Medical Developments International Limited's (ASX:MVP) Price Is Right But Growth Is Lacking

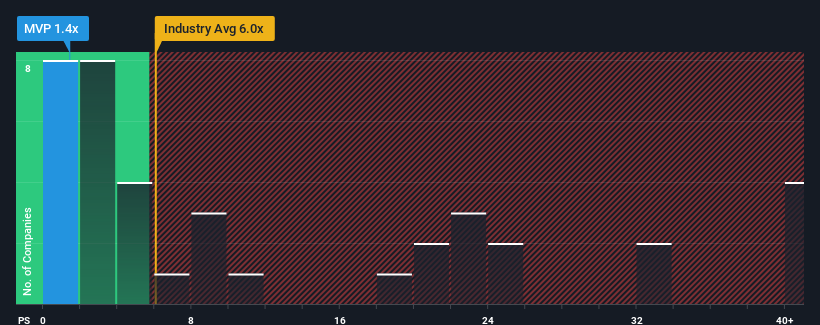

With a price-to-sales (or "P/S") ratio of 1.4x Medical Developments International Limited (ASX:MVP) may be sending very bullish signals at the moment, given that almost half of all the Pharmaceuticals companies in Australia have P/S ratios greater than 6x and even P/S higher than 22x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Medical Developments International

How Has Medical Developments International Performed Recently?

Medical Developments International could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Medical Developments International's future stacks up against the industry? In that case, our free report is a great place to start.

Is There Any Revenue Growth Forecasted For Medical Developments International?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Medical Developments International's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 105% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 105% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 24% as estimated by the sole analyst watching the company. That's not great when the rest of the industry is expected to grow by 336%.

In light of this, it's understandable that Medical Developments International's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Medical Developments International's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Medical Developments International's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for Medical Developments International (1 shouldn't be ignored!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance