Abstract: although BMW is currently mired in diesel scandals, illegal price negotiations and other problems, affecting its performance in the stock market, BMW has eight consecutive years of profit growth and development goals in line with the trend of the times, so the investment prospect is still optimistic.

The return on BMW stock is as high as 5%

How is BMW developing at present?

At present, BMW's investment situation is not optimistic because of anti-competitive investigations, diesel scandals, rising commodity costs and the appreciation of the euro, as well as public concerns that BMW will lag behind in future competition for technology-related development. But in fact, BMW is doing very well. The company has broken its profit and sales records for eight years in a row (including 2018).

In 2017, BMW's sales were 98.7 billion euros (up 5 per cent from a year earlier) and pre-tax profit was 10.7 billion euros (up 10 per cent from a year earlier). After-tax profit rose to 870 million euros from 690 million euros, exceeding expectations. BMW's main target is profit margin before interest and tax, which is 8.9%, reaching the target range of 8-10%. BMW has maintained its position as the world's number one car company with record sales for the seventh consecutive year. Sales of the brand hit an all-time high, driven by strong growth in the BMW X-Series (up 9.6%) and the new BMW 5-Series. In addition, BMW successfully exceeded its target of selling at least 100000 electric vehicles (103080), similar to Truss TSLA (103000), cementing its leading position in high-end electric vehicles. In 2018, BMW aims to sell more than 140000 electric vehicles.

In the future development direction, BMW's focus is in line with the development trend of the industry, which will also be a boost to its development. BMW will significantly increase its research and development budget for electric vehicles and develop new models, with plans to offer as many as 25 different models by 2025. This goal promotes BMW's continuous research and development. In 2017 and 2018 alone, BMW has produced about 40 new and upgraded models and plans to launch more models priced higher than the BMW 8-Series and X7 SUV in 2020, when profits per car will also rise.

In terms of production costs, BMW plans to reduce indirect costs by 100 million euros by 2019, that is, all other product lines that have nothing to do with actual car production. This means that the company will reduce its production of steering wheels and seats to make production more streamlined and efficient.

What can investors expect?

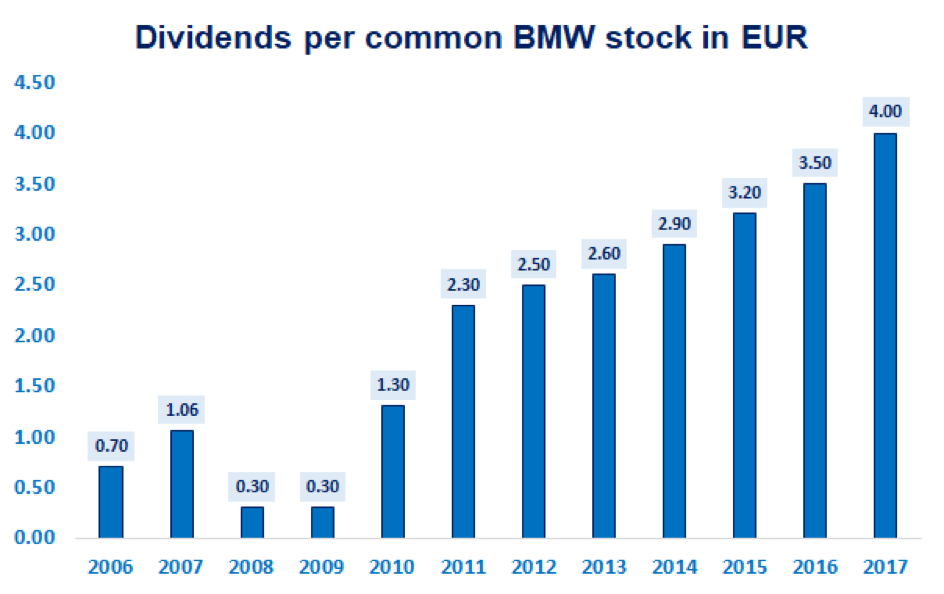

Despite the highly cyclical nature of the auto industry, BMW's dividend has been on a growing trend. The company's shares listed on the Frankfurt Stock Exchange are divided into preferred shares and common shares. Preferred shares are sold at a price of 15% less than common stock. Recently, the company announced an increase of 14.2 per cent in its annual dividend, raising the yield on preferred shares to 5 per cent. BMW's dividend has increased 5.7-fold over the past 11 years, raising interest rates nine times, cutting it only once at the height of the financial crisis in 2008. This is the eighth year in a row that BMW has increased its dividend at a compound annual growth rate of 33.4%. These increases have something to do with previously very low initial dividends. By calculating the compound annual growth rate over the past five years, we can see that the compound growth rate for that year is about 10%, which is even lower than the latest dividend growth rate, so dividends have risen by 25% in the past two years alone.

(dividend per BMW common share is in euros)

BMW will pay a dividend on May 17 and pay a dividend of 4 euros a year thereafter. Assuming the company's dividend remains stable, BMW's expected dividend yield for 2019 will be as high as 5.3%, despite an expected fall of 4 euros on that day.

Is BMW worth investing?

Combined with the current situation, BMW's stock is still worth investing.

Transport remains a bright spot for future development, especially in growth markets such as Asia. BMW can benefit from this trend with its vast dealer network and cost-efficient production lines. In its plan for the next hundred years, the company has identified six major trends that will focus on the relationship between transportation and technology, energy and society, indicating that the company is actively changing to adapt and serve future needs. In addition, BMW recently opened a new autopilot center, which will provide BMW with "greater innovation and higher development efficiency", thus "ultimately ensuring the company's future sustainability". This suggests that BMW is also looking for innovative ways to deal with disruptive changes in the auto industry.

However, on the technical side, while BMW has a clear advantage in electric vehicles, it needs to invest more money in self-driving cars, especially in the face of powerful rivals such as Apple Inc and Alphabet Inc-CL C. Because Alphabet Inc-CL C collects an astonishing amount of data with Waymo, and given that artificial intelligence is the key to self-driving cars, it is difficult to tell how far Apple Inc and Alphabet Inc-CL C are ahead of BMW. In this context, the worst-case scenario is that BMW will only provide the hardware of the car, while driving technology will be dominated by Alphabet Inc-CL C and Apple Inc. Ideally, it will take more time to solve the dangers and unresolved problems of self-driving cars, which will give BMW enough time to develop and adjust its technology.

Alphabet Inc-CL C and Apple Inc have been committed to level 5 automation (fully self-driving) from the very beginning, while traditional automakers have always focused on level 1 (driver assistance) and level 2 (partial automation). Level 3 (self-driving in specific situations) is currently being implemented. Optimistically, German companies hold most of the patents related to self-driving, so the argument that big technology companies will overtake carmakers is a bit unrealistic.

If investors can accept the above risks, they can get 5% of the current return now, but they also need to be patient and actively observe the future development of BMW.

(this article is produced by Futu Information compilation team, compiled / Deng Wei, proofread / Yang Weiyi)