summary

The overseas insurance technology industry is developing rapidly, and technology, capital, regulation, and demand are important factors affecting its development.The overseas insurtech industry has developed rapidly over the past 10 years. In 2015, global insurtech financing jumped from the previous level of 2-4 billion US dollars per year to the level of 2-4 billion US dollars since then. We have analyzed the key factors affecting the development of the overseas insurtech industry, including technology, capital, regulation, and demand. I think: 1) Technological progress has directly promoted the emergence of new business models for insurtech. Technology with a higher degree of maturity and a wider range of application scenarios can drive the development of insurance technology. 2) Capital helped accelerate the explosion of the insurtech industry. 3) Insurtech companies not only face stricter supervision, but are also gradually being encouraged by regulation under the premise of compliance. 4) Solving the pain points of customer needs (such as low price, convenience, etc.) has become a concentrated innovation direction for insurtech companies.

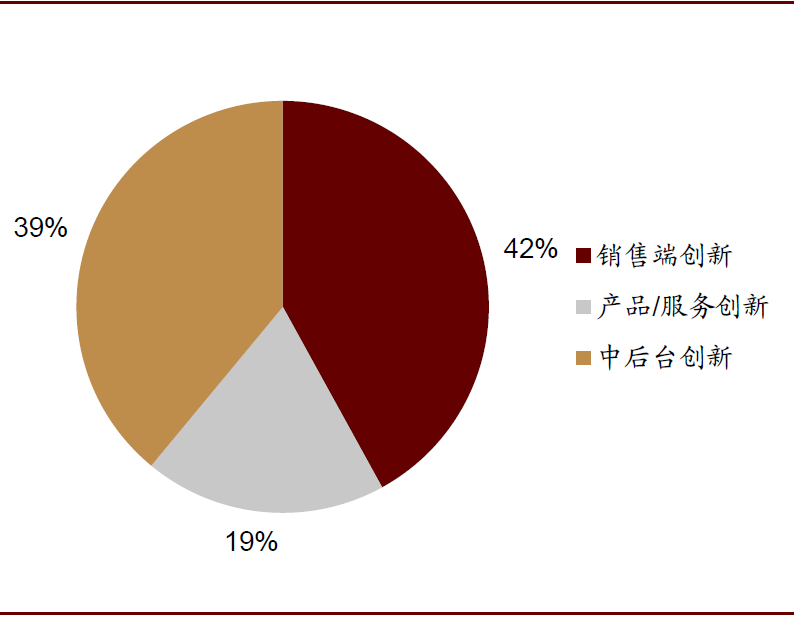

Overseas insurtech company models are in full bloom.We divide the direction of overseas insurtech companies into sales side innovation, product/service innovation, and middle and back office innovation. We believe: 1) The current direction of innovation is more focused on the sales side and middle and back office. Among all companies surveyed by Oliver Wyman in 2017, the number of sales side, product/service, and back office companies accounted for 42%, 19%, and 39%, respectively. 2) There is a big difference in popularity between different models. More companies participate in the popular model and obtain more financing on behalf of the company. For example, in sales side innovation, price comparison platforms and B2C online insurance brokerage models are more mainstream.

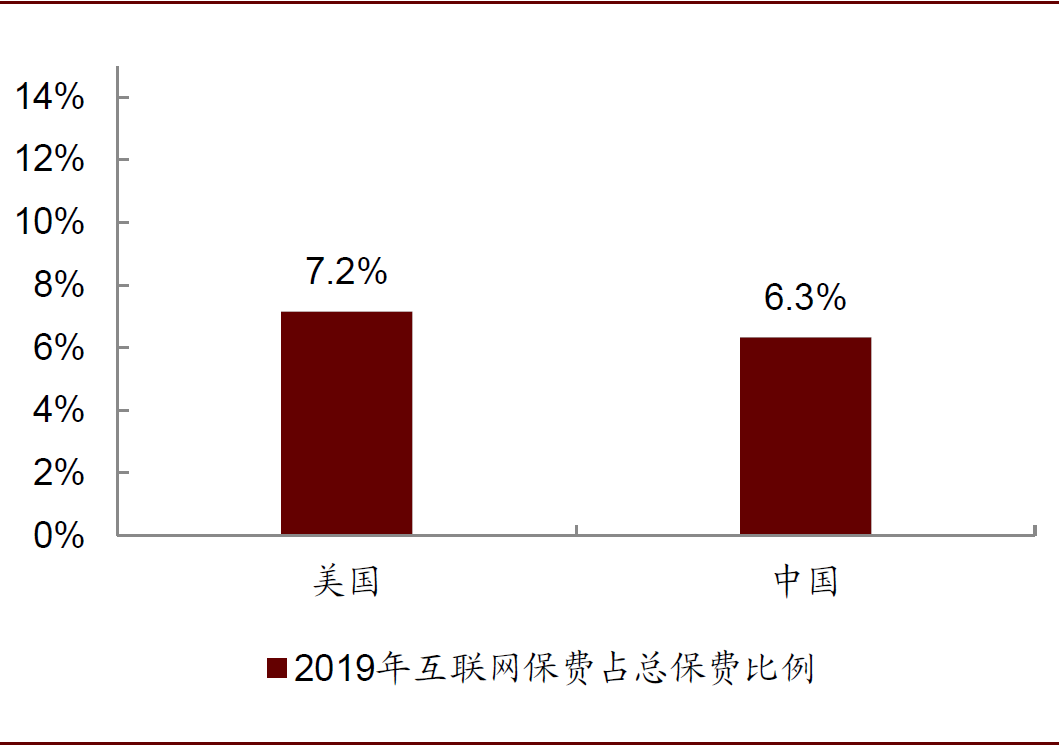

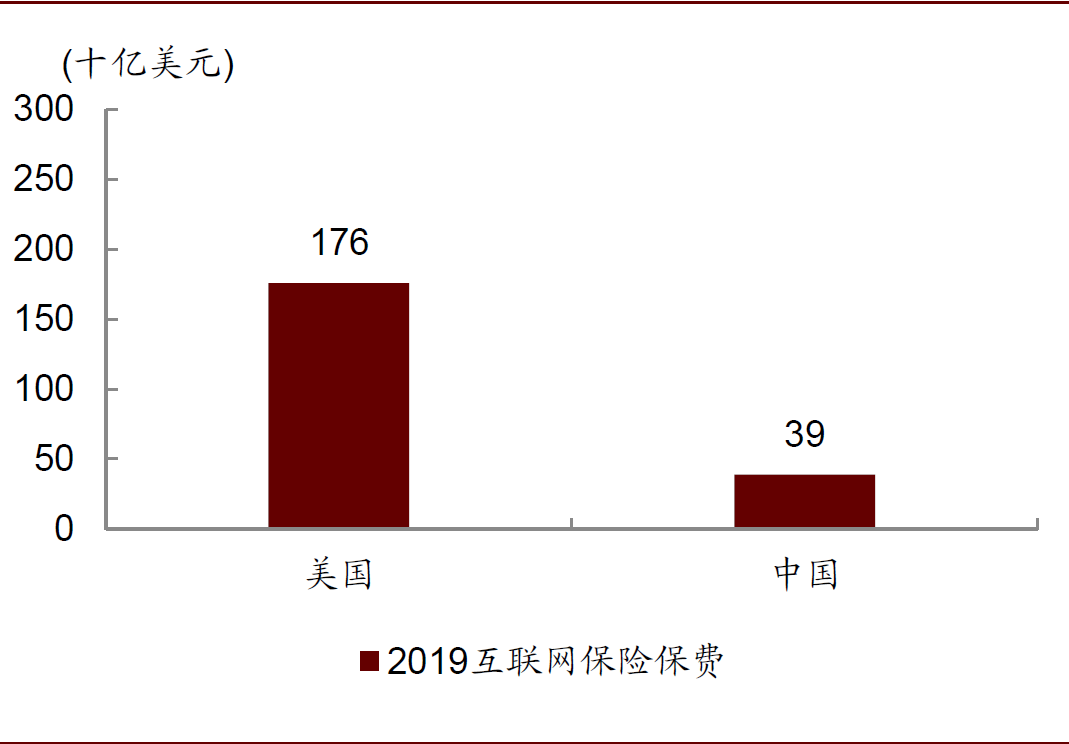

The insurtech industry in China and the US is close to the degree of development, and the US is slightly more diverse in business models.In terms of development, China's Internet premiums accounted for 6.3% of total premiums in 2019, which is close to 7.2% in the US. In terms of model diversity, the business environment, development stages, and regulatory policies, the US has slightly more insurtech business models than China (5 unique US models vs. 2 Chinese models). We believe that in the medium term, the gradual maturity of the development stage and changes in regulatory policies in specific fields will be the main driving force for China to bridge the model diversity gap with the US, while the business environment will be more difficult to change. For example, we believe that comprehensive auto insurance reform may make UBI auto insurance possible in China. However, the differences in the 2B insurance technology market are due to differences in social security models, so we expect it to be difficult to change in the medium term.

Valuation of US insurtech companies: Benchmarking technology companies is higher than that of Chinese peers.By comparing the valuations of US insurtech companies, traditional US insurance companies, US tech giants, and Chinese insurtech companies, we found that: 1) The valuation of US insurtech companies is higher than that of China. On September 18, the average transaction of US insurtech companies was 14.7 times 2019a P/B, higher than that of Chinese insurtech companies (5.1 times). 2) Since US investors are more willing to believe in the high growth of insurtech companies and the differences in the regulatory environment, US investors benchmark insurtech companies and give higher valuations to technology companies. On September 18, the average transaction of the three US sales side insurance technology companies was 7.6 times 2019a P/S, close to technology giants (6.0 times) and far surpassing traditional insurance companies (0.8 times). 3) Through a regression analysis of the compound revenue growth rates of 2020e P/s and 2020-22e, we believe that the revenue growth rate is the main factor affecting the valuation gap of different insurtech companies. The higher the expected growth rate, the higher the P/S.

risks

Unfavorable regulatory policy changes; application of technology falls short of expectations.

body

The development history of the overseas insurtech industry: An observation from two dimensions of time and space

Time dimension: After 2015, an outbreak period was ushered in, and now it has entered an initial stage of maturity

In terms of time, the development of the overseas insurtech industry is divided into 3 stages:

►Technology-driven rapid development stage (before 2014): With the maturity and popularity of technologies such as the Internet, the Internet of Things, and big data, the number of insurtech companies is growing rapidly. According to CB Insight, the number of newly established insurtech companies worldwide grew from 46 in 2008 to 143 in 2014.

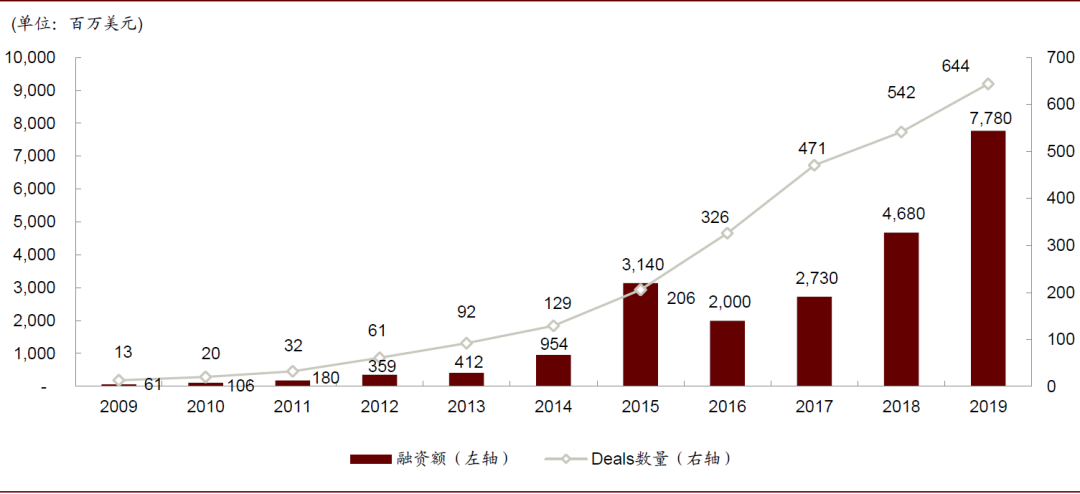

►The stage of accelerated development driven by capital (2015-2019): After 2015, some insurtech company models gradually gained capital recognition, and capital quickly entered the insurtech industry (the landmark event was that AXA established an insurtech incubator in early 2015), driving the industry to accelerate development. According to CB Insight, global insurtech financing in 2015 jumped from the previous level of $2-4 billion per year to the level of $2-4 billion since then.

