Market Still Lacking Some Conviction On Pyxis Tankers Inc. (NASDAQ:PXS)

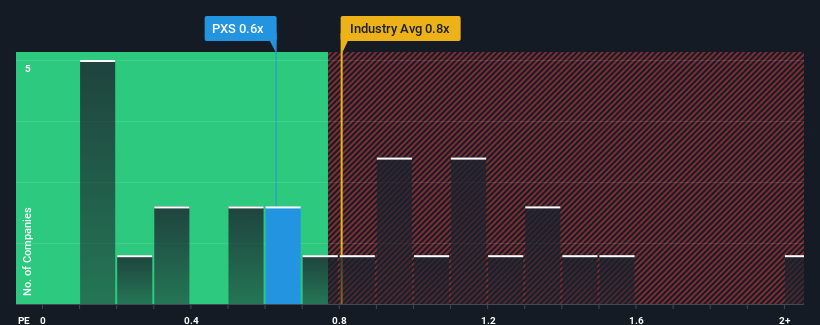

There wouldn't be many who think Pyxis Tankers Inc.'s (NASDAQ:PXS) price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S for the Shipping industry in the United States is similar at about 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Pyxis Tankers

What Does Pyxis Tankers' Recent Performance Look Like?

Recent times have been quite advantageous for Pyxis Tankers as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Pyxis Tankers, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Pyxis Tankers' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 133% gain to the company's top line. Pleasingly, revenue has also lifted 128% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 15% shows it's a great look while it lasts.

With this information, we find it odd that Pyxis Tankers is trading at a fairly similar P/S to the industry. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From Pyxis Tankers' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As mentioned previously, Pyxis Tankers currently trades on a P/S on par with the wider industry, but this is lower than expected considering its recent three-year revenue growth is beating forecasts for a struggling industry. When we see a history of positive growth in a struggling industry, but only an average P/S, we assume potential risks are what might be placing pressure on the P/S ratio. Without the guidance of analysts, perhaps shareholders are feeling uncertain over whether the revenue performance can continue amidst a declining industry outlook. The fact that the company's relative performance has not provided a kick to the share price suggests that some investors are anticipating revenue instability.

It is also worth noting that we have found 3 warning signs for Pyxis Tankers that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here