Here's Why We Think SHH Resources Holdings Berhad (KLSE:SHH) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like SHH Resources Holdings Berhad (KLSE:SHH), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for SHH Resources Holdings Berhad

How Fast Is SHH Resources Holdings Berhad Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that SHH Resources Holdings Berhad's EPS went from RM0.0027 to RM0.065 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The good news is that SHH Resources Holdings Berhad is growing revenues, and EBIT margins improved by 4.7 percentage points to 7.3%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

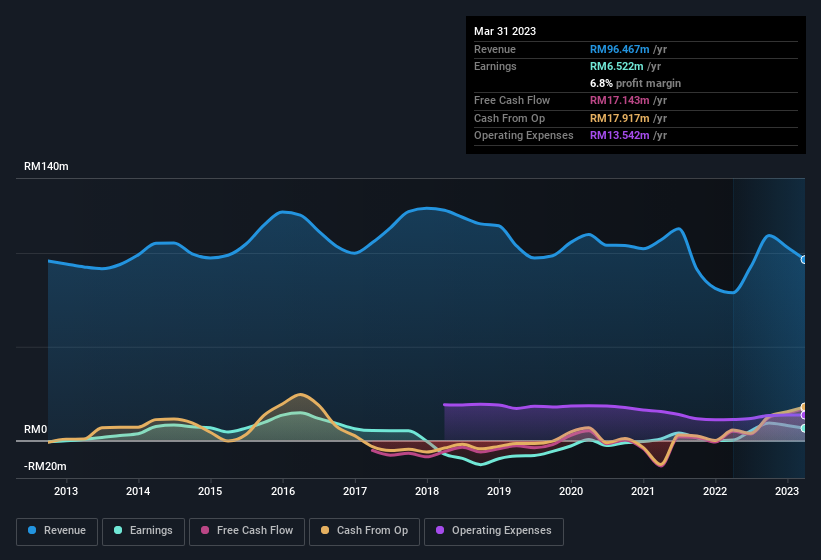

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

SHH Resources Holdings Berhad isn't a huge company, given its market capitalisation of RM93m. That makes it extra important to check on its balance sheet strength.

Are SHH Resources Holdings Berhad Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So those who are interested in SHH Resources Holdings Berhad will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Owning 48% of the company, insiders have plenty riding on the performance of the the share price. Those who are comforted by solid insider ownership like this should be happy, as it implies that those running the business are genuinely motivated to create shareholder value. Of course, SHH Resources Holdings Berhad is a very small company, with a market cap of only RM93m. So this large proportion of shares owned by insiders only amounts to RM45m. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

Is SHH Resources Holdings Berhad Worth Keeping An Eye On?

SHH Resources Holdings Berhad's earnings per share growth have been climbing higher at an appreciable rate. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So based on this quick analysis, we do think it's worth considering SHH Resources Holdings Berhad for a spot on your watchlist. It is worth noting though that we have found 2 warning signs for SHH Resources Holdings Berhad (1 shouldn't be ignored!) that you need to take into consideration.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here