Check Out What Whales Are Doing With ATT

Check Out What Whales Are Doing With ATT

Someone with a lot of money to spend has taken a bearish stance on AT&T (NYSE:T).

有很多錢可以花的人採取了看跌立場 AT&T (紐約證券交易所:)。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the big position showed up on publicly available options history that we track here at Benzinga.

今天,當我們在Benzinga追蹤的公開期權歷史記錄中出現大頭寸時,我們注意到了這一點。

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with T, it often means somebody knows something is about to happen.

我們不知道這是機構還是僅僅是一個富人。但是,當 T 發生這麼大的事情時,通常意味着有人知道某件事即將發生。

So how do we know what this whale just did?

那麼我們怎麼知道這隻鯨魚剛才做了甚麼?

Today, Benzinga's options scanner spotted 10 uncommon options trades for AT&T.

今天,Benzinga的期權掃描儀發現了AT&T的10筆不常見的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 30% bullish and 70%, bearish.

這些大額交易者的整體情緒分爲30%看漲和70%(看跌)。

Out of all of the special options we uncovered, 4 are puts, for a total amount of $128,051, and 6 are calls, for a total amount of $513,199.

在我們發現的所有特殊期權中,有4個是看跌期權,總金額爲128,051美元,6個是看漲期權,總金額爲513,199美元。

What's The Price Target?

目標價格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $13.0 to $20.0 for AT&T over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚的目標價格似乎從13.0美元到20.0美元不等。

Volume & Open Interest Development

交易量和未平倉合約的發展

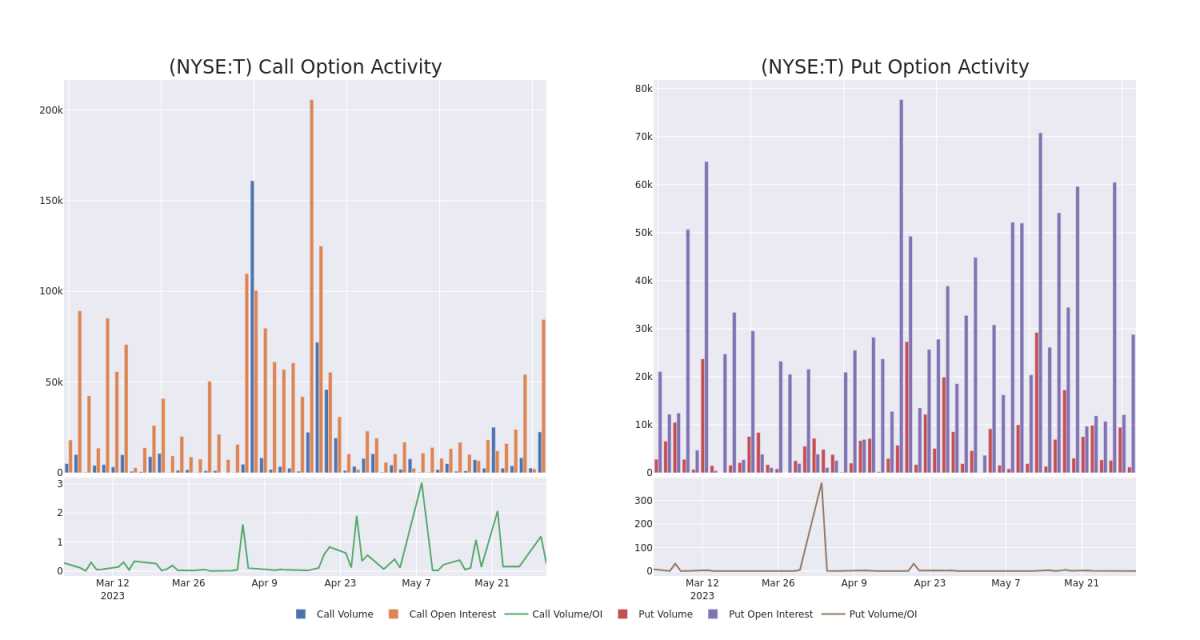

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for AT&T's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of AT&T's whale trades within a strike price range from $13.0 to $20.0 in the last 30 days.

在交易期權時,查看交易量和未平倉合約是一個強有力的舉措。這些數據可以幫助您跟蹤給定行使價下AT&T期權的流動性和利息。下面,我們可以觀察到過去30天內在行使價範圍內,AT&T的所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的分別變化情況。

AT&T Option Volume And Open Interest Over Last 30 Days

過去 30 天的 AT&T 期權交易量和未平倉合約

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| T | CALL | TRADE | BULLISH | 01/19/24 | $20.00 | $259.0K | 54.7K | 18.5K |

| T | CALL | SWEEP | BULLISH | 06/21/24 | $17.00 | $84.9K | 6.0K | 10 |

| T | CALL | SWEEP | BEARISH | 01/19/24 | $17.00 | $64.7K | 12.1K | 25 |

| T | PUT | SWEEP | BEARISH | 07/21/23 | $16.00 | $50.5K | 10.0K | 666 |

| T | CALL | SWEEP | BEARISH | 06/30/23 | $16.00 | $37.1K | 1.8K | 3.5K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|

| T | 打電話 | 貿易 | 看漲 | 01/19/24 | 20.00 美元 | 259.0 萬美元 | 54.7K | 18.5K |

| T | 打電話 | 掃 | 看漲 | 06/21/24 | 17.00 美元 | 84.9 萬美元 | 6.0K | 10 |

| T | 打電話 | 掃 | 粗魯的 | 01/19/24 | 17.00 美元 | 64.7 萬美元 | 12.1K | 25 |

| T | 放 | 掃 | 粗魯的 | 07/21/23 | 16.00 美元 | 50.5 萬美元 | 10.0K | 666 |

| T | 打電話 | 掃 | 粗魯的 | 06/30/23 | 16.00 美元 | 37.1 萬美元 | 1.8K | 3.5K |

Where Is AT&T Standing Right Now?

AT&T 現在在哪裏?

- With a volume of 17,271,273, the price of T is up 0.9% at $15.78.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 50 days.

- T的交易量爲17,271,273美元,上漲了0.9%,至15.78美元。

- RSI 指標暗示標的股票可能已接近超賣。

- 下一份財報預計將在50天后公佈。

What The Experts Say On AT&T:

專家對AT&T的看法:

- RBC Capital downgraded its action to Sector Perform with a price target of $19

- 加拿大皇家銀行資本將其行動評級下調至行業表現,目標股價爲19美元

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

If you want to stay updated on the latest options trades for AT&T, Benzinga Pro gives you real-time options trades alerts.

如果您想隨時瞭解AT&T的最新期權交易,Benzinga Pro會爲您提供實時期權交易提醒。

譯文內容由第三人軟體翻譯。