本文作者為來自美股投資網站(seekingalpha)的分析師(Isak Hirsch)

貿易爭升戰級導致京東股價下跌

過去幾周,雖然京東股價跌幅高達14%,京東很可能只會在短期內受到全面貿易戰的影響,長期投資者可以把這看作是一個投資的機會。如果貿易戰不斷升級,美元對人民幣的升值很可能會繼續下去。主要因為以下兩點:

1.與中國大環境不同,京東是一個純靠進口商品銷售的電商企業。這意味着它的進口大於出口,因此貨幣貶值意味着進口將變得更加昂貴。問題的關鍵是京東的銷售額到底有多少來自進口商品。根據其電子商務網站、訪談和研究報告顯示,進口商品總額有20億美元,約佔總銷售額的25%。京東擁有25%的市場份額,其收入幾乎與跨境電商銷售總額相當(746.8億美元vs 764億美元)。因此,美元升值不會對其收入產生任何明顯的影響,儘管可能會拉低利潤率。

2.第二個原因是貨幣風險。以美元為例,如果衝突不緩和,美元對人民幣將繼續上漲,美國存託憑證(美國商業銀行為協助外國證券在美國交易而發行的一種可轉讓證書)將會貶值。美元對人民幣的反彈將使人民幣相對於美元貶值。如果衝突持續升級的話,這一對外匯組合比值很容易上升到7或更高。也就是説,股票將會貶值7%。因此,這也是一個小風險,至少對所有長期投資者來説是如此,因為從長期來看,人們對人民幣的看法樂觀(多數預測到2050年,中國經濟將超過美國)。

消費潮流

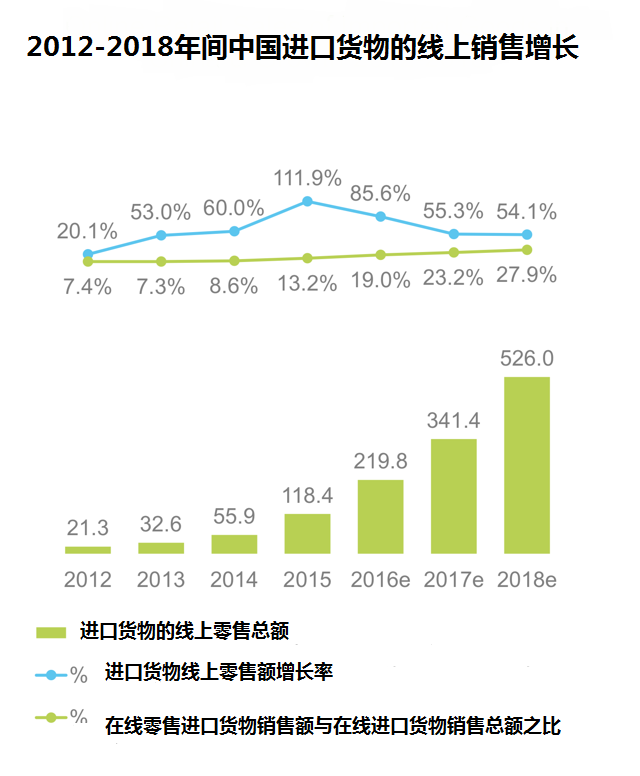

隨着中產階級的不斷壯大,跨境電子商務在中國迅速發展。中國生活水平的提高使外國產品更受歡迎。

來源:iResearch

2014年政府放鬆對網絡零售的控制以來,進口銷售迅速增長。京東首席執行官劉強東(Richard Liu)估計,在5至10年內,中國大城市的電子商務將有一半是進口商品。這一增長對中國電子商務的總體增長做出了巨大貢獻。隨着進口變得更加昂貴,這種增長將在貿易戰中受到威脅,美國產品的受歡迎程度可能也會受到影響。此外,中國政府可能會倡議消費者不購買美國產品。

