In China's high-value medical consumables market, Valve Therapy Medical Devices (TAVR) is a rare "Pure Land" field without multinational companies. Hillhouse Capital has almost completed the omni-directional layout of this segment of the domestic medical device market. In October 2019, Hillhouse spent nearly $140 million to buyPeijia Medical treatmentNearly 10% of the shares, and then successively built Qiming Medical and minimally invasive Medical. (note: Qiming Medical was listed in December last year)

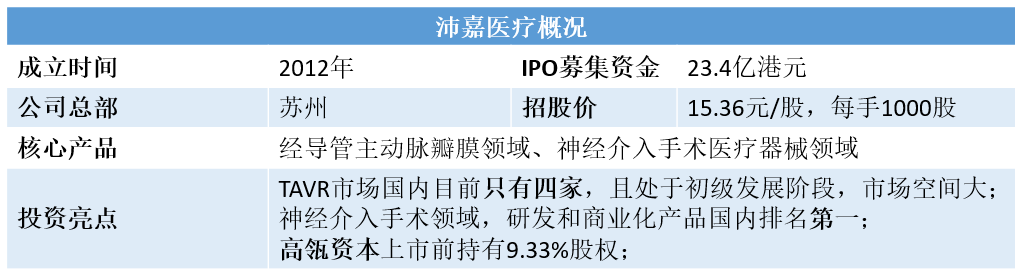

NowPeijia Medical treatmentWhat will be the future performance of the IPO, which begins on May 5, 2020?

Source: wind, Futu Securities

First, the company introduction:

Focus on China's high-growth interventional medical device market, and is the leading domestic player in China's transcatheter valvular medical device market and nerve interventional medical device market.

Source: Peijia Medical prospectus

Second, historical development:

2012-incorporation of the company

2017-Taurusone begins feasibility clinical trials in China

2019-acquire Gage and start selling its Presgo products

Product introduction:

The company focuses on the high-growth interventional medical device market in China.Medical instruments for transcatheter valve therapyMarket andMedical instruments for nerve interventional surgeryThe leading domestic player in the market.

Among them, the company is one of only four domestic participants with TAVR products in clinical trials or more advanced in the Chinese market. In terms of the total number of commercial products and clinical trial products under development, it ranks third in the Chinese market, and its products rank first in the Chinese market in the field of neurointerventional surgical medical devices. The company's products are shown below:

Source: Peijia Medical prospectus

1)The field of transcatheter valvular therapy medical devices:

A) Core product introduction:

Its core product TAVR has completed the deterministic clinical trial phase, and Q1 or Q2 was approved and launched TaurusOne by the State Drug Administration in 2021. The second and third generation TAVR products are in the stage of research and development, and their core products are mainly aimed at the field of valvular heart disease, with shorter operation time and faster recovery time.

Source: Peijia Medical prospectus

B) Industry analysis:

The heart is the organ that pushes the blood of the whole body, and the blood vessels are the channels that transport the blood. Through the rhythmic contraction and relaxation of the heart, it promotes the continuous circulation of blood in the blood vessels in a certain direction, which is called blood circulation. There is a key point, that is, let the blood flow in a certain direction, and the biggest contribution to the flow in a fixed direction is the "heart valve"!

When the valve is narrow, it affects the amount of blood left from another chamber to another. When the valve is not fully atresia, it will cause the blood to flow back to the previous chamber. To put it simply, the valve is narrow, like the door is stuck and cannot be pushed open, so that the blood can not flow through. Valve atresia is not complete, because the door is broken and can not be closed tightly, resulting in blood reflux. No matter which valve has countercurrent or stenosis, it will increase the work burden and may lead to heart failure and death.

Source: Heho Health, Futu Securities

C) treatment options:

1. Take medicine; it can be relieved, but there is no cure.

2. Traditional open heart valve replacement and repair surgery.

3. Minimally invasive valve surgery

4. Transcatheter valvular therapyTranscatheter valvular therapy is expected to be the main development direction of valvular heart disease treatment in the world.

D) Industry size:

I) Global TAVR market size:

The number of patients who can undergo TAVR surgeries worldwide increased from 3.4 million in 2014 to 3.6 million in 2018, and the number of TAVR surgeries worldwide increased from 56.7 thousand in 2014 to 127.8 in 2018, with a compound annual growth rate of 22.5 percent, and the proportion of surgery increased from 1.7 percent to 3.5 percent.

The global market for TAVR products grew from $1.5 billion in 2014 to $4.1 billion in 2018, a compound annual growth rate of 27.8%, and is expected to grow further to $10.4 billion in 2025.The cost of each operation in 2018 is close to 230000 yuan.(4.1 billion US dollars / 127.8 thousand cases).

I) scale of China's TAVR market:

The number of patients who can undergo TAVR surgeries in China has increased from 656.8,000 in 2014 to 742.1 in 2018. The number of TAVR surgeries in China increased from zero in 2014 to 1.0000 in 2018, and is expected to increase to 44.6,000 in 2025, with a compound annual growth rate of 20.3 per cent.

