Edited by Guoxin Securities: "Meituan comments on major events: competition with BABA or protracted war"

Guoxin Securities believes that BABA Group set up a local life service company, Meituan comments corresponding to the organizational structure adjustment, the competition between the two will be a protracted war.

1. Major event 1: BABA Group sets up a local life service company

In October, BABA established a local life service company, which was formed by the merger of ele.me and word-of-mouth. In addition, Baidu, Inc. takeout officially changed its name to "ele.me Xingxuan".

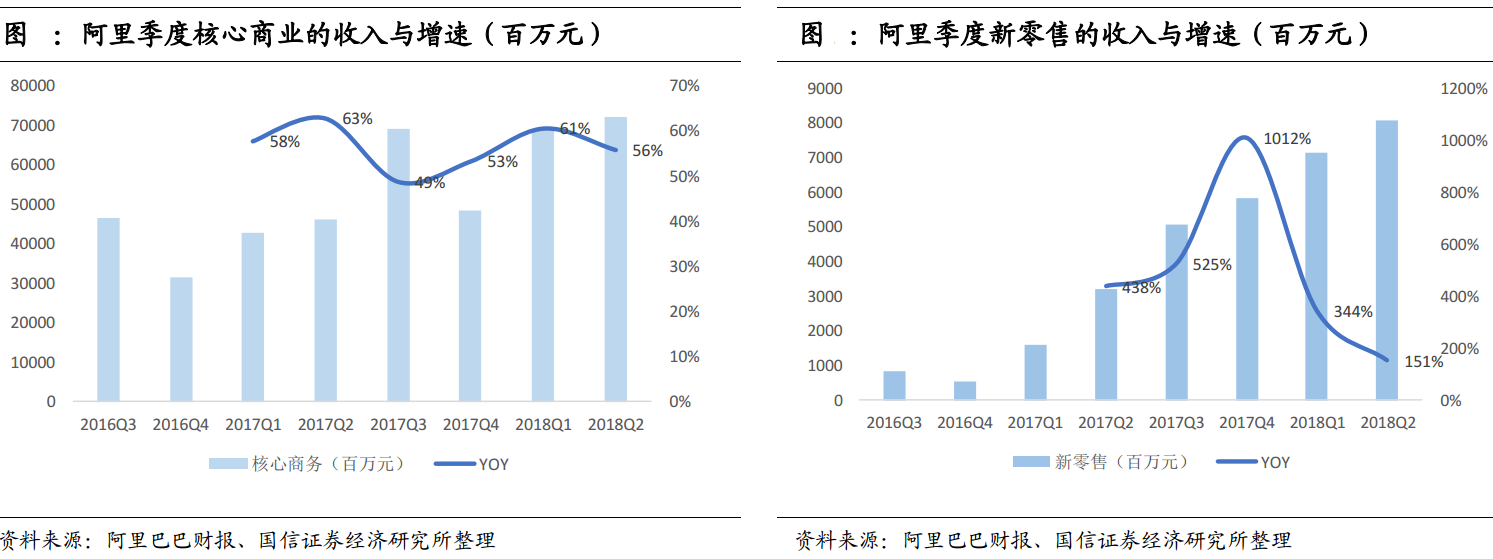

BABA's second quarterly report showed that core ecommerce growth slowed to 56 per cent year-on-year (63 per cent in the same period last year), and BABA cut its full-year revenue guidance due to lower-than-expected revenue in a single quarter. On the other hand, the growth rate of new retail is 151%, which is still the fastest growing sector of BABA's core e-commerce, accounting for 11% of the core e-commerce revenue. Guoxin Securities believes that in the next few quarters,BABA will pay more attention to the business integration and share repair of local services.。

The layout of BABA's local life service business mainly includes the following aspects:

1) Guoxin Securities believes that this integration is characterized by high specification, momentum and many resources; 2) CEO Wang Lei put forward key measures to reform ele.me. Under BABA's empowerment, he led the process of digitization, production, online and offline integration of the entire local life service market, opening up membership, data, warehouse allocation, operation and marketing; 3) hummingbird is becoming the infrastructure of BABA's new retail. 4) investors such as BABA and Softbank Corp. will invest US $3 billion in the new company, which may continue the situation of subsidies in the short term, which will keep the incentive cost of users at a high level; 5) after August, BABA began to promote 88VIP.

2. Major event 2: Meituan's organizational structure change

On October 30th, Meituan commented on the adjustment of the organizational system.

Guoxin Securities believes that the adjustment of Meituan's organizational structure has the following characteristics: 1) merging the wine and travel division to make the business model of arrival more complete; 2) weakening the travel division temporarily, it can be seen that the company will still focus on the "eating + platform" in the future; 3) highlight the to B business of the fast donkey business; 4) explore a new model of fresh retail for the baby elephant. 5) strengthen the function and value of data, and set up user platform and LBS platform.

Combined with Wang Xing's speech at Wuzhen Internet Conference (November 7-September), Guoxin Securities believes that Meituan will devote more efforts to 2B digitization and ecological construction.

3. Review and prospect

Q3 takeout industry data review

Guoxin Securities found that the DAU of the takeout industry was similar to that of the same period last year, while ele.me Q3 declined significantly.

Guoxin Securities found that the takeout industry basically formed a competitive pattern of 6:4, with Meituan 60% and ele.me + Baidu, Inc. 40%.

Prospects for the future

At present, there are two main attitudes in the capital market. one is that Meituan's "thin arms cannot beat his thighs." in this regard, Guoxin Securities believes thatUnderestimated Meituan's ability.:

1) Meituan has a 60% share of the takeout market and is a leader rather than a follower. "choose one of the two" competition in e-commerce does not apply to Meituan. 2) the idea of Wang Xing and Meituan is to focus on doing a good job of toC and strengthening toB at the same time, while Meituan has always accumulated a lot of software business integration capabilities on toB. 3) the push force of tens of thousands of people is a unique resource that BABA does not have (and will not have in the future). BABA's light asset model has been solidified and cannot be copied.

Another view is that Meituan is sure to win the takeout campaign. Guoxin Securities believes that it is also true.Underestimated BABA's determination.:

1) BABA can only advance, not retreat, on the battlefield of local life and service. Because this is related to the offline ecological strategy of BABA Group, if you lose takeout, you will lose the real-time distribution network, and if you lose the real-time distribution network, you will lose the radiation capacity of fresh e-commerce / new retail. Therefore, takeout is a must in BABA's campaign; 2) BABA has customer advantages and cross-industry integration advantages, especially concentrated on the TOC end. It can put 3 billion US dollars or more funds in the future into user incentives / rider subsidies (just like WeChat Pay of Tencent), so the competition for marginal users (high price sensitivity and low timeliness requirements) will remain fierce.

4. Risk hint

The competition in the takeout market remains fierce, so that the company's high subsidies continue.

In the future, the company may be involved in some markets with uncertain profit prospects, resulting in an increase in losses.

The Fed's rate hike has led to systemic risks in global stock markets.