Events:According to Fastmarkets, VALE.US 's chief financial officer, Luciano Siani,

Pires said it would shut down its nickel-cobalt mine in Goro, New Caledonia, in 2021.

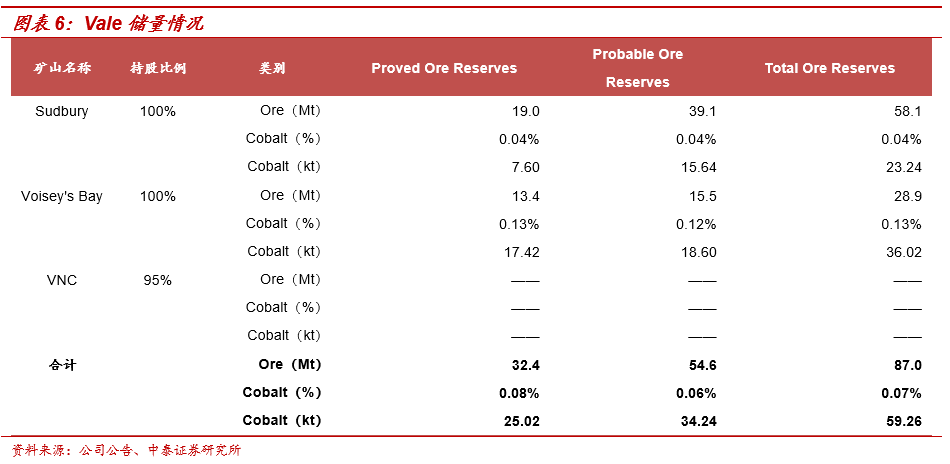

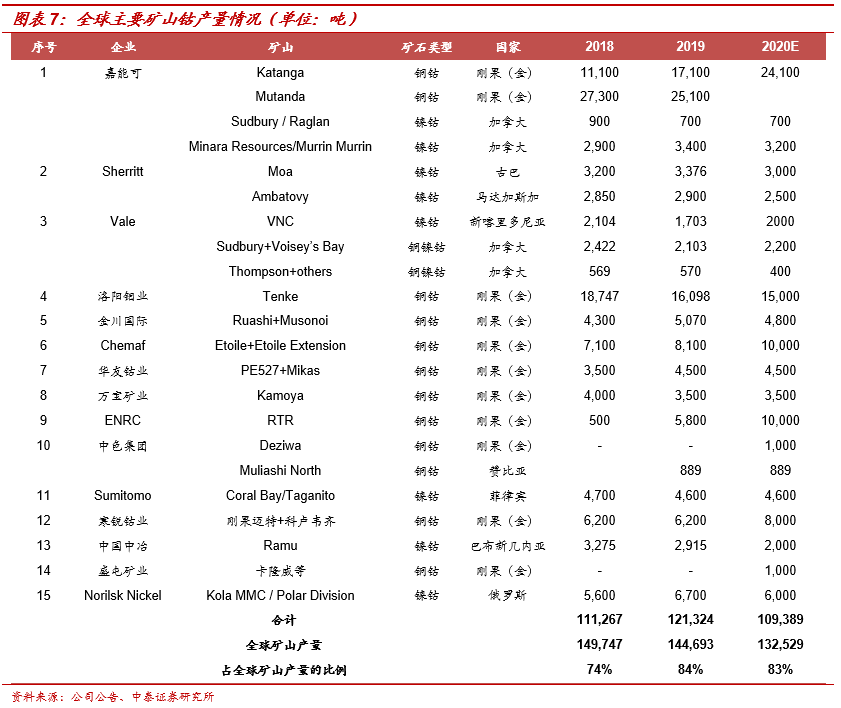

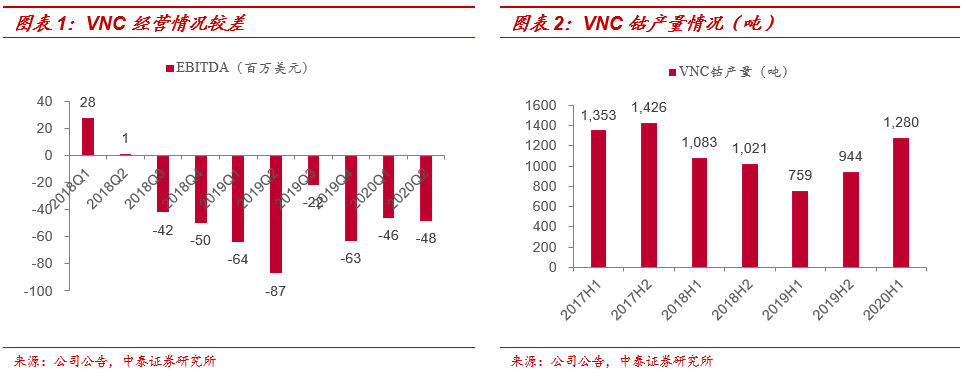

The operation of VNC is poor, and the shutdown is mainly for economic reasons..VNC-owned Goro nickel / cobalt ore production began in 2011, the main products are nickel oxide, nickel cobalt hydroxide, the design of crude cobalt hydroxide nominal production capacity of 4500 tons / year. The Goro mine produced 1280 tons of cobalt in the first half of the year and is expected to produce about 2000 tons for the whole year, accounting for about 1.5 per cent of the global supply. 1. VNC shuts down Goro mine mainly because of its lack of economy. The operating cost of the VNC nickel-cobalt mine has been high, with VNC mine EBITDA of-63 million in 2018, VNC mine EBITDA of-236 million in 2019 and EBITDA of-94 million in 2020. 2. Vale has been trying to sell VNC mines in 2019. On May 29, 2020, Vale signed an exclusive agreement with Australia's New Century Resources Limited (NCZ) to negotiate the sale of its ownership of VNC in New Caledonia. Vale SA failed to reach a sale agreement with NCZ on Sept. 8, 2020, and failed to find a suitable buyer for a month after the talks broke down.

