Wells Fargo's Options: A Look at What the Big Money Is Thinking

Wells Fargo's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bearish stance on Wells Fargo.

有大量資金的巨頭對威爾斯法戈持明顯的看淡態度。

Looking at options history for Wells Fargo (NYSE:WFC) we detected 22 trades.

查看威爾斯法戈(紐交所:WFC)的期權歷史,我們發現了22筆交易。

If we consider the specifics of each trade, it is accurate to state that 36% of the investors opened trades with bullish expectations and 50% with bearish.

如果考慮每筆交易的具體情況,可以準確地說,36%的投資者以看漲的預期進行交易,50%則是看淡的。

From the overall spotted trades, 7 are puts, for a total amount of $352,454 and 15, calls, for a total amount of $2,035,449.

從總體發現的交易中,7筆是看跌期權,總金額爲352,454美元,15筆是看漲期權,總金額爲2,035,449美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $67.5 and $95.0 for Wells Fargo, spanning the last three months.

在評估交易量和未平倉合約後,明顯可以看出主要市場參與者正在關注威爾斯法戈的價格區間在67.5美元到95.0美元之間,覆蓋了過去三個月。

Volume & Open Interest Trends

成交量和未平倉量趨勢

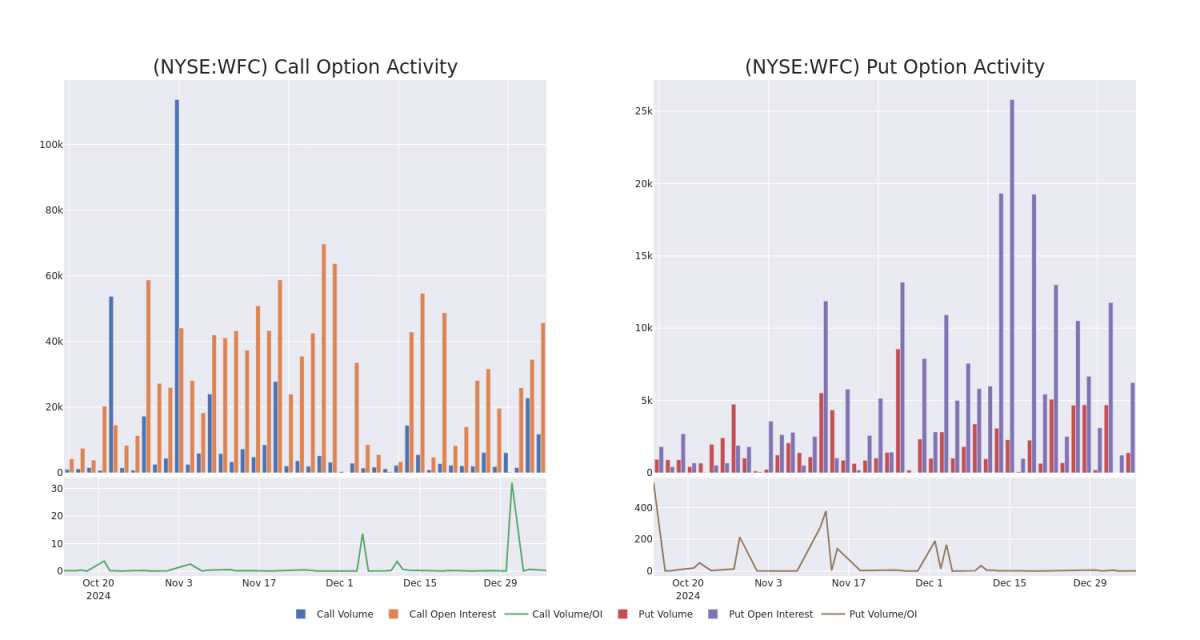

In today's trading context, the average open interest for options of Wells Fargo stands at 3054.76, with a total volume reaching 13,166.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Wells Fargo, situated within the strike price corridor from $67.5 to $95.0, throughout the last 30 days.

在今天的交易環境中,威爾斯法戈期權的平均未平倉合約爲3054.76,總成交量達到13,166.00。附圖描繪了威爾斯法戈高價值交易中看漲和看跌期權的成交量及未平倉合約的變化,位於67.5美元到95.0美元的行權價區間內,涵蓋了過去30天。

Wells Fargo Call and Put Volume: 30-Day Overview

富國銀行看漲和看跌期權成交量:30天綜述

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | TRADE | BULLISH | 01/24/25 | $2.93 | $2.85 | $2.93 | $72.00 | $1.3M | 80 | 4.7K |

| WFC | CALL | TRADE | BEARISH | 01/16/26 | $12.55 | $11.4 | $11.55 | $67.50 | $144.3K | 2.2K | 125 |

| WFC | PUT | SWEEP | BULLISH | 04/17/25 | $7.55 | $7.35 | $7.35 | $77.50 | $84.5K | 262 | 116 |

| WFC | CALL | SWEEP | BEARISH | 03/21/25 | $3.05 | $3.0 | $3.0 | $75.00 | $60.0K | 15.3K | 348 |

| WFC | CALL | SWEEP | BULLISH | 01/17/25 | $3.4 | $3.35 | $3.35 | $71.00 | $57.3K | 1.1K | 247 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | 看漲 | 交易 | 看好 | 01/24/25 | $2.93 | $2.85 | $2.93 | $72.00 | $1.3M | 80 | 4.7K |

| WFC | 看漲 | 交易 | 看淡 | 01/16/26 | $12.55 | $11.4 | $11.55 | $67.50 | ¥144.3K | 2.2K | 125 |

| WFC | 看跌 | 掃單 | 看好 | 04/17/25 | $7.55 | $7.35 | $7.35 | $77.50 | $84.5K | 262 | 116 |

| WFC | 看漲 | 掃單 | 看淡 | 03/21/25 | $3.05 | $3.0 | $3.0 | $75.00 | 60,000美元 | 15.3K | 348 |

| WFC | 看漲 | 掃單 | 看好 | 01/17/25 | $3.4 | $3.35 | $3.35 | $71.00 | $57.3K | 1.1千 | 247 |

About Wells Fargo

關於富國銀行

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

富國銀行是美國最大的銀行之一,資產負債表資產約爲1.9萬億美元。該公司有四個主要部門:消費銀行、商業銀行、企業及投資銀行,以及財富與投資管理。它幾乎完全專注於美國市場。

Where Is Wells Fargo Standing Right Now?

富國銀行現在的狀況如何?

- With a volume of 5,735,066, the price of WFC is up 2.15% at $72.84.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 9 days.

- WFC的成交量爲5,735,066,價格上漲2.15%,現爲$72.84。

- RSI因數提示相關股票可能接近超買。

- 下次業績預計將在9天內發佈。

Expert Opinions on Wells Fargo

關於富國銀行的專家意見

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $84.0.

在過去30天內,共有2位專業分析師對這隻股票發表了看法,設定了84.0美元的平均目標價。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:聰明資金正在行動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for Wells Fargo, targeting a price of $85. * An analyst from Compass Point persists with their Neutral rating on Wells Fargo, maintaining a target price of $83.

Benzinga Edge的期權異動板塊在潛在市場動向發生之前識別出可能的市場推動因素。查看大資金在您最喜歡的股票上採取了哪些頭寸。點擊這裏獲取訪問權限。* 保持其立場,一位來自瑞銀的分析師繼續對富國銀行保持買入評級,目標價格爲85美元。* 一位來自Compass Point的分析師對富國銀行持中立評級,目標價維持在83美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Wells Fargo options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。警覺的交易者通過不斷教育自己、調整策略、監控多個因數,並密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報,保持對最新富國銀行期權交易的了解。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 7 are puts, for a total amount of $352,454 and 15, calls, for a total amount of $2,035,449.

From the overall spotted trades, 7 are puts, for a total amount of $352,454 and 15, calls, for a total amount of $2,035,449.