Edited by Guosheng Securities: "the rise and fall of American stocks-- the second of a series of reports on American stocks."

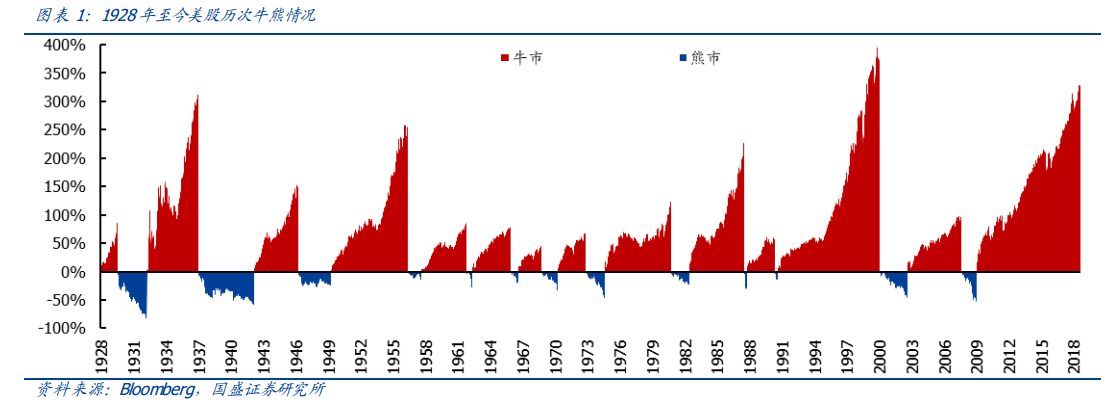

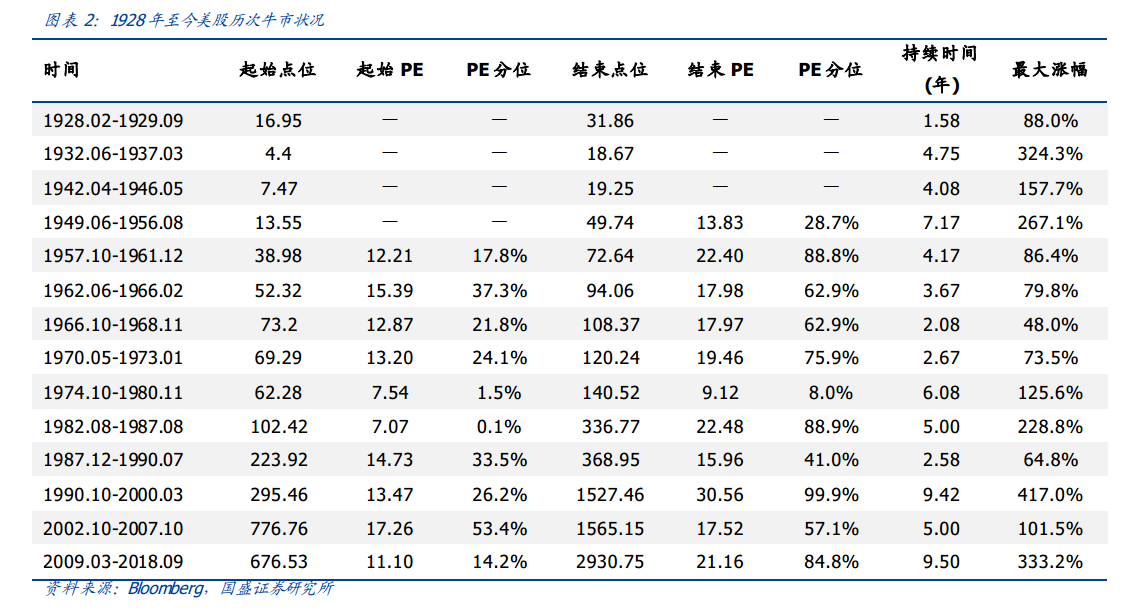

Recently, US stocks fluctuated sharply, with all three major US stock indexes falling below the annual line, and investors' worries about the change from bull to bear have deepened again. With reference to the S & P 500 index, US stocks have experienced 13 waves of bull-bear switching in the 90 years since 1928.Guosheng SecuritiesThe study found that when the United States changes from a bull market to a bear market, its macro-economy usually has two obvious characteristics.

1. Review the previous bull-bear switches in US stocks in the past hundred years.

1930s: from innovation to war.The stock market cycle from 32 years to 39 years was opened by Roosevelt's New deal after the Great Depression, and under the shadow of war in the early days of World War II, the US economy fell into recession and prices rose rapidly. After the Federal Reserve tightened policy in 1937, the US stock market turned from bull to bear.

1940s: success is war, defeat is war.After the United States entered the war in 41, the economy entered a state of war, and the Federal Reserve assumed the obligation to keep interest rates on treasury bonds low at the request of the Treasury. The stock market began to rise before the Battle of Midway. By the end of the war in 45 years, price control was lifted at the beginning of 46 years. The marginal monetary policy of the Federal Reserve tightened under high inflation, and US stocks began to fall.

From mid-1949 to early 66: the postwar economic take-off period.On the whole, there have been several bull turns in US stocks during this period, and the United States is close to the turning point of the economy from upward to downward. at the same time, the monetary policy of the Federal Reserve is also tightening.

66-82: economic transition, through the "beautiful 50" era of the big bear market.The market suffered bear markets in 69, 73-74 and 81-82 respectively, which were all due to the periodic recession of the US economy and the tightening of monetary policy by the Federal Reserve under high inflation, accelerating the double killing of Davis in the stock market.

83-07: the era of great detente.

1) from 1983 to 1990: the country was founded by science and technology, the economy was transformed, and Japan's economic bubble burst in 1990.

2) from 1991 to 2000: the revolution of IT, the acceleration of the popularization of capital, and the change from bull to bear after the bursting of the bubble of science and technology.

3) from 2001 to 2007: financial disintermediation, real estate bubble, subprime mortgage crisis continued to ferment after the bull turned to bear.

2. Conclusion

The historical experience of the past 90 years tells us that when the US stock market changes from a bull market to a bear market, its macro-economy usually has two major characteristics:

1) the economy is running to the top of the cycle, which is about to or has begun to change from boom to bust.

2) the Fed has adopted a tight monetary policy and is in the middle and second half of the interest rate hike cycle for most of the time.

This bull market in US stocks has been rising for nearly a decade since the end of the financial crisis in 2009, the highest in any previous bull market.Against the backdrop of the slowing recovery of the world economy and the rise of trade protectionism, the strong growth of the US economy has maintained investor confidence. Under the flood of global capital, despite the recent sharp fluctuations in the US stock market, the whole is still at an all-time high.

At present, the US economy still leads the world, but looking back, it is becoming more and more difficult to stay in a high position.The possibility of reaching a peak cannot be ruled out.At the same time, since the Federal Reserve entered the interest rate hike cycle in December 2015, the federal funds target rate has been raised by 2%, supported by high employment and steadily rising inflation.The Fed will continue to raise interest rates and there will be more and more pressure on US stocks.

3. Risk hint

1) if the current upward cycle of the US economy lasts longer than usual, the bull market of US stocks is still expected to continue, which may be due to sudden technological shocks or demand shocks.

2) the trend of raising interest rates in the United States has shifted, or even to cut interest rates sharply again in more extreme cases, and valuations will still rise in the face of a flood of market liquidity.