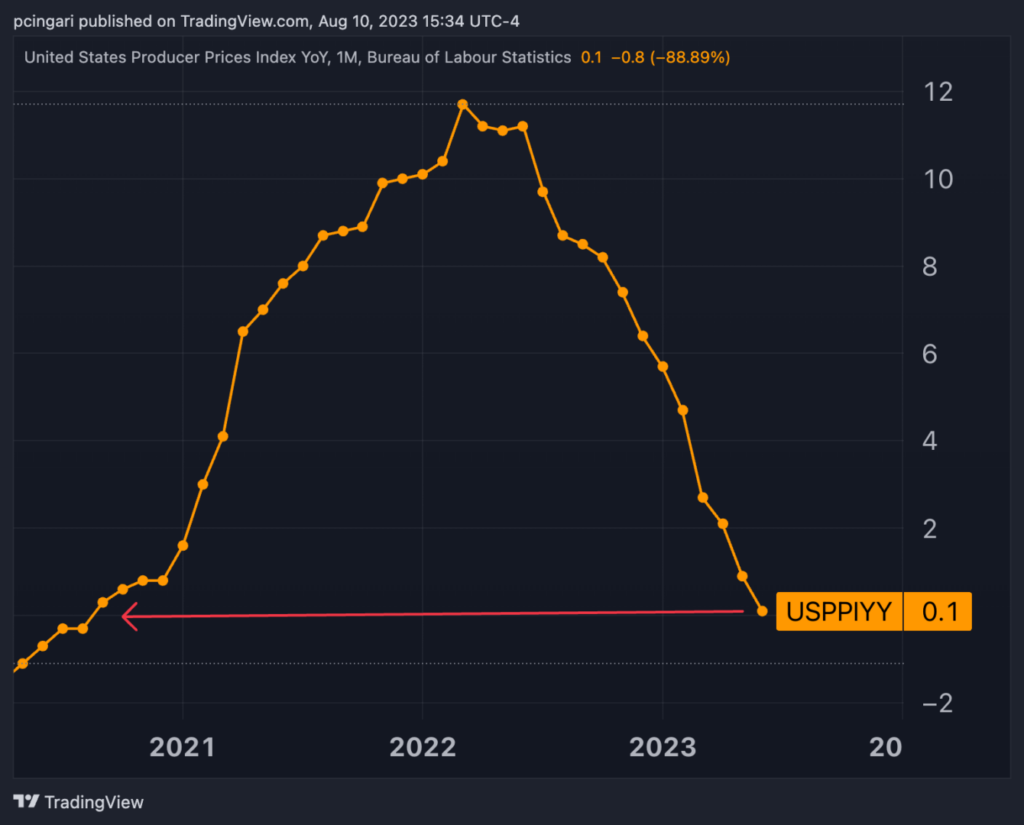

Chart: June's PPI Inflation Plummeted To The Lowest Level Since August 2020

圖表:6月PPI通脹率驟降至2020年8月以來最低

Commodities Rose In July, Traders Believe Fed Is Done With Hiking

7月份大宗商品價格上漲,交易員認為美聯儲已經結束加息

July emerged as a positive month for global commodities, which posted an increase not seen since March 2022.

7月份成為全球大宗商品的積極月份,實現了自2022年3月以來未曾見過的漲幅。

The Bloomberg Commodity Index, which is closely tracked by the iShares Bloomberg Roll Select Commodity Strategy ETF (NYSE:CMDY) surged almost 6% last month, after rising 3.5% in June.

彭博大宗商品指數,該指數受到IShares Bloomberg Roll精選商品策略ETF(紐約證券交易所股票代碼:CMDY)繼6月份上漲3.5%後,上個月飆升近6%。

Rising commodity prices may affect the overall producer price index as the weight for final demand goods in the PPI basket hovers at about 30%.

大宗商品價格上漲可能會影響整體生產者價格指數,因為最終需求商品在PPI籃子中的權重徘徊在30%左右。

However, investors are increasingly convinced the Fed is about to end its rate-tightening campaign.

然而,投資者越來越相信,美聯儲即將結束其收緊利率的行動。

The odds of leaving rates on hold in September according to Fed futures market pricing rose to over 90% on Thursday. The same odds relative to the November meeting amounted to 70%.

根據美聯儲期貨市場定價,9月份維持利率不變的可能性週四升至90%以上。與11月會議相比,同樣的賠率達到了70%。

Now Read: Deflation Rocks Used Car Market, Price Bubble Bursts: 5 Stocks Face Margin Squeeze Risks

現在閱讀:通縮岩石二手車市場,價格泡沫破裂:5只股票面臨保證金擠壓風險

Photo: Shutterstock

圖片:快門

譯文內容由第三人軟體翻譯。

Yet, a chilling revelation might be on the horizon.

Yet, a chilling revelation might be on the horizon.