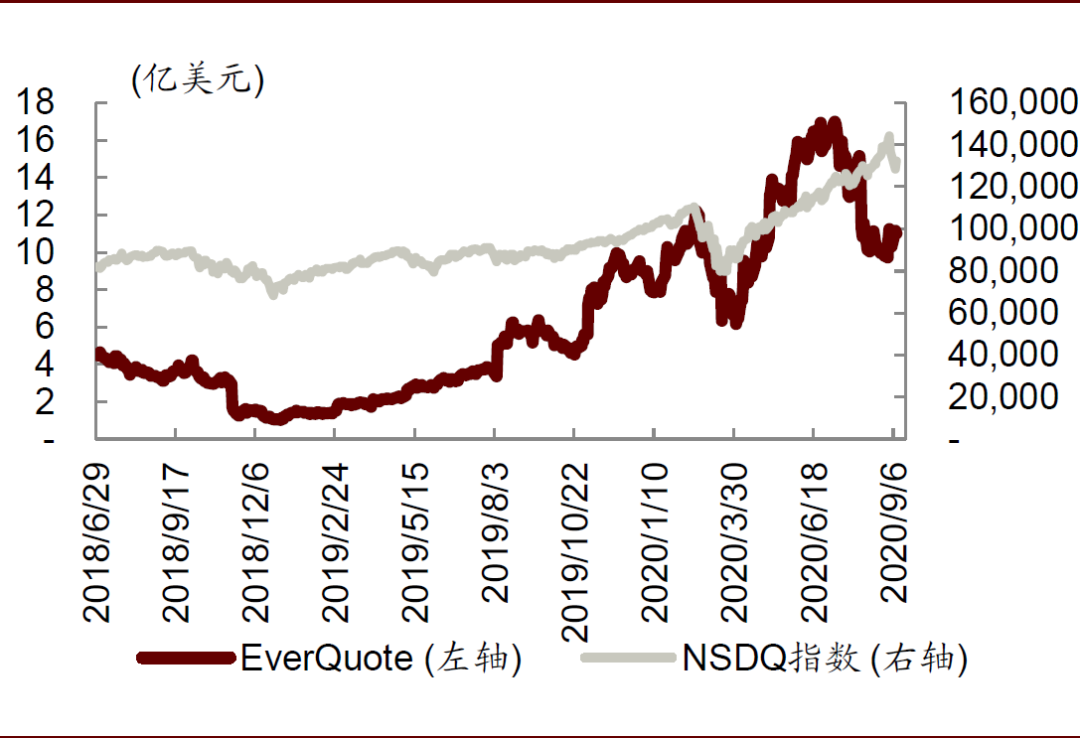

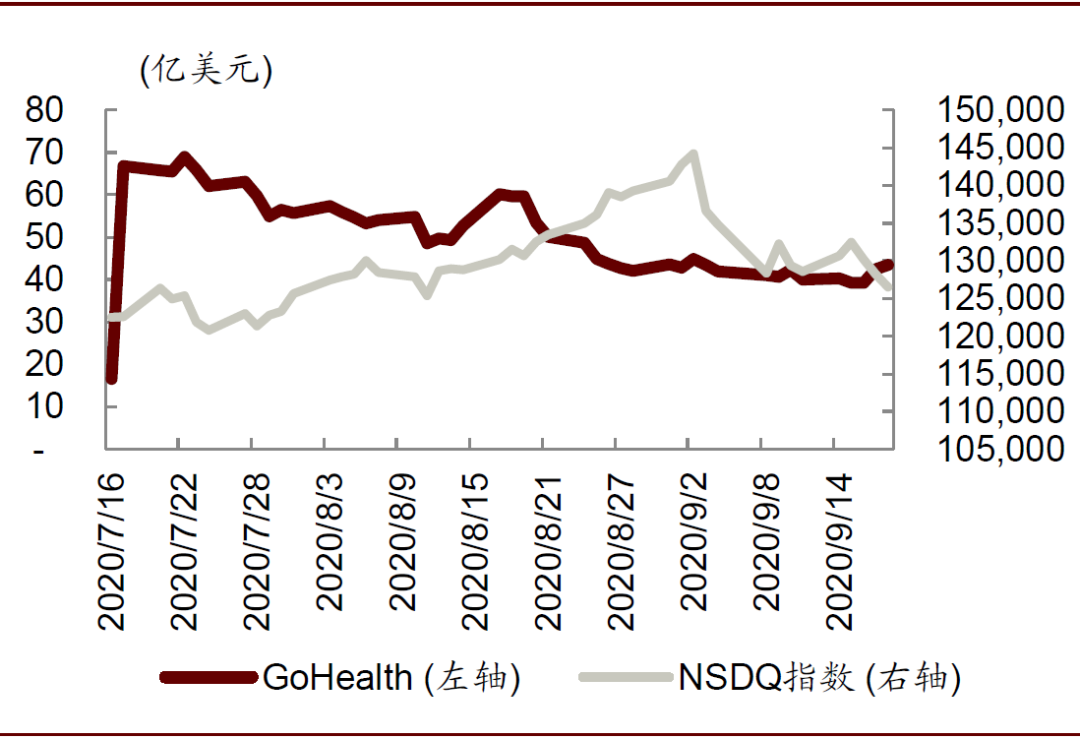

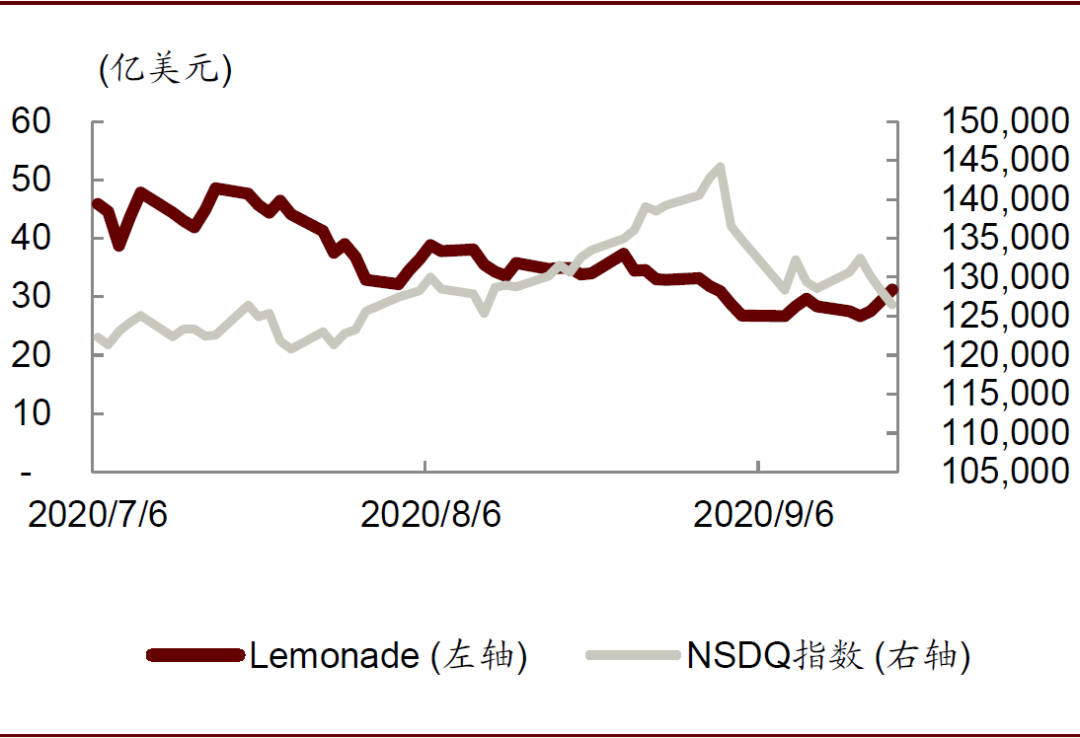

► Preliminary maturity stage (2020 to date): Since May of this year, 3 insurtech companies (SelectQuote, GoHealth, Lemonade) have been listed on the US stock market. This has also brought the number of domestic insurtech companies listed in the US to 4 (including EverQuote listed in 2018). On September 18, the total market value of US listed insurtech companies was US$12 billion. At the same time, the number of newly established insurtech companies has declined sharply since 2017, but the amount of financing is still growing rapidly, reflecting that capital favors already more mature companies. We believe these two phenomena mark the initial maturity of the industry.

Market area

Judging from the market area, the development of the overseas insurance technology industry has two characteristics:

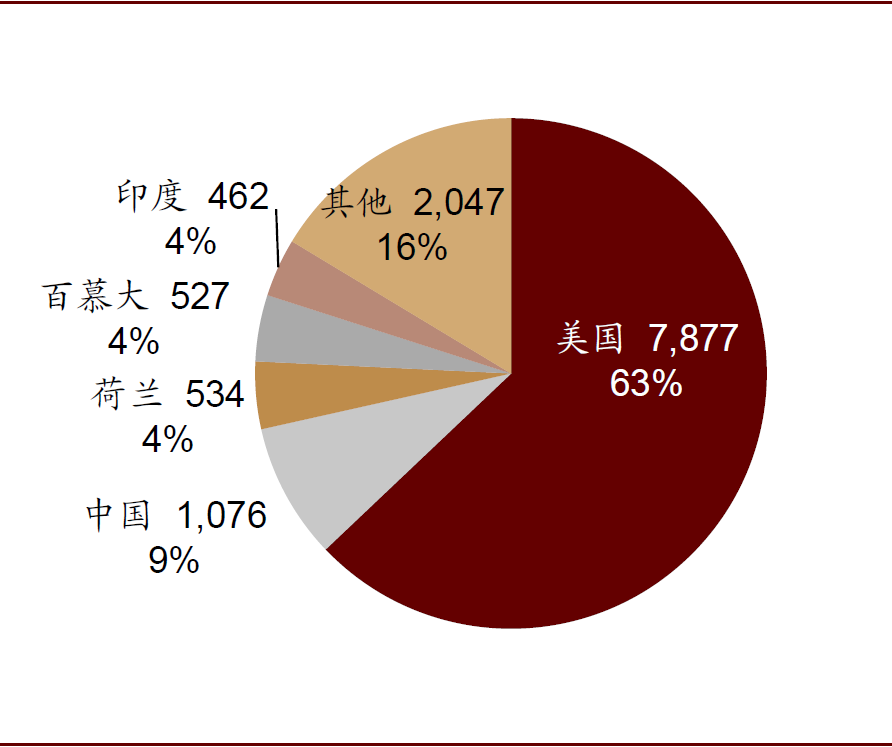

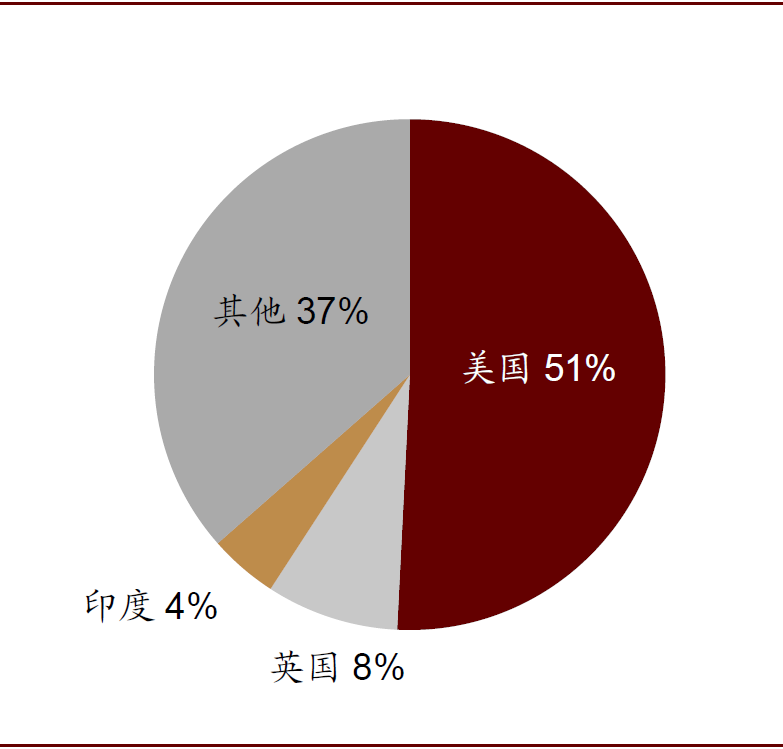

►Most insurtech was founded and funded in the US. According to MILKEN (a non-profit economic think tank) statistics, from 1998 to 1H2018, US insurtech companies accounted for 63% of global financing, and the number of newly established insurtech companies accounted for 51%. In addition to the US, insurance technology in China, the UK, and India has also developed well.

►In the early days (before 2012), almost all of the insurtech developments were in the US, and insurtech in other countries began to increase rapidly after 2013.

Chart: Global insurtech company financing volume and transaction volume from 2009 to 2019

Source: Statista, CB Insight, CICC Research Division

Chart: Number of newly established insurtech companies worldwide from 2008 to 2018

Source: CB Insight, CICC Research Department

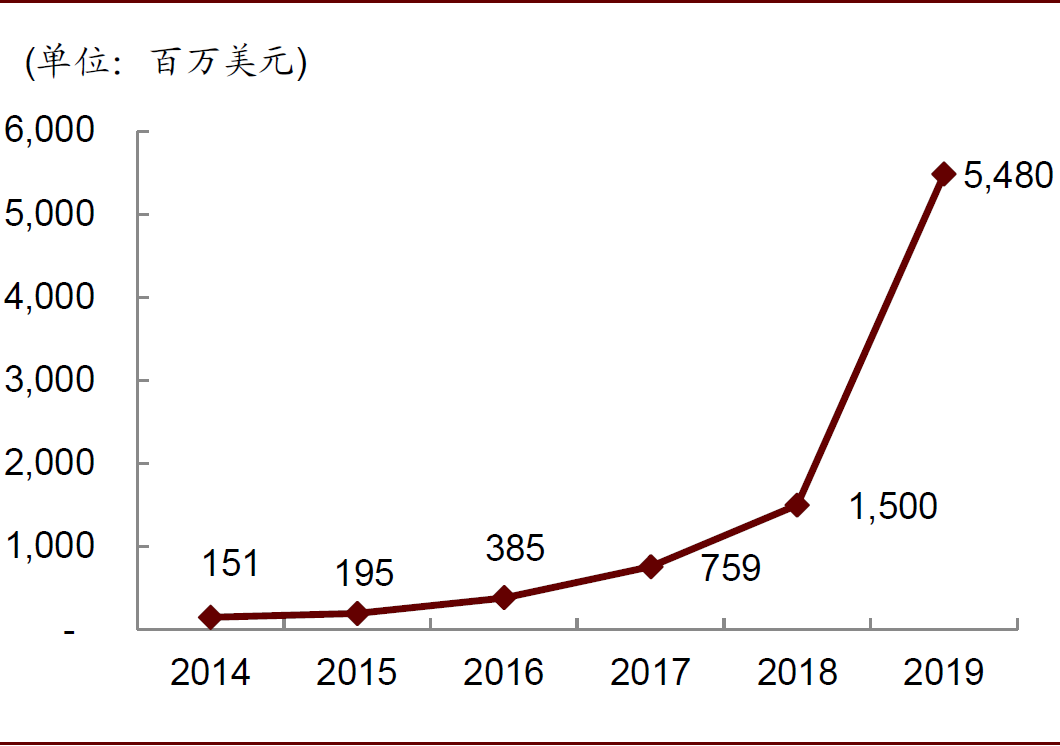

Chart: Global insurtech company revenue from 2014 to 2019

Source: Grand View Research, Business Wire, CICC Research Division

Chart: From 1998 to 1H2018, US insurtech companies accounted for 63% of global financing

Source: MILKEN Corporation, Research Department of CICC

Chart: From 1998 to 1H2018, the number of newly established insurtech companies in the US accounted for 51% of the world

Source: MILKEN Corporation, Research Department of CICC

Factors affecting the development of the overseas insurtech industry: technology, capital, regulation, demand

We have analyzed several important factors affecting the development of the overseas insurtech industry, including technology, capital, regulation, and demand. I think: 1) Technological progress has directly promoted the emergence of new business models for insurtech. Technology with a higher degree of maturity and a wider range of application scenarios can drive the development of insurance technology. 2) Capital helped accelerate the explosion of the insurtech industry. 3) Insurtech companies not only face stricter supervision, but are also gradually being encouraged by regulation under the premise of compliance. 4) Solving the pain points of customer needs (such as low price, convenience, etc.) has become a concentrated innovation direction for insurtech companies.

Technology: Continuing to promote the development of insurance technology

The impact of technology on the insurtech industry

Our judgment on the impact of technology on insurtech is as follows:1) Technological progress has directly promoted the emergence of new business models in insurtech.Judging from history, after major breakthroughs in technology, it gradually integrated with the insurance sector. The main technologies include the Internet, big data, the Internet of Things, artificial intelligence, cloud computing, blockchain, etc.2) The maturity of the technology and the breadth of application scenarios determine whether the technology can spawn the development of insurance technology.Technology with a higher degree of maturity and wider application scenarios can drive the development of insurance technology. This is reflected in the fact that at present, overseas insurance technology applications still mainly rely on Internet technology with a high degree of maturity and a wide range of application scenarios, and big data and cloud computing technology that is inherently compatible with the insurance industry. Looking ahead, we believe that as technologies such as the Internet of Things, artificial intelligence, and blockchain become more mature, related insurtech applications may develop significantly.

Mapping from basic technology to insurtech applications

We have summarized the mapping between basic technology and overseas insurtech applications and explained what kind of applications are being promoted by different technologies. It is worth noting that quite a few insurtech applications use multiple technologies at the same time. For example, most applications use the Internet and big data.

►Internet: Internet technology (emerging in the 1990s, widely used in the early 21st century) and online payment technology (2011) are driving the emergence of an online insurance sales platform model. Smartphones (2007) and mobile apps have further deepened the development of this model.

►Big data: Hive (2008) lowered the threshold for using big data technology. Big data technology began to be widely used in 2011, and most insurtech data service providers were established during this period.

►Cloud Computing: In 2006, Amazon launched the IaaS service platform AWS, and the IT cloud service business in the insurance field developed rapidly thereafter.

►Internet of Things: The autonomous vehicle project marks the initial maturity of Internet of Vehicles technology (2009). Two years later, pay-per-mileage car insurance products based on Internet of Vehicles technology appeared; revolutionary advances in wearable technology emerged in 2013, and wearable technology began to be applied to the health insurance field a year later, helping insured persons monitor health conditions in real time.

►AI: Artificial intelligence achieved a milestone development in 2016 (Alpha defeated Lee Se-seok). In the same year, AI also began to be applied in the insurance field. For example, Lemonade used AI for partial underwriting and claims processing.

►Blockchain: Blockchain achieved a breakthrough at the application level in 2015, and blockchain-based PolicyPal was established in 2016. The P2P insurance/network mutual assistance model has also begun to be integrated with blockchain technology. For example, Friendship uses blockchain for identity identification, smart contracts, and automated claims processing.

Capital: Helping the insurtech industry accelerate its explosion

The help of capital has played a very important role in the development of the insurtech industry. We saw that after 2014, some insurtech company models gradually gained capital recognition, and capital quickly entered the insurtech industry (the landmark event was that AXA established an insurtech incubator in early 2015), driving the industry to accelerate development. According to CB Insight, global insurtech financing in 2015 jumped from the previous level of $2-4 billion per year to the level of $2-4 billion since then. This period was also the fastest growing period for the insurtech industry: in 2014-16, an average of 181 new insurtech companies were founded each year vs. 56 in 2008-10.

Supervision: Strict supervision and supervision encourage the coexistence of

The supervisory attitude of overseas regulators on insurance technology is to encourage the overall role of technology in promoting the insurance industry, protect consumers' rights and interests, and create a level playing field between insurtech companies and traditional insurance companies.In terms of this attitude, overseas insurtech companies not only face stricter supervision, but are also gradually being encouraged by regulation under the premise of compliance.The main regulatory rules faced by overseas insurtech companies include license supervision, anti-discount laws, anti-discriminatory pricing, data privacy protection, and machine consulting qualifications. The incentives for overseas insurtech companies to be regulated are mainly reflected in the establishment of specialized agencies under the supervisory authority to serve insurtech companies and the establishment of a sandbox mechanism.

Restrictive policies

The main regulatory rules faced by overseas insurtech companies include license supervision, anti-discount laws, anti-discriminatory pricing, data privacy protection, and machine consulting qualifications.

►License regulation: Since insurance laws between US states are relatively independent, companies need to obtain a license from that state to carry out insurance business in any state. This has restricted some insurtech companies from exhibiting in different states. For example, Metromile's auto insurance products can only be sold in 8 states.

►Anti-discount law: The anti-discount law requires that insurance marketing cannot provide other valuable services for free. This has limited some insurtech companies from providing a package of services. Zenefits, for example, had to change the original free HR outsourcing service to a fee-based service.

►Anti-discriminatory pricing: indicates that different price standards cannot be applied when providing the same product to different consumers (such as different pricing by region). This limits the extent to which insurtech companies use big data to differentiate pricing.

►Data privacy protection: Overseas countries attach great importance to the protection of data privacy. For example, the US has clear regulations on data privacy in the areas of children, health, and credit. This limits the amount and dimension of data acquisition for insurtech companies. In Europe, companies face fines of up to €20 million or 4% of annual turnover (whichever is greater) if they lose money due to data or privacy breaches.

►Machine consulting qualifications: Some countries require robots that provide consulting services to obtain qualifications equivalent to natural person standards. This requirement directly raises the threshold for machine consulting applications.

Incentives policy

The incentives for overseas insurtech companies to be regulated are mainly reflected in the establishment of specialized agencies under the supervisory authority to serve insurtech companies and the establishment of a sandbox mechanism.

►Regulators have specialized agencies to serve insurtech companies: In 2014, the British regulator FCA established an innovation center to help innovative companies understand regulations. In 2017, the US insurance regulator NAIC set up an Innovation and Technology (EX) Task Force to help regulators understand the state of insurtech development.

►Establish a sandbox mechanism: A sandbox mechanism means that insurtech companies can apply to the regulation to test new technology without being restricted by the existing regulatory framework for the time being (such as mandatory indicators such as capital requirements). Then, based on the test results, the regulation determines future regulatory measures. Since 2014, many countries, including the United Kingdom, the United States, and Singapore, have set up insurtech sandboxes. It is worth noting that not all insurtech companies can successfully apply for sandbox protection; they generally need to prove that it is beneficial to consumers.

Demand: Solving customer pain points (such as low price, convenience, etc.) has become the focus of innovation for insurtech companies

Customer demand has also promoted the development of overseas insurance technology. This is reflected in customer demand for low prices and convenience, which has also become a concentrated innovation direction for insurtech companies. The demand of individual customers for low-cost insurance policies has given birth to the model of price comparison platforms. For example, EverQuote provides customers with price comparison services to provide more cost-effective products. The demand for convenience from enterprise customers has spawned a model for corporate commercial insurance solutions. For example, Zenefits provides a service for corporate employees to purchase insurance in the HR system it provides, providing one-stop convenience for enterprise employees.

Overseas insurance technology company model: full bloom, different from “China”

The insurtech industry in China and the US is close to the degree of development, but the diversity of the US model is slightly superior

The degree of development of the insurtech industry in China and the US is close

According to Statista, in 2019, the share of US internet premiums in total premiums (internet insurance penetration rate) was 7.2%, which is close to China's 6.3%. Based on this, we believe that the insurtech industry in China and the US is developing at a similar level.

The diversity of American insurtech models is slightly superior to that of China

We compared the main insurtech models in China and the US, and believe that the insurtech models unique to the US are slightly more than those in China (5 types in the US vs. 2 in China).

We believe that the business environment, stage of development, and regulatory policies have led to a slight increase in the diversity of models in the US, while differences at the technical level are less(Currently, insurance technology still does not require extremely complex technology). We believe that in the medium term, the gradual maturity of the development stage and changes in regulatory policies in specific fields will be the main driving force for China to bridge the model diversity gap with the US, while the business environment will be more difficult to change. For example, we believe that rate liberalization after comprehensive auto insurance reform may make the UBI auto insurance model possible in China. However, the differences in the 2B insurance technology market are due to differences in social security models, so we expect it to be difficult to change in the medium term.

Chart: Internet premiums in China and the US are relatively close in proportion to total premiums

Source: China Insurance Industry Association, Statista, CICC Research Division

Chart: Comparison of internet insurance premiums between China and the US in 2019

Source: China Insurance Industry Association, Statista, CICC Research Division

The business model of overseas insurtech

Participation in insurance management is different. We divide the direction of overseas insurance technology companies into sales side innovation, product/service innovation, and middle and back office innovation.By analyzing different links, models, and representative companies, we have determined the following: 1) The current direction of innovation is more concentrated on the sales side and the middle and back office. Of all the companies surveyed by Oliver Wyman in 2017, the number of sales side, product/service, and back office companies accounted for 42%, 19%, and 39%, respectively. 2) There is a big difference in popularity between different models. The more popular models involve a larger number of companies and obtain larger financing on behalf of the company. On the sales side, price comparison platforms and B2C online insurance brokerage models are more mainstream. Among products/services, post-insurance service innovation and scenario-based product models are more mainstream. In the middle and back office, models where big data helps accurate pricing and control compensation, and technical services help improve operational efficiency are all very mainstream.

Chart: According to Oliver Wyman Consulting, as of the end of 2018, insurtech companies had the highest number of sales and middle and back office companies

Source: Oliver Wyman Consulting, CICC Research Department

Chart: 10 insurtech companies with the highest total financing amount (since inception)

Note: Financing data as of August 20, 2020 Source: Crunch Database, CICC Research Department

Sales side

The number of companies in this direction is the largest and the business model is more mature. This field can be divided into two segments according to the different target customer groups: the personal insurance market and the corporate insurance market.

The main source of revenue for insurtech companies in the personal insurance market comes from insurance companies' commissions. The main differences between the different models are the different scenarios and methods of fundraising. Judging from the number of companies, the two models of price comparison platforms and B2C insurance brokers are more mainstream.The main models of this type of company are:

►Price comparison platform: Provide price comparison services to attract customers. This type of model is more popular. It is worth noting that overseas regulations allow insurance price comparison, so there are a large number of price comparison platforms, while China has stricter restrictions. Typical companies include The Zebra and EverQuote.

►B2C insurance brokerage: Attracting traffic through online advertising and other means. This type of model is more popular. However, due to the passive sales nature of insurance and fierce competition, this type of model faces the problem of high customer acquisition costs. Typical companies include PolicyPal and GoHealth. This type of model is similar to China's Huize To C business, Little Umbrella.

►D2C: Precise marketing to attract potential customers, provide convenience to consumers through full-process services (the main difference from B2C insurance brokers), and achieve high customer retention rates. This type of model faces the problem of high upfront customer acquisition costs. Typical companies include Ladder and SelectQuote. This type of model is similar to China's Wukong Bao.

►Financial planning: Providing online financial services while selling insurance products through cross-selling. For such companies, the sale of insurance products is only one part of their financial services. Typical companies include Bank Bazaar. This type of model is similar to that of various bank apps in China to buy insurance.

Overseas employers generally have to buy insurance or self-insurance for their employees, so the ToB (corporate insurance market) business development on the overseas sales side is higher than that of China.Depending on whether an enterprise needs commercial insurance or self-insurance for the type of insurance, the corporate insurance market generally has 2 models:

►Enterprise commercial insurance solutions: If enterprises need commercial insurance, the more popular model provides a human resources management system for insurtech companies, and in this system, enterprises can purchase commercial insurance for employees. After the order is issued, the insurtech company can collect the insurance company's commission. Typical companies include Zenefits. This type of model is similar to China's quantum conservation.

►Enterprise self-insurance solutions: If a business needs to insure itself, the provider can help the company establish a self-insurance plan and then charge a service fee. Typical companies include Collective Health. Compared to this, the demand for self-insurance for Chinese SMEs is very low.

Product/Service

This direction can be divided into product innovation and service innovation. There are relatively few companies in this direction, mainly because current technology has not created a large number of new products (more model innovation and empowerment). butInnovative models of post-insurance services have given birth to unicorns in many health fields (such as Oscar Health).

Product innovation companies' profits come from underwriting profits. Innovation is mainly reflected in improving product flexibility and convenience, expanding the scope of underwriting risk, and reducing moral risk.There are five main models in this direction. Judging from the number of companies, the scenario insurance model is more mainstream:

►Scenario-based products: Embedding insurance products into specific scenarios greatly enhances product convenience and interaction with policyholders. Typical companies include Trov, which provides property insurance for cameras when traveling. This type of model is similar to China's return shipping insurance.

►Highly flexible products+risk partners: Covering people who cannot pay for traditional insurance through highly flexible, low-cost products. This part of demand is small and scattered, and often cannot be met by expensive offline agents. Typical companies include Getafe, which provides life insurance products with monthly payments and low prices. This type of model is similar to China's monthly health insurance of one million.

►IoT products: Products that can be accurately priced using the Internet of Things. Typical companies include Metromile, which offers car insurance priced by mileage and driving habits. The future development of UBI auto insurance in China may also follow this model.

►Products based on new risk types: cover new risk types due to new scenarios or risks that were once difficult to cover due to technical restrictions (such as cybersecurity risks). Typical companies include Superscript. This type of model is similar to China's online account theft insurance.

►P2P insurance/online mutual assistance: Through acquaintance leaders, high-quality low-risk groups are brought together to share risk on a small scale, and a reward mechanism is used to motivate mutual supervision among acquaintances to reduce moral risk. Typical companies include Friendships. This type of model is similar to China's Mutual Treasure.

Service innovation companies reduce conflicts of interest between insurance companies and policyholders through services and receive commissions or service fees from insurance companies; insurance companies increase their underwriting profits through such service innovation.There are two main models in this direction. Judging from the number of companies, post-insurance service innovation is more mainstream:

►Post-insurance service innovation: To provide users with remote intervention services (including telemedicine services, etc.) after applying for insurance, the purpose is to reduce insurance payout rates. The model can be simply understood as a closed loop of internet-based insurance+health ecology. Typical companies include Oscar. This type of model is similar to China's Ping An Insurance+Ping An Good Doctor joint service.This type of model has given birth to many unicorns. According to our statistics, these companies occupy 3 seats among the top 5 insurtech companies in the world by financing volume.

►Pre-insurance service innovation: This type of company conducts online health tests for policyholders in the pre-insurance stage to help policyholders obtain lower premiums, help insurance companies obtain healthier customers, and in turn charge insurance company commissions. Typical companies include Health IQ.

Middle back stage

Compared to domestic insurance technology companies, overseas insurtech companies pay more attention to the underlying technology. Innovation in the middle and back office is an important direction for overseas insurtech companies. It is mainly divided into 2 models: big data helps accurate pricing and control compensation, and technical services help improve operational efficiency. Both models are quite popular, and quite a few companies are participating.

►Big data helps to accurately price and control payments: These companies use their strengths in data and experience to provide solutions for insurance companies in terms of pricing, risk control, and claims, and their services mainly rely on big data technology. Its revenue comes from service fees. Typical companies include Shift Technology and ICEYE. This type of model is similar to China's Aibao Technology and its summary data.

►Technical services help improve operational efficiency: These companies rent or customize online systems to improve the operational efficiency of insurance companies. These companies charge for services or regularly charge membership fees. Typical companies include: Pokitdok. This kind of model is similar to China's Zhongke Soft. At the same time, some companies provide AI service solutions, which benefit insurance companies from reducing labor costs. Reduce labor costs by replacing manual services with AI robots. Typical companies include Lemonade. This type of model is similar to the AI car insurance survey damage developed by Ping An in China.

Valuation of US insurtech companies: benchmarking technology companies, higher than Chinese peers

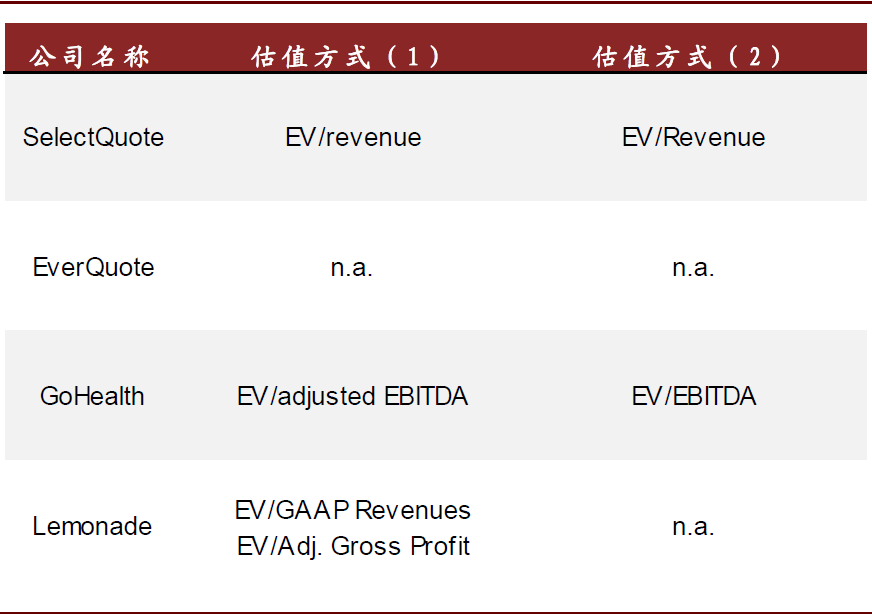

Valuation method

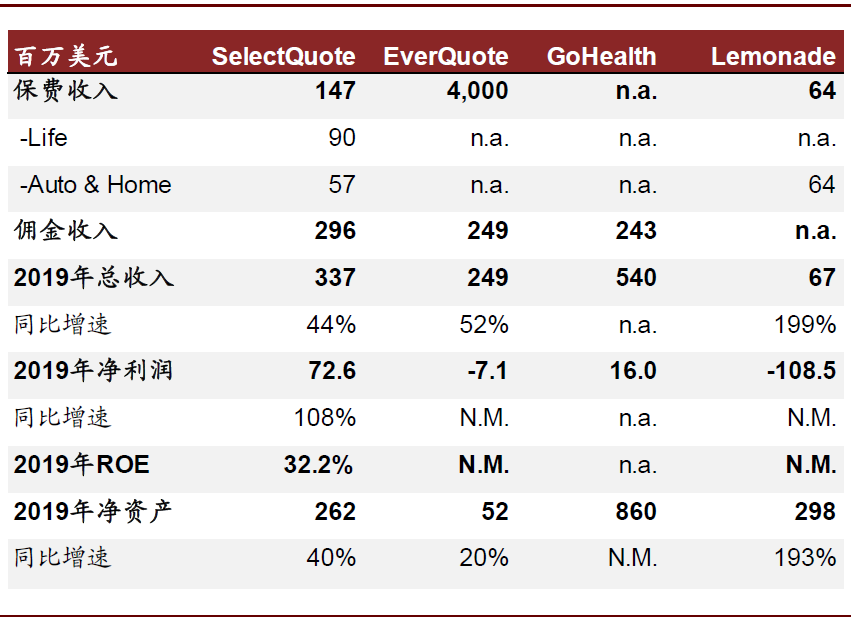

Currently, 4 insurtech companies are listed in the US, namely SelectQuote, EverQuote, GoHealth, and Lemonade. The listing locations are all in the US. Lemonade is a direct underwriter, and the remaining 3 are all sales side companies.

We have studied the valuation methods of some investment banks,It was discovered that the US capital market mainly uses EV/Revenue and EV/EBITDA to value insurtech companies.This is mainly due to: 1) some companies are still unprofitable; 2) insurtech companies, using EV/Revenue and EV/Ebitda to help price their growth.

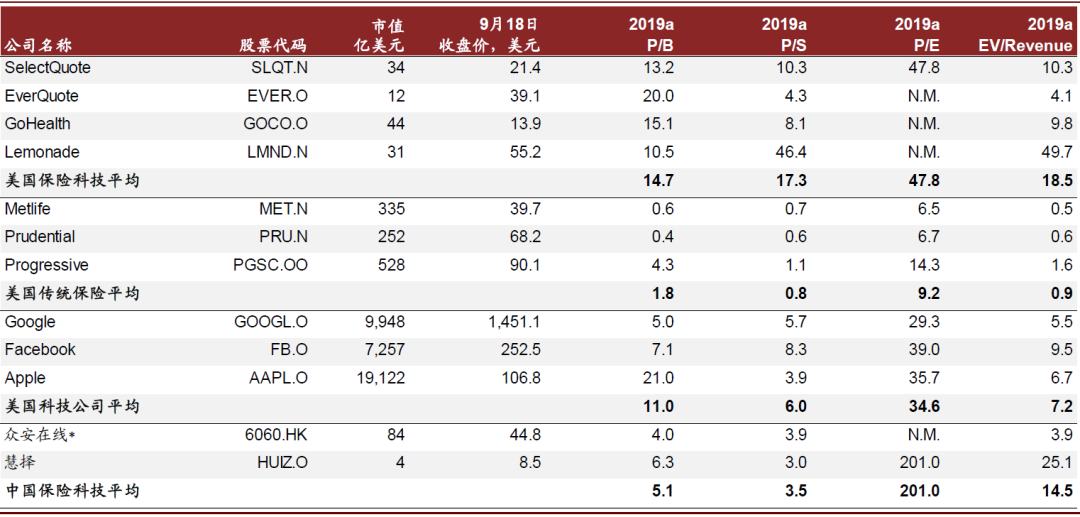

Valuation level

By comparing the valuations of US insurtech companies with traditional US insurers, US tech giants, and Chinese insurtech companies, we found that:

►The valuation of US insurtech companies is higher than that of China:On September 18, the average transaction of US insurtech companies was 14.7 times 2019a P/B, and the average transaction of Chinese insurtech companies was 5.1 times 2019a P/B.

►US investors are more willing to benchmark insurtech companies against tech giants and give them higher valuations:For example, on September 18, the average transaction of the three sales side companies was 7.6 times 2019a P/S, close to technology giants (6.0 times) and far surpassing traditional insurance companies (0.8 times). Lemonade's transaction was 46.4 times the 2019A P/S, surpassing other companies.We think this is because:1) American investors are more willing to believe that technology empowerment can enable insurtech companies to achieve much higher growth than traditional insurance companies, thereby giving growth premiums and thus benchmarking technology companies. 2) There are differences in the regulatory environment of the insurance industry between China and the US, and China's direct supervision of the insurance industry is more strict.

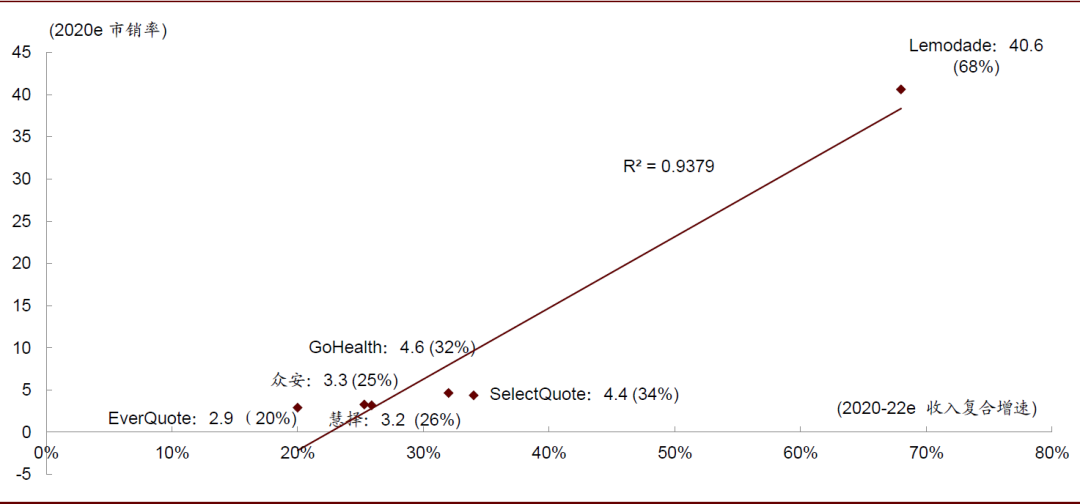

►Through a regression analysis of the compound revenue growth rates of 2020e P/s and 2020-22e, we believe that the growth rate is the main factor affecting the valuation of insurtech companies:For the four US companies, the higher the expected growth rate, the higher the P/S. Lemonade's valuation is far higher than other insurtech companies, mainly due to high market expectations for its growth.

Chart: Key financial data of four US insurtech companies

Source: Company Announcements, CICC Research Department

Chart: Mainstream valuation methods for the four US insurtech companies

Source: Capital IQ, CICC Research Department

Chart: Comparable valuations of US insurtech companies

Note: Companies marked with* are covered by CICC Source: Media Information, CICC Research Department

Chart: Regression analysis of the compound revenue growth rates of 2020e P/s and 2020-22e: the higher the growth rate forecast, the higher the valuation

Source: Media Information, CICC Research Department Note: Zhongan uses CICC forecasts, and other companies use consistent market expectations

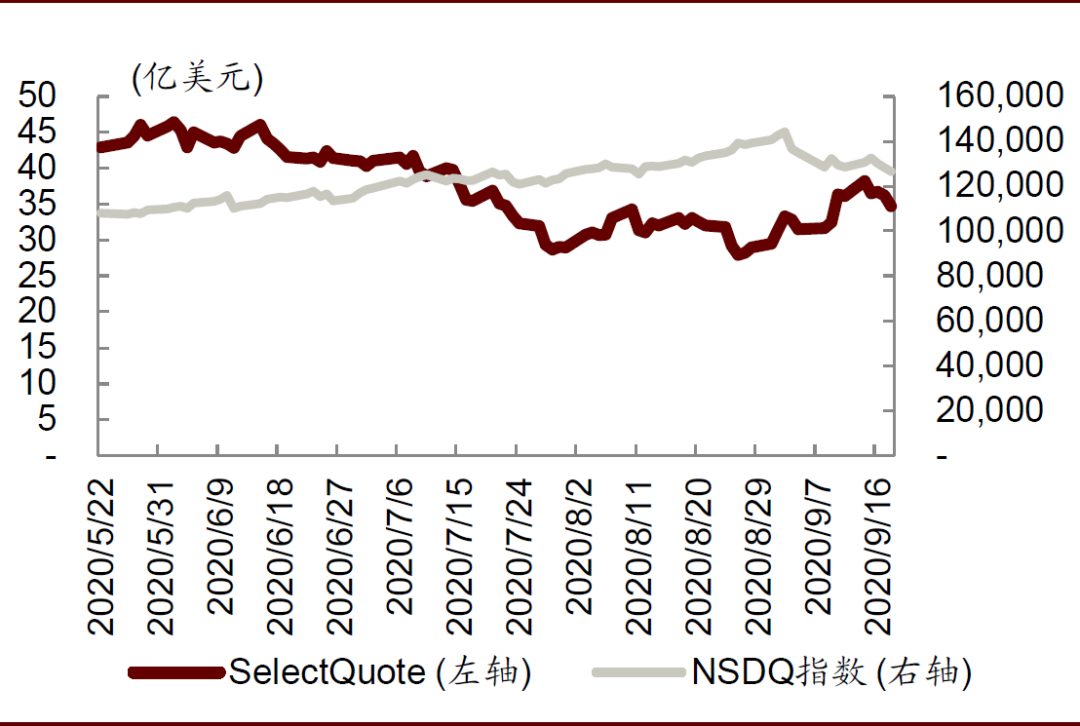

Chart: Changes in the market value of SelectQuote since its listing

Source: Media Information, CICC Research Department

Chart: Changes in the market value of EverQuote since its listing

Source: Media Information, CICC Research Department

Chart: Changes in market value of GoHealth since its launch

Source: Media Information, CICC Research Department

Chart: Changes in market value of Lemonade since its listing

Source: Media Information, CICC Research Department