This article is edited from founder Securities: five characteristics of market behavior at the bottom of the market.

At the beginning of the week, A shares rose for two days in a row, and finally stopped the trend of "falling endlessly". It seems that the "seven turnaround" can be expected. Is A-share the bottom now? From the perspectives of market representation, investor behavior and public opinion, this paper attempts to explore the common characteristics of seven important bottoms (2005.6, 2008.10, 2010.7, 2012.12, 2013.6, 2014.3, 2016.1) of A shares since 2005. and explore the anti-fall industry in the process of decline.

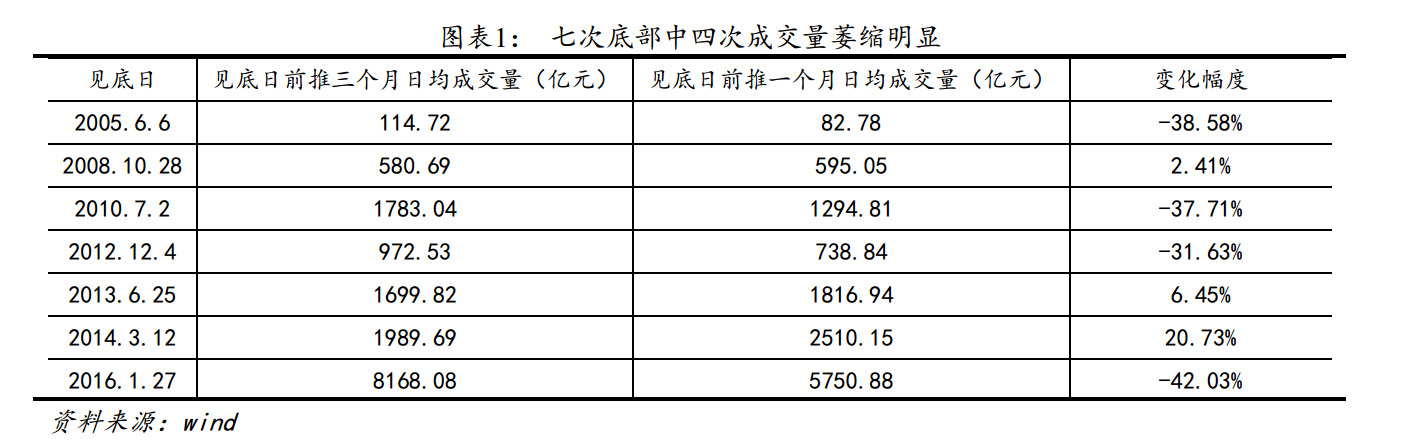

1. From the perspective of market characterization, the decline in bottom trading volume is about 30%, 40%, the turnover rate has decreased, and the volatility has increased slightly.At present, the market trading volume is about 330 billion, which is about 28% lower than that of the two cities with 3100 points 450 billion, which is close to the corresponding decline level of the bottom trading volume. Since 2004, the average turnover rate in the market has been 1.47%. In history, the average turnover rate in the bottom region is 0.84%, and the lowest is 0.38% at the end of 12 years. The current turnover rate is 0.7%, which is lower than the turnover rate in 05, 13, 14 and 16 years. It is close to the turnover rate of the region at the end of 10 years.

