A friend of Niu suggested that everyone who saw it all the way here was about to become a "fund doctor". Why didn't Niuniu talk about buying a fund? he simply had a stomach full of talent but had no place to show it. So Niuniu launched this hard-core practical information for friends who want to be the base people.

Where can I buy a fund?

After an in-depth understanding of the previous round of introductions, have you chosen some funds that are suitable for you according to the situation? At this time, the question is, where can we buy the fund?

As a matter of fact, there are generally three channels for buying funds:

Plan A: purchase funds underwritten by banks through banks

Plan B: buy directly through the fund company's website

Plan C: funds purchased and sold through third-party platforms on the Internet

These methods have their own advantages and disadvantages. I will tell you quietly that if you buy the same fund from different channels, your handling fees may vary several times. Let's take a look at the difference between these three ways.

PLAN A: purchase funds underwritten by banks through banks

The first way is to "buy funds sold by banks", which is the preferred choice of the early base people, because the bank has a good image, people are more at ease, and almost most funds have established sales partnerships with different banks, so some people like to invest in funds through banks.

But the disadvantages of this approach are also obvious:

(1) the fee is high, and there is no discount for the purchase fee.

(2) the variety of funds sold by each bank is limited, so it is unlikely to cover all the funds in a fund company, and the choice is limited.

(3) the purchase threshold is higher, and the purchase fee is relatively expensive.

PLAN B: buy directly through the fund company's website

With the development of the Internet, people gradually buy funds through the Internet, and one of the common ways is to buy funds directly "on the website of the fund company or its APP". The advantage of this kind of purchase is that the fund can be purchased at a more favorable rate.

But the drawback is:

(1) A fund company only sells its own products. If you want to buy multiple funds at the same time, you need to register multiple accounts. It is easy for investors to confuse how much money different funds have invested and how much profits they have made.

(2) usually each fund company supports different bank cards, which will bring some inconvenience to investors.

To sum up, the convenience of operation and the selectivity of products in this channel are not as flexible and friendly as those of third-party consignment agencies.

PLAN C: funds purchased and sold through third-party platforms on the Internet

And come to the last more common purchase channel is "through the Internet third-party platform to buy consignment funds." Now this way is very popular, well-known platforms are Tiantian Fund, Ant Wealth, Futu Niuniu, etc., the operation is very convenient, easy to use, and there are often a lot of preferential activities.

Take Fortune Elephant Wealth as an example, enter the "Fund Finance" entrance on the [account opening] page.

Then click [Open account now] and you can start to choose a fund that is suitable for you to start investing.

This kind of channel is easy to operate and has a wide range of funds to choose from, covering funds of different companies, such as Fortune Elephant Wealth Services, including money funds, bond funds, stock funds and regular financial management, with a global investment scope and a variety of funds with different themes to choose from.

Having said so much, have you chosen the purchase method that suits you?

But before you get ready to buy, there are two more things you have to pay attention to. That is the cost of redemption and the specified time, which will directly affect your investment profit, so let's go on together.

02 how to grasp the timing and cost of purchase and redemption?

Time of purchase / redemption

When we trade funds, we must know when to buy and when to start calculating returns, so as to ensure our own interests.

First of all, there is a specified time for fund trading.Fund trading day is called T-day, generally weekends and holidays do not belong to T-day, it can also be understood that T-day is the working day of the fund company, start to deal with your order.

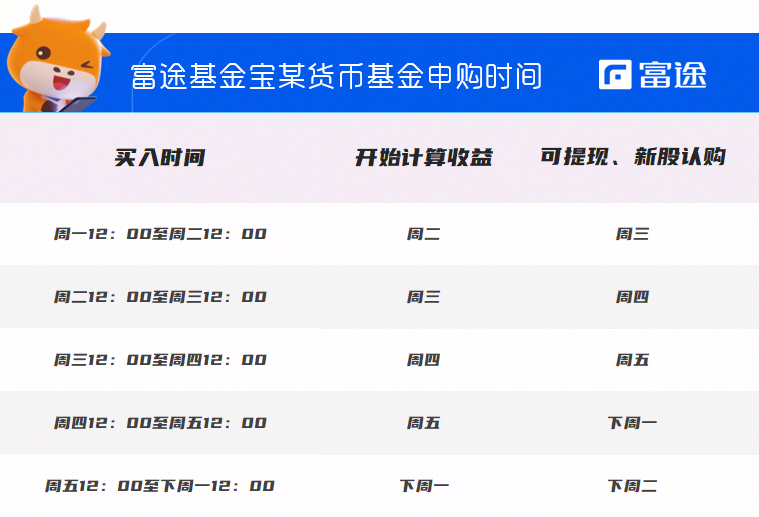

Different fund companies, their T-day switching time is different, for example: suppose a money fund in Futu set up a trading day at 12:00, then the purchase before 12:00 on Monday is regarded as the order on Monday, and the purchase after 12: 00 is regarded as the order on Tuesday.

The redemption process is similar: redemption before 12:00 on Monday is treated as a Monday application, redemption after 12: 00 Monday is treated as an application submitted on Tuesday, and so on.

However, it is worth noting that for different types of funds, the duration of "redemption" is inconsistent. In general, the redemption time of monetary funds is the shortest, followed by bond funds, and the redemption time of equity funds is the longest among the three.

Take the redemption time of a monetary fund in Futu as an example, monetary funds generally have a short redemption time and can soon withdraw cash from their accounts.

Expenses arising from purchase / redemption

The purchase of funds and redemption funds will produce corresponding fees, although the rate is generally low, but the long-term accumulation is not a small amount, can not be ignored.

(1) purchase fee

When we buy the fund, we need to pay a purchase fee, the professional term is the purchase fee, the current industry standard is 1.5% of the total amount.

For example, if you spend 10000 yuan to buy this fund and deduct 1.5% of the purchase fee, the amount you actually buy is 9850 yuan, which means you need to spend 150 yuan on the purchase fee.

10000-10000 X 1.5% RMB9850

Calculated on the basis of 1.5% handling fee, if you invest continuously for 10 years, you will have to spend more:

10000 X 1.5% X 10 = 1500

Even if the fund increases by 5% a year, you will still have an increase of 1900 yuan in ten years, which is not a small sum, so let's not underestimate the purchase expenses saved.

Here is a small tips: the redemption fee of the Futu fund is free, which can save a lot of money for investors.

(2) redemption fee

Similar to the expenses incurred by the purchase, the redemption fund will also incur expenses, which should be paid attention to when trading. (third-party platforms often have promotions, so there are often discounts to varying degrees.)

The above is the place that needs to be paid attention to when applying for purchase and redemption, investors must understand clearly the expenses that may be generated by purchase, and protect their own rights and interests.

Edit / wendy

Disclaimer

Risk and disclaimer: this document is not and should not be regarded as the basis for soliciting, soliciting, inviting, recommending the sale of any investment products or investment decisions, nor should it be interpreted as professional advice. Those who read this document or before making any investment decision should fully understand the risks and the characteristics and consequences of the relevant laws, taxes and accounting, and decide whether the investment is in line with their financial position and investment objectives according to their own circumstances, and whether it can withstand the relevant risks, and should seek appropriate professional advice if necessary.

Investment involves risks, and investors should carefully read the fund information and related documents (including its risk factors). Investors are advised to note that the prices of fund products can rise or fall, and may change substantially within a short period of time. Investors may not be able to get back the amount they have invested in the fund. The past performance of the fund does not predict future performance. If there are similar forward-looking statements in this document, such contents or statements shall not be regarded as guarantees of any future performance, and it should be noted that the actual situation or development may differ materially from such statements.

Those whose investment income is not in Hong Kong dollars or US dollars are subject to the risk of exchange rate fluctuations.