Smart Money Is Betting Big In VST Options

Smart Money Is Betting Big In VST Options

Deep-pocketed investors have adopted a bearish approach towards Vistra (NYSE:VST), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in VST usually suggests something big is about to happen.

資金雄厚的投資者對Vistra(紐交所:VST)採取了看淡的態度,這一點市場參與者不能忽視。我們在Benzinga對公共期權記錄的追蹤揭示了今天這一重大舉動。這些投資者的身份尚不清楚,但VSt如此大規模的舉動通常意味着某種重大事件即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 12 extraordinary options activities for Vistra. This level of activity is out of the ordinary.

今天我們通過觀察獲得了這些信息,當時Benzinga的期權掃描儀突出了Vistra的12個異常期權活動。這種活動水平是非常不尋常的。

The general mood among these heavyweight investors is divided, with 16% leaning bullish and 75% bearish. Among these notable options, 6 are puts, totaling $199,700, and 6 are calls, amounting to $252,128.

這些重量級投資者之間的總體情緒分化,16%看好,75%看淡。在這些顯著的期權中,6個是看跌期權,總計199,700美元,6個是看漲期權,總計252,128美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $115.0 to $170.0 for Vistra over the recent three months.

根據交易活動,顯著投資者似乎尋求在最近三個月內Vistra的價格區間從115.0美元到170.0美元。

Volume & Open Interest Trends

成交量和未平倉量趨勢

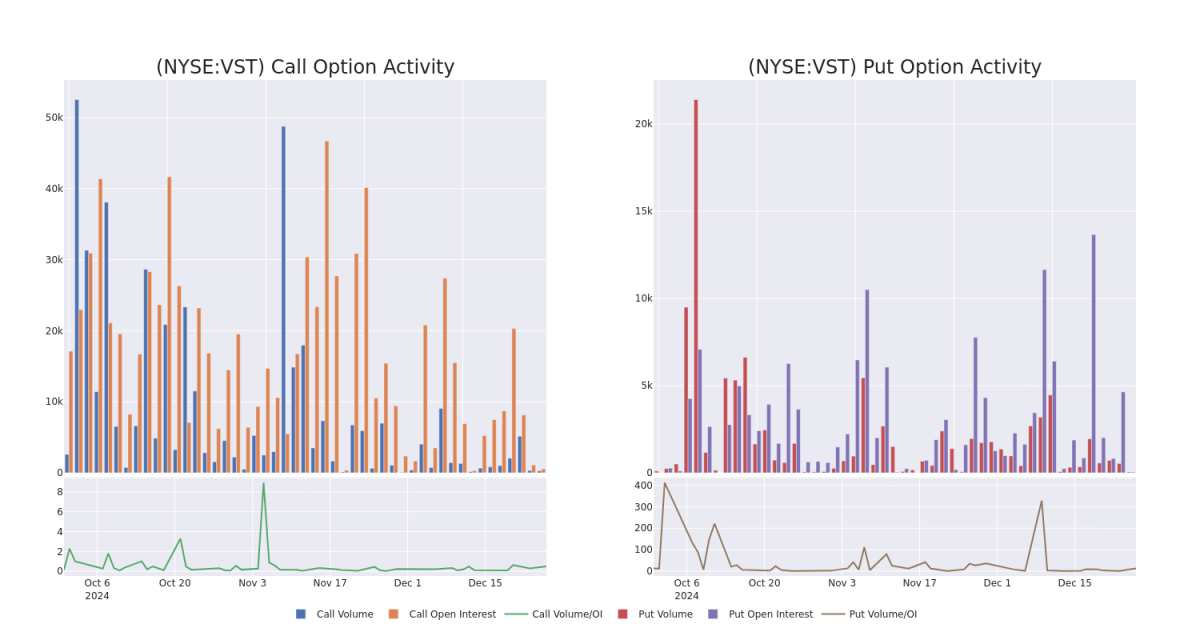

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Vistra's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Vistra's substantial trades, within a strike price spectrum from $115.0 to $170.0 over the preceding 30 days.

評估成交量和未平倉合約是進行期權交易的戰略步驟。這些指標揭示了在特定行權價下Vistra的期權流動性和投資者興趣。即將發佈的數據將可視化過去30天內Vistra的主要交易活動相關的看漲和看跌期權的成交量和未平倉合約的波動,行權價範圍從115.0美元到170.0美元。

Vistra 30-Day Option Volume & Interest Snapshot

vistra 30天期權成交量和利息快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | TRADE | BEARISH | 01/16/26 | $36.9 | $35.8 | $36.0 | $145.00 | $68.4K | 124 | 20 |

| VST | CALL | TRADE | BULLISH | 02/21/25 | $33.0 | $32.1 | $32.8 | $115.00 | $49.1K | 11 | 15 |

| VST | CALL | TRADE | BEARISH | 01/24/25 | $7.3 | $7.1 | $7.1 | $148.00 | $46.8K | 48 | 96 |

| VST | PUT | TRADE | BEARISH | 07/18/25 | $40.7 | $39.8 | $40.7 | $170.00 | $40.7K | 3 | 20 |

| VST | PUT | TRADE | BEARISH | 07/18/25 | $40.7 | $39.8 | $40.7 | $170.00 | $40.7K | 3 | 10 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Vistra Energy | 看漲 | 交易 | 看淡 | 01/16/26 | $36.9 | $35.8 | $36.0 | $145.00 | 68.4K美元 | 124 | 20 |

| Vistra Energy | 看漲 | 交易 | 看好 | 02/21/25 | $33.0 | $32.1 | $32.8 | $115.00 | $49.1K | 11 | 15 |

| Vistra Energy | 看漲 | 交易 | 看淡 | 01/24/25 | $7.3 | $7.1 | $7.1 | $148.00 | 46.8K美元 | 48 | 96 |

| Vistra Energy | 看跌 | 交易 | 看淡 | 07/18/25 | $40.7 | $39.8 | $40.7 | $170.00 | $40.7K | 3 | 20 |

| Vistra Energy | 看跌 | 交易 | 看淡 | 07/18/25 | $40.7 | $39.8 | $40.7 | $170.00 | $40.7K | 3 | 10 |

About Vistra

關於Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 500萬 customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

In light of the recent options history for Vistra, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到Vistra最近的期權歷史,現在重點關注公司本身是合適的。我們旨在探討其當前的業績。

Where Is Vistra Standing Right Now?

目前Vistra的狀況如何?

- Currently trading with a volume of 1,016,633, the VST's price is up by 0.59%, now at $144.2.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 62 days.

- VST目前的成交量爲1,016,633,價格上漲0.59%,現價爲$144.2。

- RSI讀數表明該股票目前在超買和超賣之間保持中立。

- 預計盈利發佈將在62天后進行。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

一位擁有20年經驗的期權交易員揭示了他的單行圖表技巧,幫助判斷何時買入和賣出。複製他的交易,這些交易每20天平均獲得27%的利潤。點擊這裏獲取訪問權限。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因數以及密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $115.0 to $170.0 for Vistra over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $115.0 to $170.0 for Vistra over the recent three months.