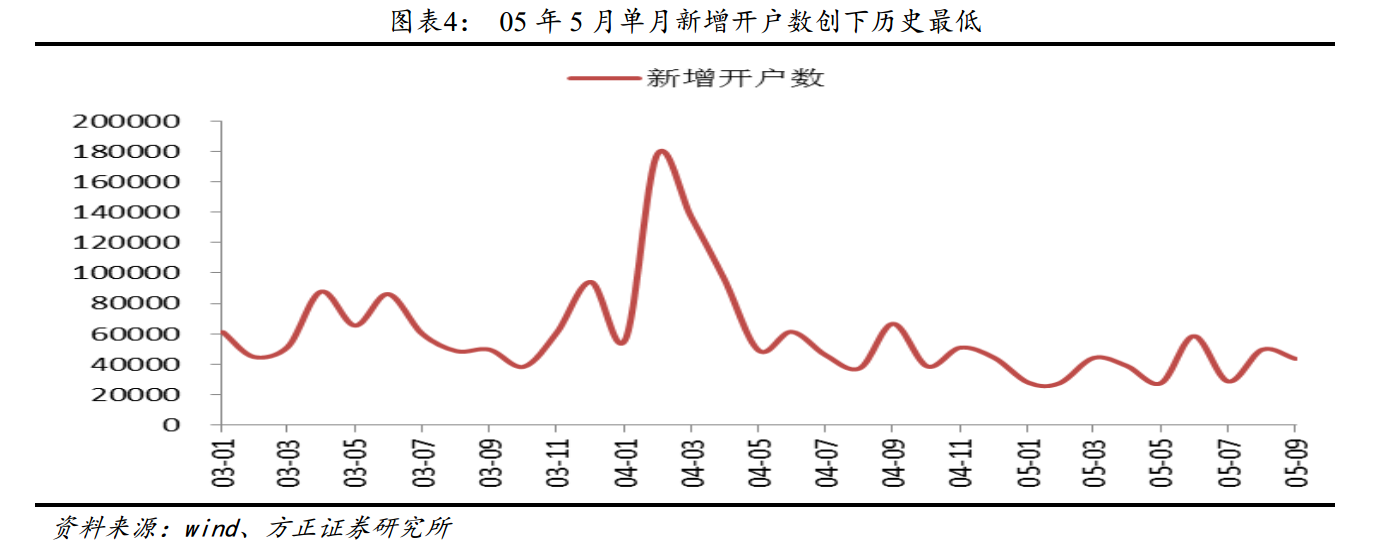

2. From the perspective of traders' behavior, the number of new accounts at the bottom of the market has reached a stage low, and the number of accounts participating in transactions has decreased significantly.The Shanghai Stock Exchange added only 27568 accounts in May 2005, the lowest monthly figure on record, and the market bottomed out in early June. The number of new accounts in October 2008 was 353964, down 46 per cent from the September average before 18. The number of accounts involved in trading at the end of the big bear market fell by about 50 per cent from the beginning of the year, and the market bottomed out at the end of October.

3. From the point of view of the position and allocation of the fund, the position of the fund decreases obviously at the bottom, and the choice of heavy stocks is mainly focused on finance and consumption, among which the proportion of individual stocks in the consumer industry is increasing year by year.The overall position of the fund fell to about 60% in the third quarter of 2008 and to about 50% in July 2010. The choice of industry is mainly finance, public utilities and consumption. Of the fund heavy positions that have been pushed forward for three quarters from the bottom of the seven markets, at least one of the stocks in the top 10 by market capitalization is in the banking and insurance sectors, with six stocks in the financial sector in July 2010 and seven in January 2016. Since 2012, the fund has become more willing to hold shares in the consumer industry during the process of huddling at the bottom, with Yili rising significantly in the market value of its holdings at both bottoms in June 2013 and January 2016; Kweichow Moutai's bottom holdings rose 24 places to the top seven in March 2014.

4. From the perspective of the behavior of active traders, the average daily trading volume at the bottom of the business department has declined significantly, but since the previous bottoms, the decline has gradually decreased, light index, heavy stock phenomenon is more and more obvious.The average daily trading volume decreased by nearly 73% at the bottom of 2005 compared with the whole year, and decreased to less than 50% after 2013. At the end of 2016, the average daily trading volume decreased by only 18%. The phenomenon of light index at the bottom and emphasis on individual stocks is becoming more and more obvious.

5. From the perspective of public opinion, the public opinion represented by analysts at the bottom of the period is basically pessimistic, even if there are positive factors to maintain a cautious attitude.In the process of market bottoming, the key words of public opinion are mainly weakness, decline, deterioration, shock, waiting, caution, even if there are positive factors such as policy reform or the improvement of the external environment, it is difficult to be optimistic and cautious.

6. from the perspective of industry performance, banks, home appliances, food and beverage, pharmaceutical biology and electronics are more resistant to decline in the process of decline, but we should pay attention to the risk of making up for the decline in some previous anti-fall industries in the later stage.The more obvious supplementary declines occurred in medicine in June 2010 and food and beverage in November 2012.

For more wonderful content, please mark: the past period of the rich way research election.