精编自申万宏源(香港)—— 物业管理行业:逢低布局,维持超配评级

物业管理行业特性:天然防御性

区别于房地产板块,物业管理板块具备防御属性

其上市物业管理公司基本处于净现金状态,受融资持续收紧影响有限;上一轮市场的强劲复苏有效保障了物业管理公司未来几年管理面积的稳健增长;以及基于高毛利率的酬金制管理业务和增值服务业务贡献占比提升的结构优化使得综合毛利率将持续改善,对比房地产开发商因受限于目前各类严厉调控政策(如限购限售限价等)而毛利率有所承压。

行业龙头:碧桂园服务

作为中国最大物业开发商碧桂园旗下的物业管理服务板块,于6月19日在香港联交所主板独立上市,并基于当日收盘价10.0港币,一举以250亿港币的市值成为行业内新的领头羊。

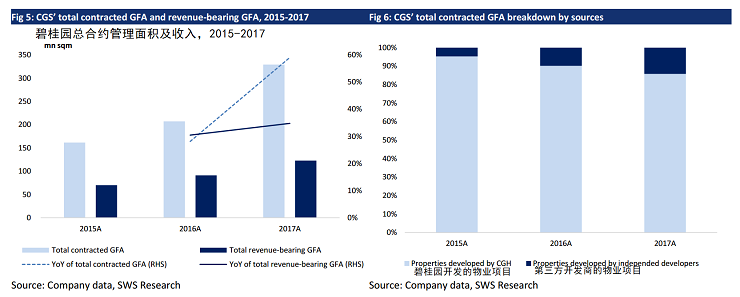

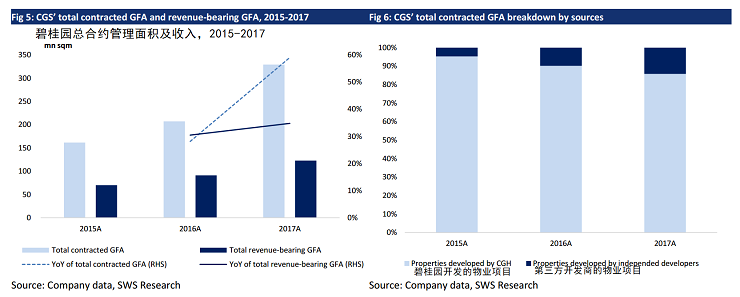

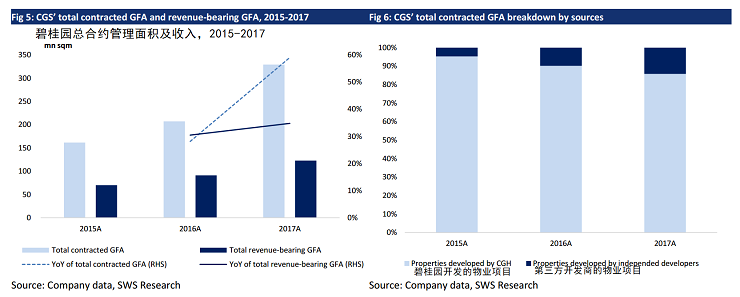

截止2017年末,碧桂园服务总合约管理面积为3.3亿平米(2015-2017年复合增长率为43%,其中86%来自于碧桂园开发的物业项目),位列物业管理板块管理面积第二位,仅次于彩生活服务同期的4.4亿平米(2015-2017年复合增长率为16%,其中99%来自于第三方开发商的物业项目)。