China's TAVR product market is expected to grow from 196.6 million yuan in 2018 to 6332.6 million yuan in 2025, with a compound annual growth rate of 64.2 percent. In 2018, the cost of each operation is close to 196000 yuan (196.6 million yuan / 1.0000 cases).

E) Market competition pattern:

At present, there are only four players in the domestic market: overseas Edward Life Technology, domestic Qiming Medical, minimally invasive Medical and Jiecheng Medical, in order to obtain the approval of the China Drug Administration. Multinational giants such as Medtronic PLC have not been approved for listing by NMPA. Peijia Medical has completed the definitive clinical trial phase, and if nothing happens, it will be approved by the State Drug Administration in 2021.

Qiming Medical VenusA-Valve, minimally invasive Medical VitaFlow and Peijia Medical Taurusone enter through the femoral artery, so the surgical risk is relatively safe. While Jiecheng Medical's J-Valve is entered from the apex of the heart, the operation still needs to cut open the patient's heart, which is a high risk. Therefore, Peijia Medical's real domestic competitors may come from Qiming Medical and minimally invasive Medical. In addition, Qiming Medical's VenusA-Valve has reached 80% of the domestic market share of valve implantation in 2018.

Note: Qiming Medical and minimally invasive Medical have been listed on the Hong Kong stock market; NMPA is the State Drug Administration

2) Medical instruments for nerve interventional surgery

Common neurovascular diseases include hemorrhagic stroke and ischemic cerebrovascular disease. Stroke is a medical symptom of poor blood flow to the brain, which leads to cell death. Related symptoms include fatigue, impaired peripheral vision, thinking problems, unclear speech, loss of balance or coordination, which are more common in patients over the age of 60. At present, nerve interventional surgery can be used for treatment.

A) treatment regimen:

Endovascular embolization with coils can treat all patients with cerebral arteries. The purpose of endovascular embolization with coils is to separate aneurysms from normal blood circulation. The embolized coils are mainly made of platinum-tungsten alloy, and the placement methods include hydrolytic placement, electrolytic placement, mechanical placement and hot melt placement.

B) Industry size:

The number of intravascular coil embolization in China increased from 25.3 thousand in 2014 to 52.0 thousand in 2018, with a compound annual growth rate of 19.7 percent, and is expected to further increase to 158.9 thousand in 2025.

The market size of China's intravascular coil embolization equipment has increased from 990 million yuan in 2014 to 2.18 billion yuan in 2018, with a compound annual growth rate of 21.7 percent, and is expected to reach 5.54 billion yuan in 2025. The cost of each operation in 2018 is about 45000 yuan.

C) Market competition pattern:

The market of embolized coils in China is relatively concentrated.In terms of sales earnings in 2018, the market shares of the five companies are 39.5%, 32.2%, 16.7%, 5.5% and 3.3%, respectively. Gage ranks sixth in the market and second in China, with a market share of 1.5%. At present, the number of its R & D stage and commercial products ranks first among domestic enterprises, and is expected to become a domestic leader. In the future, with the continuous promotion of domestic substitution, the share of Chinese enterprises and shopping malls will be further increased in the future.

IV. Financial analysis:

TaurusOne, the core product of Peijia Medical, has not been approved to be listed, which leads to the fact that the company does not get any income from its core product R & D and operation, and the expenses are mainly in R & D and administrative expenses, which is a reasonable phenomenon.

After the acquisition of Jiaqi in March 2019, it began to recognize income and incur income costs and sales expenses, and the net loss increased significantly from 51.261 million yuan in the nine months of 2018 to 242 million yuan in the nine months ended 2019.

5. Summary:

In the field of transcatheter valvular medical device market, the domestic market is still in the initial stage of development, the scale growth potential of the market is very large, and at present, only 4 domestic enterprises have passed the FDA, so the real industry leader is not stable. In addition, the surgery is generally targeted at patients over the age of 60. With the aging of China's population, there are more and richer people aged between 50 and 60 in China (the first batch of young people to receive the dividends of domestic reform and opening up that year).

In the field of medical instruments for neurointerventional surgery, Peijia Medical successfully entered the field of neurovascular diseases through the acquisition of Jiaqi in March 2019. In addition, the domestic market share of its core product embolic spring coil is 1.5%, ranking sixth and domestic second, but the number of Peijia medical research and development stage and commercial products ranks first in domestic enterprises, and is expected to become a domestic leader in the future.

VI. Risk hints:

1. At present, the operation cost of a TAVR in China is about 25-300000 yuan, and there is no medical insurance reimbursement, the average family may not be able to afford it, and the penetration rate of heart surgery of Peijia Medical products in the future fails to meet expectations.

2. The use of Peijia Medical products requires doctors to undergo a series of training, and the number of doctors who meet the standards in the future may not meet the expectations.

Edit / elisa