美國肉製品在中國尤其受歡迎。去年,京東宣佈未來三年將購買價值12億美元的美國牛肉和豬肉。7月6日,這項協議將受到中國首波總計34億美元的關税浪潮的衝擊,波及對象包括特朗普的主要支持者——美國農民。

利率隱患

匯率風險和美國產品的關税都將損害京東最大的優勢之一——利潤率。京東的利潤率很低,如果成本增加,利潤率很快就會變成負數。這將進一步拖累股價,看空者則表示京東永遠不會盈利。然而,對於任何長期投資者來説,利潤率並非決定性因素。目前,京東唯一關注的是收入和市場增長。在公司成熟並完全發揮其市場潛力之前,利潤率並非主要考慮因素。

擴張計劃受阻

貿易衝突推遲了京東2018年下半年向美國擴張的計劃。在與沃爾瑪(Walmart)和谷歌(Google)的合作中,劉強東對美國有遠大的擴張計劃,而現在將不得不暫停計劃。在當前形勢下,進入美國的風險太大,京東成為全球電子商務領導者的長期願景將因此被推遲。

另一方面,特朗普計劃限制中國企業投資美國科技公司的權限,認為此舉會導致知識產權問題。這更讓阿里巴巴(Alibaba)和騰訊(Tencent)等中國科技巨頭擔憂。這兩家巨頭最近在美國科技領域投入了大量資金,相比之下,京東在外國公司的投資不多,所投資的通常是物流或商業公司,因此對京東的影響不大。

機遇挑戰並存

現在又到了機遇與挑戰並存的時期。歷史經驗表明劉強東是一個善於抓住機遇的人。2003年,非典危機襲擊中國,導致774人死亡,引發大面積恐慌,並讓消費者待在家中。劉強東注意到了更高的電子商務需求,並決定進入這個行業。一年後,京東創立。

現在,美國和世界其他地區之間的貿易戰影響巨大。然而,這可能會改善中歐關係。亞馬遜在擴張過程中可能會遇到困難,給京東帶來真正的競爭機會。歐洲電子商務行業仍然非常分散,亞馬遜在歐洲最大的電子商務市場英國只有13%的市場份額。京東在歐洲大舉投資,計劃擴展物流網絡。最近的谷歌合作伙伴關係使京東擁有前所未有的機會。

經濟週期的威脅

分析師擔心貿易戰對經濟的影響,尤其是中國經濟。中國股市本週早些時候進入熊市,中國經濟在經歷了10年的強勁增長後,面臨放緩的風險。大多數人認為,現階段正處於市場週期的後期。當經濟衰退時,京東也會受到衝擊。然而,科技產業在經濟衰退中往往表現不佳(見下圖),京東可能會受到比整體市場更大的打擊。此外,成長型公司通常會受到衝擊,因利潤率容易成負值。如果貿易戰繼續並升級,未來12到16個月很有可能發生經濟衰退。

(來源: Fidelity Investments (AART))

京東股價已經下跌,並被壓低一段時間,目前的股價比6月18日宣佈谷歌合作計劃時下跌了13%。在緊張局勢升級的情況下,更多的負面影響將會湧現。然而,這場戰爭不太可能演變成一場曠日持久的貿易戰。因為特朗普明白這會損害美國經濟和他再次當選的機會。中國也明確表示有意避免貿易戰,因為對其經濟的影響將是毀滅性的。任何一方做出一些妥協,都可以結束衝突。

因此,京東股價下跌可能是短期的,並可能促成買入該股的絕佳時機。多數投資者認為,許多風險已經過去,因此,如果美國和中國之間的緊張關係緩和,短期內也應該會有收穫。

該股目前的股價已經低得離譜,市盈率不到1,營收增長強勁。因此,京東雖然有短期下行風險,但實際上將大有可為,股價具有了很大吸引力。

(本文由富途資訊編譯團隊出品,編譯/馬正陽,校對/朱天安)