精編自興業證券:《山雨欲來——興業證券2019年全球宏觀經濟報告》

1、寬鬆漸近天花板,矛盾由匯率轉向利率

金融危機後的十年,「貨幣救經濟」大行其道

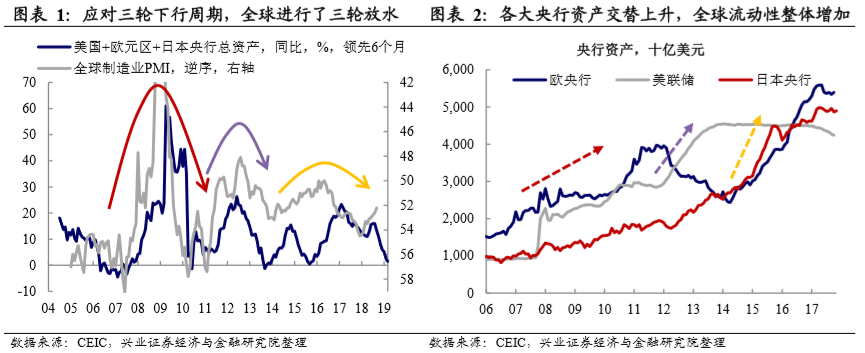

「缺需求」是後金融危機時代全球繞不過去的坎兒。金融危機後,美國信息技術革命及全球價值鏈分工深化動能不再,全球需求增長逐步陷入停滯。在全球弱需求格局下,各國央行重複了三輪「貨幣救經濟」的輪迴。

2007-2008年的金融危機、2012年歐債危機、2014-2015年受商品價格拖累導致貿易萎縮。而與之對應,主要發達經濟體相繼進行了三次貨幣寬鬆,伴隨着本國利率下降、貨幣貶值,經濟也出現回暖。

然而,貨幣政策的不斷寬鬆並未真正刺激經濟的增長,反而造成金融市場較多的隱患——資產負債表對金融資產價格的依賴度不斷上升,這意味着全球流動性寬鬆的瓶頸已至。資產負債表、經濟「復甦」對貨幣寬鬆的依賴,使得寬鬆欲罷不能。但貨幣寬鬆推升了全球債務,卻並未解決「缺需求」的根本矛盾。

全球流動性「由放轉收」,主要矛盾從匯率轉向利率

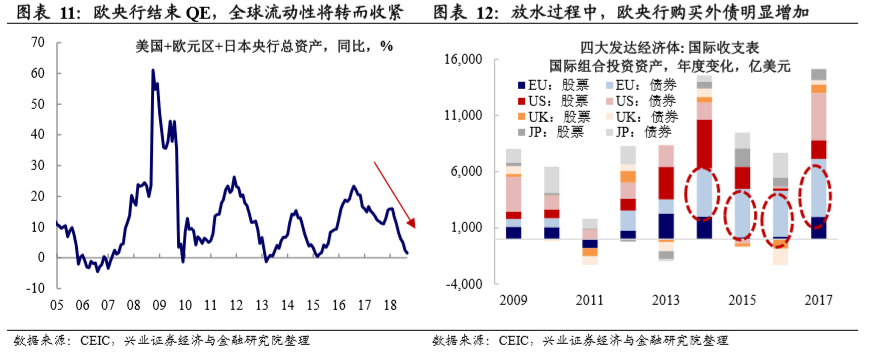

在過去幾年間,由於全球央行的寬鬆此起彼伏,這使得匯率波動成為市場的主要矛盾。然而,隨着歐洲寬鬆政策接近尾聲,全球利率將真正意義上開始面臨上升壓力,全球市場的主要矛盾將由匯率轉向利率。

值得注意的是,2014年以來歐洲放水的過程中,實際上歐央行所提供的流動性成為全球資產配置的主力。從 G4經濟體的組合投資的資產端來看, 歐央行釋放的流動性成為了2014年之後壓低全球利率水平的主要來源。但隨着2019年歐央行結束QE,歐央行購買債券的這一部分邊際增量也將開始收縮,全球資金成本將開始上升,這將成為未來全球金融市場的主要矛盾。

2、美國財政提前接棒貨幣,但效用正在減弱

財政擴張接棒貨幣寬鬆,但本輪實際上有所「搶跑」

貨幣寬鬆瓶頸出現後,美國財政政策接力,但本輪提前支取了未來擴張空間。需要注意的是,財政政策刺激往往是逆經濟週期的,即財政赤字的擴張和經濟下行往往是同步的,甚至是滯後的。但2016年以來,這兩者出現了明顯背離,説明特朗普減税在內的財政刺激政策,實際上是提前支取了未來的財政擴張空間。這也意味着,當經濟進入下行週期的時候,財政可以發揮作用的空間將被壓縮。

但財政拉動漸近尾聲,美國經濟恐也將下行

雖然特朗普減税支撐2018年美國經濟在全球範圍內「一枝獨秀」,但伴隨着財政刺激作用逐步消退,2019 年美國經濟也將放緩。 從三季度經濟數據看,企業投資已出現放緩。美國2018年三季度實際GDP環比折年增速回落至3.5%。從分項看,税改的提振效應在居民部門仍然有明顯體現;但固定資產投資進一步放緩,則成為最大拖累。

除了税改作用消退,投資走弱或還有外需回落和貿易戰抬升成本的作用。從近期數據看,居民部門的動能也有所減弱。

3、「逆全球化 2.0」,全球將面臨的挑戰

「禍水東引」或標誌着「逆全球化 2.0」的正式開啟

2018年,中美貿易戰實際上暴露出另一個問題——逆全球化,在貨幣政策寬鬆遇到瓶頸,財政政策有明顯外溢性的背景下,全球各國政府「以鄰為壑」,走向「分餅」是必然的。這一問題可能未必會在短期內對全球經濟乃至金融市場產生劇烈的影響,但其長期影響值得我們現在就開始關注。

全球化倒車,對發達經濟體通脹及利率的壓制將逆

逆全球化將壓制需求——貿易和投資,在此過程中不僅新興市場受損,美國企業通過新興市場資本開放參股新興市場企業所獲取的財富也將打折扣。與此同時,發達經濟體的通脹壓力也在上升。而隨着新興經濟體對美債需求 的降低,全球化對利率的壓制也將逆轉。因而,從更長週期的角度來看,全球資金成本也面臨上升的壓力。

4、資金成本上行的兩個潛在風險點。

資金成本上行潛在風險之一:新興市場的脆弱性

從短期和長期兩個視角討論,利率上行都將成為全球主要矛盾。一方面, 新興市場整體的外部脆弱性仍未下降,這意味着雖然美元對於新興市場收入端的壓制作用下降,但部分外債高、償付能力弱的新興市場的風險仍然難以下降。

另一方面,相對而言市場有所忽視的是,在過去全球低利率環境中,美國企業也是明顯的受益者,從一些指標來看,其債務償付能力已弱於上一輪週期的尾聲,這意味着與此相關的美國高收益債市場可能成為下一個風險點。而相對而言,由於中國在新興市場經濟體償債能力相對較高,中國在新興市場中可能會成為避風港。

資金成本上行潛在風險之二:美國企業償債壓力抬升

利率上行,危機後低利率融資「後遺症」在未來某個時點爆發。長期低利率的環境,使得全球金融機構面臨資產荒,進而壓低了所有資產的收益率,債權融資成本也隨之下降。受益於此,美國企業債權融資規模迅速 擴張。而在利率上行的背景下,債權融資的成本將直接上升,這不僅會擠壓企業利潤,還將給企業償債和資金週轉帶來壓力。

實際上,低利率環境下債權融資收益最多的主要是美國中小型企業。因此,隨着利差上升,中小企業的脆弱性也將更高。而需要注意的是,如果全球流動性開始收緊,大中型企業的壓力也將上升。 這可能意味着美國高收益債市場有出現「補跌」的風險。

5、風險提示

全球經濟超預期失速;金融市場波動上升;地緣政治風險