At present, the price of cobalt is at the bottom of a long historical period, and there is little profitability in the mine.Force.Since Q2 in 2018, the price of cobalt has continued to decline due to the decline of domestic new energy vehicles. The price of MB cobalt (standard grade) has dropped from a low of US $44.13 / lb to US $12.63 / lb, a decrease of 71.39%. MB cobalt alloy grade has dropped from a low of US $44.08 / lb to US $12.43 / lb, a drop of 71.8%. The current price has fallen to the bottom of the long period in 2006 and 2016. Under the current price level, the profitability of both mining enterprises and smelting enterprises is low, and there is little room for price downward under the support of cost.

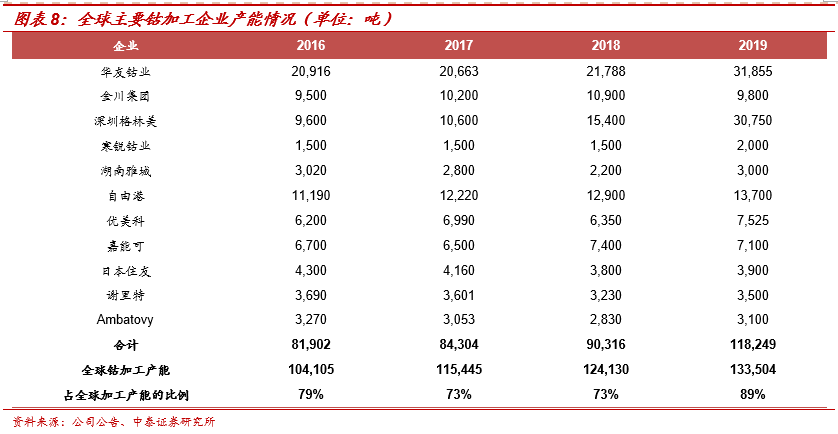

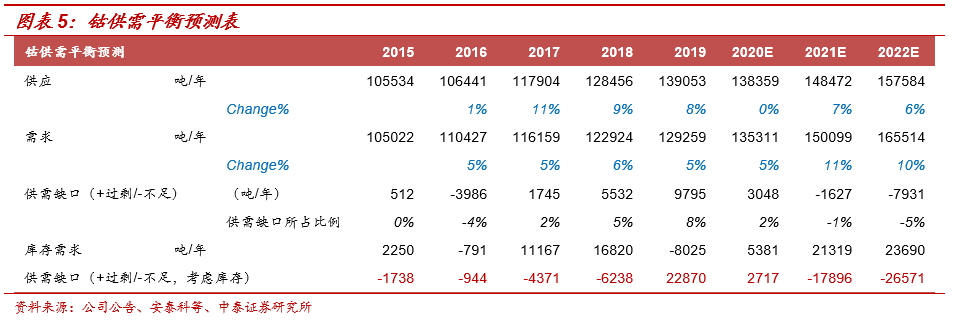

Demand cycle + capacity cycle + inventory cycle resonance, cobalt price center may gradually move up.1) the margin of demand continues to improve. Domestic sales of 138000 new energy vehicles in September, production of the yoy+67.7%, power battery industry chain increased by 30% month-on-month in October, and the operating rate of ternary material manufacturers continued to increase. Sales of new energy vehicles in six European countries increased by 169% in September compared with the same period last year. It is expected that the annual growth rate of yoy50%+;5G mobile phone replacement trend may gradually come, and traditional areas such as superalloys will also be gradually repaired. 2) the supply side will be flat in the next 2-3 years. Glencore shut down Mutanda mines at the end of 2019, affecting about 16% of the global supply. from the perspective of the new mines, the incremental projects in the next three years are mainly concentrated in Glencore Katanga project and Shalina Etoile.

Mine project, Eurasian Resources RTR project and China Color Group Deziwa project, in addition, there are no large-scale mine construction plans, the overall incremental projects are limited and orderly release 3) the inventory of the industrial chain remains low. After 19 years of destocking cycle, the inventory of the material factory in the middle reaches of the industrial chain is only 1-2 weeks, which can only maintain normal turnover, and the inventory is mostly concentrated in the upstream mines, but the inventory is basically locked by the long order. According to our estimates, the supply of cobalt may fall short of demand in 2021, and the industrial chain may replenish the warehouse or enlarge the gap between supply and demand.

Risk Tips:The risk of production and sales of new energy vehicles falling short of expectations, the risk of higher-than-expected release of cobalt production, the risk of industrial policy fluctuation, etc.

Appendix: