A Closer Look at Rigetti Computing's Options Market Dynamics

A Closer Look at Rigetti Computing's Options Market Dynamics

High-rolling investors have positioned themselves bearish on Rigetti Computing (NASDAQ:RGTI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in RGTI often signals that someone has privileged information.

高風險投資者對Rigetti Computing (納斯達克:RGTI)的看法看淡,零售交易者應當注意。這一活動今天通過Benzinga對公開期權數據的跟蹤引起了我們的注意。這些投資者的身份尚不清楚,但在RGTI上發生如此重大變動通常意味着有人掌握了內部信息。

Today, Benzinga's options scanner spotted 17 options trades for Rigetti Computing. This is not a typical pattern.

今天,Benzinga的期權掃描儀發現Rigetti Computing有17筆期權交易。這不是一個典型的模式。

The sentiment among these major traders is split, with 23% bullish and 70% bearish. Among all the options we identified, there was one put, amounting to $27,700, and 16 calls, totaling $1,630,393.

這些主要交易者的情緒相互分化,23%看好,70%看淡。在我們識別的所有期權中,有一筆看跌期權,總額爲27,700美元,16筆看漲期權,總計1,630,393美元。

What's The Price Target?

價格目標是什麼?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $20.0 for Rigetti Computing over the last 3 months.

考慮到這些合約的成交量和未平倉合約,鯨魚們在過去3個月裏似乎瞄準了Rigetti Computing的價格範圍在10.0美元到20.0美元之間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

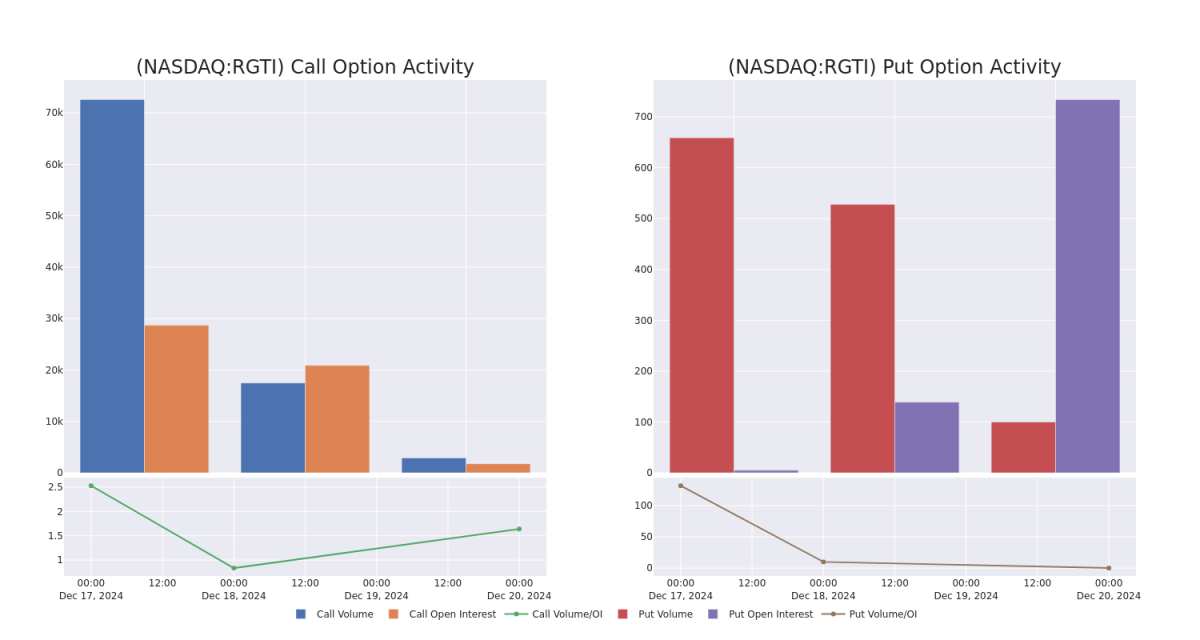

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Rigetti Computing's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Rigetti Computing's whale trades within a strike price range from $10.0 to $20.0 in the last 30 days.

查看成交量和未平倉合約是交易期權時一個強有力的動作。這些數據可以幫助您跟蹤Rigetti Computing在特定執行價格上的期權流動性和興趣。以下是我們可以觀察到的Rigetti Computing在過去30天內所有鯨魚交易的看漲和看跌期權的成交量和未平倉合約的演變,範圍從10.0美元到20.0美元。

Rigetti Computing Option Volume And Open Interest Over Last 30 Days

Rigetti Computing在過去30天的期權成交量和未平倉合約

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RGTI | CALL | SWEEP | BEARISH | 01/31/25 | $3.4 | $2.4 | $2.35 | $12.50 | $540.5K | 416 | 2.3K |

| RGTI | CALL | TRADE | NEUTRAL | 05/16/25 | $4.1 | $3.9 | $4.0 | $16.00 | $288.4K | 93 | 2.0K |

| RGTI | CALL | SWEEP | BEARISH | 01/17/25 | $2.1 | $2.0 | $2.0 | $13.00 | $120.0K | 4.9K | 859 |

| RGTI | CALL | SWEEP | BEARISH | 01/17/25 | $3.3 | $3.2 | $3.2 | $10.00 | $120.0K | 7.6K | 1.3K |

| RGTI | CALL | TRADE | BEARISH | 01/17/25 | $6.7 | $1.7 | $3.7 | $10.00 | $90.6K | 7.6K | 245 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 行權價 | 總交易價格 | 未平倉合約 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RGTI | 看漲 | 掃單 | 看淡 | 01/31/25 | $3.4 | $2.4 | $2.35 | $12.50 | 540.5K美元 | 416 | 2.3K |

| RGTI | 看漲 | 交易 | 中立 | 05/16/25 | $4.1 | $3.9 | $4.0 | $16.00 | $288.4K | 93 | 2.0K |

| RGTI | 看漲 | 掃單 | 看淡 | 01/17/25 | $2.1 | $2.0 | $2.0 | $13.00 | 12萬美金 | 4.9K | 859 |

| RGTI | 看漲 | 掃單 | 看淡 | 01/17/25 | $3.3 | $3.2 | $3.2 | $10.00 | 12萬美金 | 7.6K | 1.3K |

| RGTI | 看漲 | 交易 | 看淡 | 01/17/25 | $6.7 | $1.7 | $3.7 | $10.00 | $90.6K | 7.6K | 245 |

About Rigetti Computing

關於Rigetti計算公司

Rigetti Computing Inc is engaged in the business of full-stack quantum computing. Its proprietary quantum-classical infrastructure provides ultra-low latency integration with public and private clouds for high-performance practical quantum computing. The company has developed the industry's first multi-chip quantum processor for scalable quantum computing systems. Geographically, it derives a majority of its revenue from the United States.

Rigetti計算公司從事全棧量子計算業務。其專有的量子-經典基礎設施提供與公共和私有云的超低延遲集成,支持高性能的實用量子計算。該公司開發了行業首個多芯片量子處理器,用於可擴展的量子計算系統。在地理上,它的大部分營業收入來自美國。

Following our analysis of the options activities associated with Rigetti Computing, we pivot to a closer look at the company's own performance.

在對與Rigetti Computing相關的期權活動進行分析後,我們開始更深入地關注該公司的自身表現。

Present Market Standing of Rigetti Computing

Rigetti計算公司的當前市場地位

- With a volume of 89,179,572, the price of RGTI is up 24.69% at $11.68.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 80 days.

- RGTI的成交量爲89,179,572,價格上漲24.69%,達到11.68美元。

- RSI因數提示基準股可能被高估。

- 下一個業績預計將在80天后發佈。

What The Experts Say On Rigetti Computing

關於Rigetti Computing專家的看法

In the last month, 2 experts released ratings on this stock with an average target price of $8.0.

在過去一個月中,2位專家對該股票發佈了評級,平均目標價爲$8.0。

Turn $1000 into $1270 in just 20 days?

在短短20天內將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Craig-Hallum downgraded its action to Buy with a price target of $12. * An analyst from B. Riley Securities persists with their Buy rating on Rigetti Computing, maintaining a target price of $4.

一位擁有20年經驗的期權交易員透露了他的單行圖表技巧,展示了何時買入和賣出。複製他的交易,平均每20天獲利27%。點擊這裏獲取訪問權限。* 來自Craig-Hallum的分析師將其評級下調爲買入,目標價爲$12。* 來自b. Riley Securities的分析師堅持對Rigetti Computing的買入評級,維持目標價爲$4。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rigetti Computing with Benzinga Pro for real-time alerts.

交易期權涉及更高的風險,但也提供了更高獲利的潛力。精明的交易者通過持續的教育、戰略性交易調整、使用各種因數以及關注市場動態來減輕這些風險。通過Benzinga Pro跟蹤Rigetti Computing的最新期權交易,以獲取實時提醒。

譯文內容由第三人軟體翻譯。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $20.0 for Rigetti Computing over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $10.0 to $20.0 for Rigetti Computing over the last 3 months.