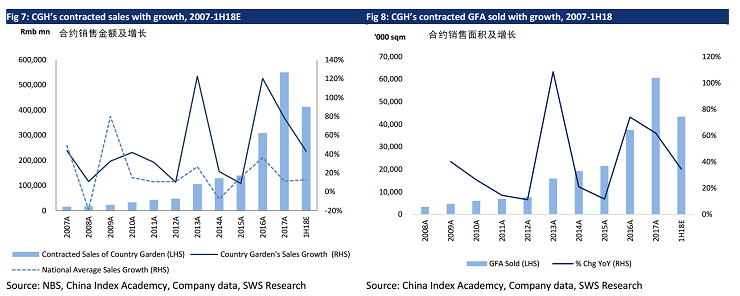

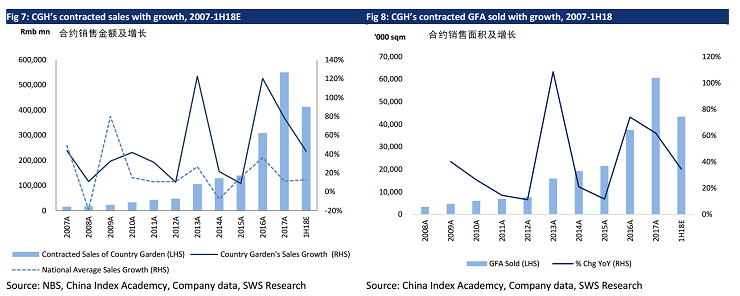

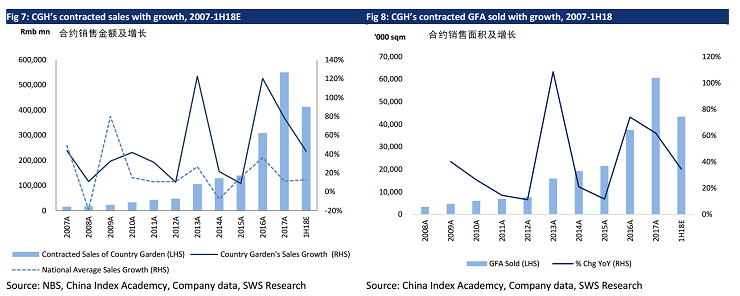

根据中国指数研究院,碧桂园于今年上半年仍位列中国房地产开发商销售规模首位,实现合约销售金额同比增长43%至4140亿元,合约销售面积同比增长35%至4300万平米,我们预计碧桂园今年全年销售额将至少突破7000亿元,较2017年再增三成。

基于其强大的开发商支持,市场预计碧桂园服务的管理面积和盈利增长可见度高,同时,聚焦低阶城市的地理布局以及大盘物业管理带来的规模经济效应,保障其物业管理费具备韧性且经营成本相对较低。

行业新股:新城悦&佳兆业集团

鉴于物业管理板块的市场认可度不断提升,多家开发商加快了旗下物业管理服务板块分拆上市的步伐。

新城悦于今年4月披露了招股书,总合约管理面积于2017年末达6800万方(2015-2017年复合增长率为45%),其中76%来自于新城发展控股开发的物业项目,且其中98%以包干制进行管理,平均住宅物业管理费为1.6元/平米/月。

此外,佳兆业集团于6月22日宣布拟分拆佳兆业物业并于香港联交所主板独立上市,佳兆业物业总合约管理面积于2017年末达3000万平米(2015-2017年复合增长率为16%),其中86%来自于佳兆业集团开发的物业项目,且其中66%以酬金制进行管理,其余34%为包干制。

![201807005455552687a9f2944.png]()

更多精彩内容请戳:富途研选往期荟萃

精編自申萬宏源(香港)—— 物業管理行業:逢低佈局,維持超配評級

物業管理行業特性:天然防禦性

區別於房地產板塊,物業管理板塊具備防禦屬性

其上市物業管理公司基本處於淨現金狀態,受融資持續收緊影響有限;上一輪市場的強勁復甦有效保障了物業管理公司未來幾年管理面積的穩健增長;以及基於高毛利率的酬金制管理業務和增值服務業務貢獻佔比提升的結構優化使得綜合毛利率將持續改善,對比房地產開發商因受限於目前各類嚴厲調控政策(如限購限售限價等)而毛利率有所承壓。

行業龍頭:碧桂園服務

作爲中國最大物業開發商碧桂園旗下的物業管理服務板塊,於6月19日在香港聯交所主板獨立上市,並基於當日收盤價10.0港幣,一舉以250億港幣的市值成爲行業內新的領頭羊。

截止2017年末,碧桂園服務總合約管理面積爲3.3億平米(2015-2017年複合增長率爲43%,其中86%來自於碧桂園開發的物業項目),位列物業管理板塊管理面積第二位,僅次於彩生活服務同期的4.4億平米(2015-2017年複合增長率爲16%,其中99%來自於第三方開發商的物業項目)。

根據中國指數研究院,碧桂園於今年上半年仍位列中國房地產開發商銷售規模首位,實現合約銷售金額同比增長43%至4140億元,合約銷售面積同比增長35%至4300萬平米,我們預計碧桂園今年全年銷售額將至少突破7000億元,較2017年再增三成。

基於其強大的開發商支持,市場預計碧桂園服務的管理面積和盈利增長可見度高,同時,聚焦低階城市的地理佈局以及大盤物業管理帶來的規模經濟效應,保障其物業管理費具備韌性且經營成本相對較低。

行業新股:新城悅&佳兆業集團

鑑於物業管理板塊的市場認可度不斷提升,多家開發商加快了旗下物業管理服務板塊分拆上市的步伐。

新城悅於今年4月披露了招股書,總合約管理面積於2017年末達6800萬方(2015-2017年複合增長率爲45%),其中76%來自於新城發展控股開發的物業項目,且其中98%以包乾制進行管理,平均住宅物業管理費爲1.6元/平米/月。

此外,佳兆業集團於6月22日宣佈擬分拆佳兆業物業並於香港聯交所主板獨立上市,佳兆業物業總合約管理面積於2017年末達3000萬平米(2015-2017年複合增長率爲16%),其中86%來自於佳兆業集團開發的物業項目,且其中66%以酬金制進行管理,其餘34%爲包乾制。

![201807005455552687a9f2944.png]()

更多精彩內容請戳:富途研選往期薈萃