Investors with a lot of money to spend have taken a bullish stance on Novo Nordisk (NYSE:NVO).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NVO, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NVO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 11 uncommon options trades for Novo Nordisk.

This isn't normal.

The overall sentiment of these big-money traders is split between 63% bullish and 36%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $464,895, and 8 are calls, for a total amount of $2,906,247.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $75.0 to $130.0 for Novo Nordisk during the past quarter.

Analyzing Volume & Open Interest

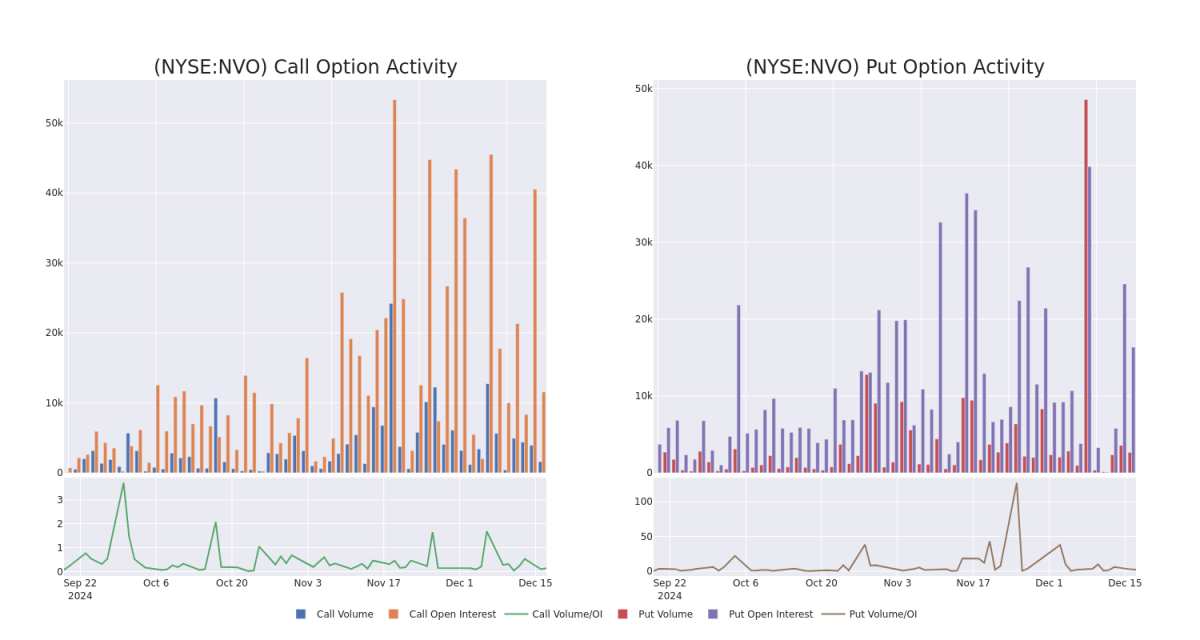

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Novo Nordisk's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Novo Nordisk's whale activity within a strike price range from $75.0 to $130.0 in the last 30 days.

Novo Nordisk Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

| NVO | CALL | TRADE | BULLISH | 12/20/24 | $2.88 | $2.54 | $2.82 | $112.00 | $1.9M | 3.0K | 457 |

| NVO | CALL | SWEEP | BEARISH | 12/20/24 | $6.35 | $6.15 | $6.21 | $105.00 | $386.4K | 3.9K | 811 |

| NVO | PUT | TRADE | BULLISH | 12/20/24 | $2.75 | $2.6 | $2.61 | $105.00 | $261.0K | 14.3K | 1.9K |

| NVO | CALL | SWEEP | BULLISH | 06/20/25 | $5.1 | $5.05 | $5.1 | $130.00 | $208.5K | 405 | 0 |

| NVO | PUT | SWEEP | BEARISH | 06/20/25 | $5.3 | $4.9 | $4.9 | $95.00 | $176.4K | 1.7K | 360 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

After a thorough review of the options trading surrounding Novo Nordisk, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Novo Nordisk

- Trading volume stands at 1,381,254, with NVO's price up by 0.24%, positioned at $108.31.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 43 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

資金雄厚的投資者對諾和諾德(紐交所:NVO)持看好的態度。

零售交易者應該了解這一點。

我們今天注意到這一點,當交易出現在我們在Benzinga跟蹤的公共可用期權歷史記錄中時。

我們不知道這些是機構還是隻是富有的個人。但當NVO發生如此大的事情時,通常意味着有人知道即將發生的事情。

我們不知道這些是機構還是隻是富有的個人。但當NVO發生如此大的事情時,通常意味着有人知道即將發生的事情。

那麼我們怎麼知道這些投資者剛剛做了什麼呢?

今天,Benzinga的期權掃描儀發現了諾和諾德的11筆期權異動交易。

這並不正常。

這些大資金交易者的整體情緒在63%的看好和36%的看淡之間分裂。

在我們發現的所有特殊期權中,有3個是看跌期權,總金額爲464,895美元,8個是看漲期權,總金額爲2,906,247美元。

預期價格變動

分析這些合約的成交量和未平倉合約,似乎大玩家在過去年季度目光鎖定了Novo Nordisk的價格區間在75.0美元到130.0美元之間。

分析成交量和未平倉合約

觀察成交量和未平倉合約是進行股票盡職調查的一個有見地的方法。

這些數據可以幫助您追蹤諾和諾德在特定執行價格下的期權流動性和興趣。

在下面,我們可以觀察到過去30天內Novo Nordisk在75.0到130.0美元的行使價區間內的看漲期權和看跌期權的成交量和未平倉合約的發展。

挪威諾德斯克看漲和看跌成交量:30天概述

檢測到重大期權交易:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|

NVO | CALL | TRADE | BULLISH | 12/20/24 | $2.88 | $2.54 | $2.82 | $112.00 | $1.9M | 3.0K | 457 |

NVO | CALL | SWEEP | BEARISH | 12/20/24 | $6.35 | $6.15 | $6.21 | $105.00 | $386.4K | 3.9K | 811 |

NVO | PUT | TRADE | BULLISH | 12/20/24 | $2.75 | $2.6 | $2.61 | $105.00 | $261.0K | 14.3K | 1.9K |

NVO | CALL | SWEEP | BULLISH | 06/20/25 | $5.1 | $5.05 | $5.1 | $130.00 | $208.5K | 405 | 0 |

NVO | PUT | SWEEP | BEARISH | 06/20/25 | $5.3 | $4.9 | $4.9 | $95.00 | $176.4K | 1.7K | 360 |

關於諾和諾德

諾和諾德在全球品牌糖尿病治療市場中佔據大約三分之一的份額,是世界領先的糖尿病護理產品提供商。該公司總部位於丹麥,生產和銷售多種人用和現代胰島素、可注射的糖尿病治療藥物(如GLP-1療法)、口服抗糖尿病藥物以及肥胖症治療藥物。諾和諾德還有一個生物製藥部門(大約佔營業收入的10%),專門研究血友病和其他疾病的蛋白質療法。

在對諾和諾德的期權交易進行全面審查後,我們開始更詳細地分析該公司。這包括對其當前市場狀態和表現的評估。

諾和諾德的當前狀態

成交量爲1,381,254,NVO的價格上漲0.24%,定位在$108.31。

相對強弱指數(RSI)因子顯示該股票可能接近超買狀態。

預計將在43天內發佈業績。

檢測到期權異動:聰明資金正在行動

Benzinga Edge的期權異動板塊在市場發生變化之前發現潛在的市場動向。看看大資金在你喜歡的股票上採取了什麼倉位。點擊這裏獲取訪問權限。

與僅僅交易股票相比,期權是一種風險較高的資產,但它們具有更高的盈利潛力。嚴肅的期權交易者通過日常學習、逐步進出交易、關注多個因子以及密切關注市場來管理這種風險。

我們不知道這些是機構還是隻是富有的個人。但當NVO發生如此大的事情時,通常意味着有人知道即將發生的事情。

我們不知道這些是機構還是隻是富有的個人。但當NVO發生如此大的事情時,通常意味着有人知道即將發生的事情。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NVO, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with NVO, it often means somebody knows something is about to happen.