Looking For Exposure To Mined Metals Critical For Clean Energy? This ETF Offers A Pure Play Option

Looking For Exposure To Mined Metals Critical For Clean Energy? This ETF Offers A Pure Play Option

The Sprott Energy Transition ETF (NYSE:SETM) was popping up slightly higher on Friday after breaking down from a rising channel pattern on Wednesday amid weak price action in the general stock market.

這個 Sprott 能源轉型ETF 由於股市價格走勢疲軟,紐約證券交易所代碼:SETM)週五小幅上漲,此前週三突破了上漲的通道模式。

With the global energy transition underway as the world's economies attempt to move from fossil fuels to more sustainable solutions, interest in battery minerals and materials, which will help to power the change to cleaner energy has grown exponentially.

隨着全球能源轉型的進行,世界經濟試圖從化石燃料轉向更可持續的解決方案,人們對電池礦物和材料的興趣呈指數級增長,這些礦物和材料將有助於推動向更清潔能源的轉變。

While Sprott offers several pure-play ETFs focused on battery metals, SETM offers exposure to a variety of the minerals and metals that will be necessary for the energy transition.

雖然Sprott提供幾隻專注於電池金屬的純交易所買賣基金,但SETM提供了能源轉型所必需的各種礦物和金屬的敞口。

SETM tracks 107 uranium, lithium, copper, nickel, silver, manganese, cobalt, graphite and rare earth elements mining companies, and corresponds to the total return performance of the Nasdaq-listed Sprott Energy Transition Materials Index. SETM is a pure-play U.S.-listed ETF focusing on critical minerals necessary for the global clean energy transition, and companies that will be critical for EV battery independence.

SETM追蹤了107家鈾、鋰、銅、鎳、銀、錳、鈷、石墨和稀土元素採礦公司,與納斯達克上市的Sprott能源過渡材料指數的總回報表現相對應。SETM是一家純粹的美國上市ETF,專注於全球清潔能源轉型所必需的關鍵礦產,以及對電動汽車電池獨立性至關重要的公司。

The three largest holdings within SETM are First Quantum Minerals Ltd. (TSX:FM), weighted at 5.55%, Freeport-McMoRan Inc, (NYSE:FCX) weighted at 5.4% and Cameco Corp. (NYSE:CCJ), which is weighted at 5.22%.

SETM最大的三大持股是 第一量子礦業有限公司 (多倫多證券交易所股票代碼:FM),權重爲5.55%, Freeport-McMoran Inc,(紐約證券交易所代碼:FCX)加權爲 5.4% 和 Cameco 公司 紐約證券交易所代碼:CCJ),加權爲5.22%。

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

想要直接分析?在 BZ Pro 休息室找我!點擊此處免費試用。

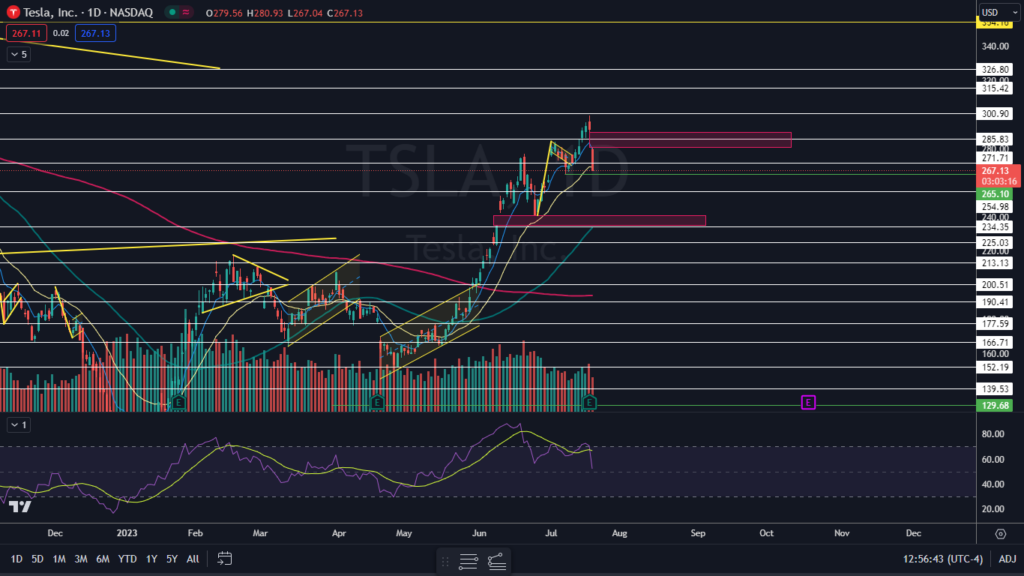

The SETM Chart: SETM broke bearishly from a rising channel on Wednesday, negating the uptrend the ETF has been trading in since May 31. The move lower came on lower-than-average volume, however, which indicates the bears aren't in control.

SETM 走勢圖: 週三,SETM從上漲通道看跌突破,抵消了ETF自5月31日以來一直處於的上漲趨勢。但是,下跌是因爲交易量低於平均水平,這表明空頭無法控制。

- On Friday, SETM was attempting to break back up into the channel and if the ETF can close the trading day within the pattern, the recent price action will serve as a bear trap and SETM could resume its uptrend.

- If SETM closes the trading day near its high-of-day, the ETF will form a bullish Marubozu candlestick, which could indicate higher prices will come again on Monday. If the ETF closes the session with a significant upper wick, SETM will form a shooting star candlestick, which could indicate the local top has occurred and the ETF will fall on Monday.

- SETM has resistance above at $18.34 and at $19.08 and support below at $17.93 and at $17.34.

- 週五,SETM正試圖突破該通道,如果ETF能夠在該模式內收盤交易日,那麼最近的價格走勢將成爲熊市陷阱,SETM可能會恢復其上漲趨勢。

- 如果SETM在交易日收於當日最高點附近,則該ETF將形成看漲的Marubozu燭臺,這可能表明週一價格將再次上漲。如果ETF收盤時大幅上漲,SETM將形成流星燭臺,這可能表明局部頂部已經出現,ETF將在週一下跌。

- SETM的阻力位高於18.34美元和19.08美元,支撐位低於17.93美元和17.34美元。

Read Next: July's Mixed Jobs Report: Payrolls Miss Estimates, Unemployment Rate Dips, Wages Surpass Expectations

繼續閱讀:7月份的喜憂參半的就業報告:就業人數未達到預期,失業率下降,工資超出預期

譯文內容由第三人軟體翻譯。

SETM tracks 107 uranium, lithium, copper, nickel, silver, manganese, cobalt, graphite and rare earth elements mining companies, and corresponds to the total return performance of the Nasdaq-listed Sprott Energy Transition Materials Index. SETM is a pure-play U.S.-listed ETF focusing on critical minerals necessary for the global clean energy transition, and companies that will be critical for EV battery independence.

SETM tracks 107 uranium, lithium, copper, nickel, silver, manganese, cobalt, graphite and rare earth elements mining companies, and corresponds to the total return performance of the Nasdaq-listed Sprott Energy Transition Materials Index. SETM is a pure-play U.S.-listed ETF focusing on critical minerals necessary for the global clean energy transition, and companies that will be critical for EV battery independence.