We Ran A Stock Scan For Earnings Growth And Finexia Financial Group (ASX:FNX) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Finexia Financial Group (ASX:FNX). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Finexia Financial Group with the means to add long-term value to shareholders.

Check out our latest analysis for Finexia Financial Group

How Fast Is Finexia Financial Group Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. Which is why EPS growth is looked upon so favourably. It's an outstanding feat for Finexia Financial Group to have grown EPS from AU$0.0099 to AU$0.053 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

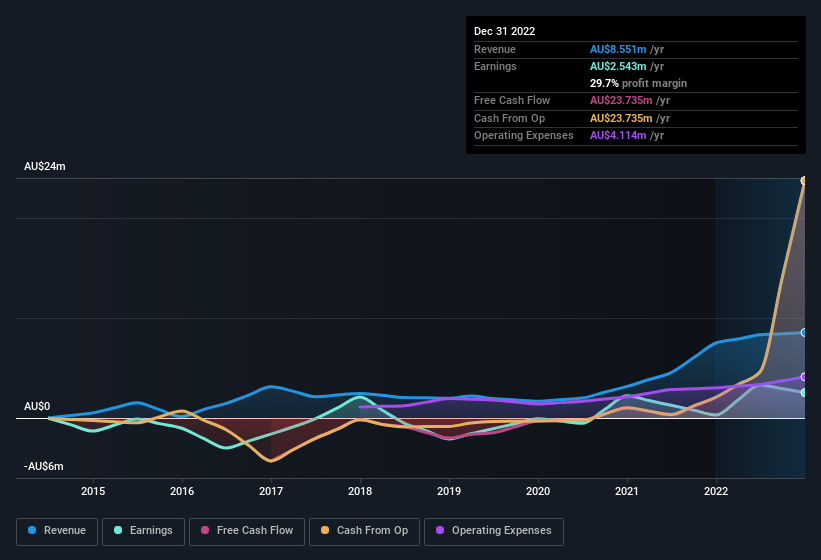

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Finexia Financial Group's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Finexia Financial Group achieved similar EBIT margins to last year, revenue grew by a solid 14% to AU$8.6m. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Finexia Financial Group is no giant, with a market capitalisation of AU$11m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Finexia Financial Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Finexia Financial Group shares, in the last year. Add in the fact that Neil Sheather, the Executive Chairman of the company, paid AU$67k for shares at around AU$0.29 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

It's commendable to see that insiders have been buying shares in Finexia Financial Group, but there is more evidence of shareholder friendly management. To be specific, the CEO is paid modestly when compared to company peers of the same size. Our analysis has discovered that the median total compensation for the CEOs of companies like Finexia Financial Group with market caps under AU$293m is about AU$425k.

The Finexia Financial Group CEO received AU$274k in compensation for the year ending June 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Finexia Financial Group To Your Watchlist?

Finexia Financial Group's earnings have taken off in quite an impressive fashion. Better yet, we can observe insider buying and the chief executive pay looks reasonable. It could be that Finexia Financial Group is at an inflection point, given the EPS growth. If these have piqued your interest, then this stock surely warrants a spot on your watchlist. Even so, be aware that Finexia Financial Group is showing 4 warning signs in our investment analysis , and 2 of those don't sit too well with us...

The good news is that Finexia Financial Group is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance