The 81% return this week takes Bass Oil's (ASX:BAS) shareholders one-year gains to 217%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Bass Oil Limited (ASX:BAS) share price had more than doubled in just one year - up 217%. Shareholders are also celebrating an even better 363% rise, over the last three months. Looking back further, the stock price is 153% higher than it was three years ago.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Bass Oil

With just US$4,163,855 worth of revenue in twelve months, we don't think the market considers Bass Oil to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that Bass Oil finds fossil fuels with an exploration program, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Bass Oil has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

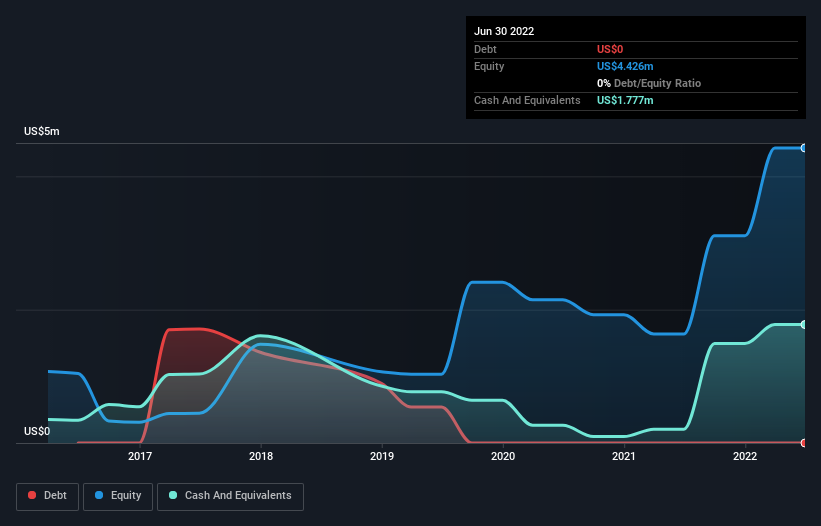

Our data indicates that Bass Oil had US$411k more in total liabilities than it had cash, when it last reported in June 2022. That makes it extremely high risk, in our view. So the fact that the stock is up 70% in the last year shows that high risks can lead to high rewards, sometimes. It's clear more than a few people believe in the potential. The image below shows how Bass Oil's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. It's often positive if so, assuming the buying is sustained and meaningful. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's nice to see that Bass Oil shareholders have received a total shareholder return of 217% over the last year. That gain is better than the annual TSR over five years, which is 10%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Bass Oil (at least 3 which are potentially serious) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here