U.S. Construction Equipment Rental Market Assessment Report 2023-2029 Featuring United, Sunbelt, Herc, Home Depot, Warren CAT, Sunstate Equipment, H&E Equipment, Maxim Crane Works, Briggs, Uperio

U.S. Construction Equipment Rental Market

Dublin, April 17, 2023 (GLOBE NEWSWIRE) -- The "U.S. Construction Equipment Rental Market - Strategic Assessment & Forecast 2023-2029" report has been added to ResearchAndMarkets.com's offering.

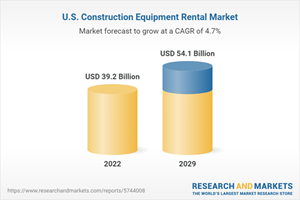

U.S. construction equipment rental market is expected to reach a value of $54.1 billion by 2029 from $39.2 billion in 2022, growing at a CAGR of approximately 4.73% from 2022 to 2029

In 2021, the Biden-Harris government signed the Bipartisan Infrastructure Law (BIL), which focused on promoting the nation's infrastructure and competitiveness by rebuilding roads, bridges, ports, and airports.

It also included the upgradation of rail systems and providing cleaner and cheaper energy. Investment in the construction industry during November 2022 was recorded at USD 1,807.5. Private construction received worth USD 1,426.4 billion in investment during the same period. The launch of BIL is focused on upgrading and renovating the nation's aging infrastructure and is expected to propel the U.S. construction equipment rental market during the forecast period.

MARKET TRENDS & DRIVERS

Investment Through the Bipartisan Infrastructure Law to Rebuild Public Infrastructure is Expected to Support the Demand for Rental Construction Equipment

The US Department of Transportation (USDOT) and Federal Highway Administration (FHWA) liquidated approximately USD 120 billion to restructure the highways and bridges for the years 2022 and 2023.

In November 2022, a list of more than 2,800 bridges was released for upgradation. USDOT also stated an investment worth USD 2.2 billion in Rebuilding American Infrastructure with Sustainability and Equity (RAISE) for 166 projects to modernize local transportation with safer, more accessible roads, bridges, and rails.

Under the National Electric Vehicle Infrastructure (NEVI), the Infrastructure Bill approved Electric Vehicle Infrastructure Deployment Plans for all 50 states. This investment included building EV charging stations with an investment of more than USD 7.5 billion.

Rising Inflation & Supply Restraints in the Country is Expected to Propel the Demand for Rental Machinery

In 2022, some of the biggest challenges faced by players in the U.S. construction industry were rising material prices and labor costs, staff shortages, supply chain issues, and worn-out stocks due to global uncertainties.

According to the U.S. Bureau of Labour Statistics analysis, the input prices of non-residential construction increased by more than 24% in 2022.

Growth in the Mining Industry to Propel the Demand for Renting Earthmoving Equipment

According to the U.S. Geological Survey, U.S. mines produced approximately USD 90.4 billion in mineral commodities in 2022, increasing by USD 9.7 billion compared to 2020. Among the non-fuel commodities, crushed stone was the leading commodity produced in 2021. The metal mine production was valued at USD 33.8 billion in 2021.

Integration of Advanced Technology in the Rental Fleet To Support the U.S. Goal of Net-Zero Emission by 2050

The United States government, in 2022, announced to achieve net-zero emissions by 2050 and a 65% reduction by 2030. Industries, in response to the announcement, are transitioning towards zero-emission power. For instance, United Rentals, the world's largest rental company, announced its partnership with Turner in response to reducing the environmental impact of its operations and helping customers reduce their carbon footprint. United Rental also introduced total control emissions tracking systems in the renting equipment so that the customers can evaluate the environmental footprint.

INDUSTRY RESTRAINTS

Rising Mortgage Rates to Restrict the Demand for Residential Construction

Residential construction in the country fell to its lowest in 2022 due to high mortgage rates and high prices of construction materials. In October 2022, the average interest rate was 7.06%, and the house prices reached USD 525,000, a 40% increase compared to 2020. The Federal Reserve further predicted the mortgage rates to be at 4.6% in 2023, which is comparatively higher than the pre-pandemic levels.

Warehouse Shrinkage in the U.S. is Expected to Restrict the Demand for Material Handling Rental Equipment

It has been anticipated that U.S. warehouse development will decline in 2023. Therefore, the U.S. industrial and leasing activity is set to fall by 10% to 15% during the same period. The average warehouse vacancy rate increased to 3.2% in the second quarter of 2022.

Labor Shortage in the Country is Expected to Hamper the Pace of Construction Projects

According to the US Bureau of Labor Statistics, the construction industry in the U.S. had approximately 440,000 job openings in April 2022. The investment announced through the Infrastructure Bill in 2021 requires more than 300,000 laborers each year to fulfill its goal of rebuilding infrastructure projects.

The BIL spending is expected to start in 2023 and continue till 2033. It has been estimated that the contractor's segment would witness a shortfall of 160,000 workers, whereas the materials sector would experience a scarcity of 145,000 workers and 40,000 workers in the engineering sector.

VENDOR LANDSCAPE

Prominent vendors in the U.S. construction equipment rental market are Caterpillar, Volvo Construction Equipment, Liebherr, Hitachi Construction Machinery, Komatsu, John Deere, Hyundai Construction Equipment, JCB & Kobelco.

JCB, John Deere & Terex are emerging strong in the U.S. construction equipment rental market. These companies are introducing innovative products to capture the construction equipment industry's share. For instance, in 2022, John Deere launched its new large, wheeled loaders (744 P-tier, 824 P-tier, 844 P-tier, and the 904 P-tier) in the US.

Other prominent U.S. construction equipment rental market vendors are CNH Industrial, Liugong, Tadano & Terex.

Liebherr, Caterpillar, Volvo Construction Equipment, Komatsu & Hitachi Construction Machinery are the U.S. construction equipment rental market leaders. These companies have a strong industry share and offer diverse products.

Caterpillar operates over 60 locations in 25 states of the United States and is a leading US exporter. Finning CAT is one of the prime distributors in the United States.

Key Attributes:

Report Attribute | Details |

No. of Pages | 119 |

Forecast Period | 2022 - 2029 |

Estimated Market Value (USD) in 2022 | $39.2 Billion |

Forecasted Market Value (USD) by 2029 | $54.1 Billion |

Compound Annual Growth Rate | 4.7% |

Regions Covered | United States |

Key Vendors

Caterpillar

Komatsu

Hitachi Construction Machinery

Volvo Construction Equipment

Liebherr

Hyundai Construction Machinery

John Deere

Kobelco

JCB

Other Prominent Vendors

Terex Corporation

Liu Gong

CNH Industrial

Tadano

Rental Companies Profile

United Rentals, Inc.

Sunbelt Rentals

Herc Rentals

The Home Depot Rental

Warren CAT

Sunstate Equipment

H&E Equipment Services

Maxim Crane Works, L.P.

Briggs Equipment

Uperio Group

Worldwide Machinery

For more information about this report visit https://www.researchandmarkets.com/r/j2wln2

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance