Synopsys Proposes Divesting Units, Including Ansys PowerArtist, For $35 Billion EU Deal Approval

Synopsys Proposes Divesting Units, Including Ansys PowerArtist, For $35 Billion EU Deal Approval

Synopsys Inc. (NASDAQ:SNPS), an American electronic design automation company, is preparing to divest an Ansys Inc. (NASDAQ:ANSS) unit, along with one of its own, to secure EU approval for its $35 billion acquisition, according to sources cited by Reuters. Ansys specializes in software development for autonomous vehicle sensor simulations, including lidar, radar, and camera design.

新思科技公司(納斯達克:SNPS),一家美國電子設計自動化公司,正在準備剝離安斯科技公司(納斯達克:ANSS)的一個部門,以及其自身的一個部門,以獲得歐盟對其350億美元收購的批准,根據路透社引用的消息來源。安斯科技專注於用於自動駕駛汽車傳感器模擬的軟件開發,包括激光雷達、雷達和攝像頭設計。

The European Commission is awaiting feedback from rivals and customers on Synopsys' proposal.

歐盟委員會正在等待來自競爭對手和客戶對新思科技提案的反饋。

Also Read: Goldman Sachs Initiates Similarweb Coverage, Product Upgrades Inspire Bullish Take

另請閱讀:高盛開始覆蓋Similarweb,產品升級激發看好的看法。

Responses are due by Dec.16.

回覆截止日期爲12月16日。

Synopsys agreed to sell its optical design tool maker, Optical Solutions Group, to design and emulation company Keysight Technologies Inc (NYSE:KEYS).

新思科技同意將其光學設計工具製造商光學解決方案集團出售給設計和仿真公司Keysight Technologies Inc(紐交所:KEYS)。

It has now also offered to divest Ansys PowerArtist, including its research, development, distribution, licensing, selling, and marketing. PowerArtist is a tool for analyzing and reducing power to enable power-efficient design.

現在,它還提議出售安斯科技的PowerArtist,包括其研究、開發、分銷、許可、銷售和市場營銷。PowerArtist是一個用於分析和減少功耗以實現功耗效率設計的工具。

Synopsys expects the Ansys deal to close in the first half of 2025, Reuters reports.

據路透社報道,新思科技預計安斯科技的交易將在2025年上半年完成。

Synopsys did not offer any behavioral remedies for its business practices, implying no regulatory objection regarding interoperability and product bundling.

新思科技沒有針對其業務慣例提供任何行爲補救措施,暗示對互操作性和產品捆綁沒有監管異議。

In January 2024, Synopsys agreed to acquire Ansys for $35 billion through $19 billion in cash and $16 billion in debt.

2024年1月,新思科技同意以350億採購安斯科技,其中包括190億現金和160億債務。

In May, Synopsys forged a deal to sell its Software Integrity Group business to Clearlake Capital Group and Francisco Partners for about $2.1 billion.

在5月份,新思科技與Clearlake Capital Group和Francisco Partners達成協議,以約21億出售其軟件完整性業務。

In October, the UK's antitrust watchdog launched an inquiry into the Synopsys-Ansys deal, citing antitrust concerns.

10月份,英國的反壟斷監管機構對新思科技-安斯科技的交易展開調查, citing 反壟斷擔憂。

Synopsys held $4.05 billion in cash and equivalents as of Oct. 31, 2024. It expects first-quarter revenue of $1.435 billion-$1.465 billion, below the consensus estimates of $1.643 billion, and adjusted EPS of $2.77-$2.82 below the forecast of $3.53.

截至2024年10月31日,新思科技持有現金及等價物40.5億。它預計第一季度營業收入爲14.35億14.65億,低於市場共識估計的16.43億,並調整後的每股收益爲2.77-2.82,低於預測的3.53。

Recent mergers, acquisitions, and investments by Big Tech giants have attracted global antitrust scrutiny. The EU is reviewing Nvidia Corp's Run:ai deal over possible stifling of competition in the AI space.

大型科技巨頭近期的合併、收購和投資引發了全球反壟斷審查。歐盟正在審查英偉達的Run:ai交易,可能會抑制人工智能領域的競爭。

The Federal Trade Commission (FTC) is examining investments by Big Tech giants, including Microsoft Corp, Amazon.com Inc and Google parent Alphabet Inc into AI startups.

聯邦貿易委員會(FTC)正在審查大型科技巨頭的投資,包括微軟、亞馬遜和谷歌母公司Alphabet Inc對人工智能初創公司的投資。

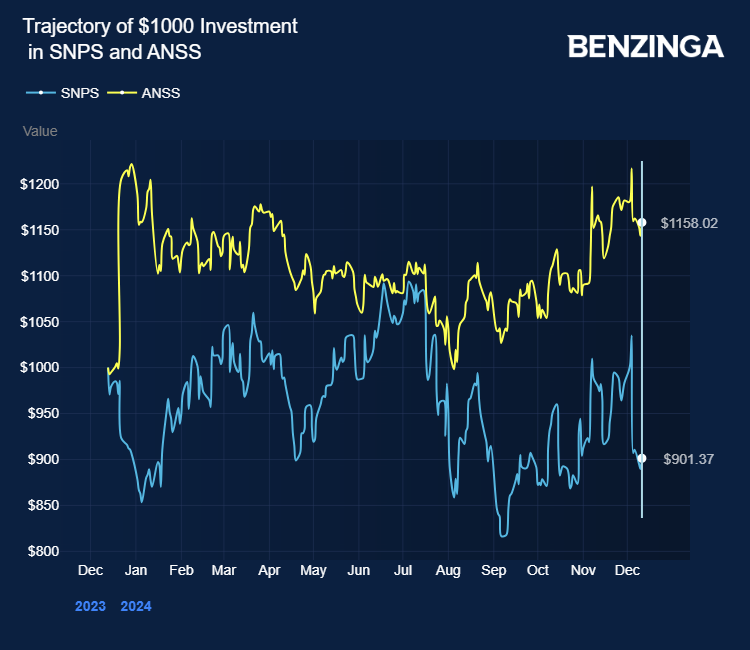

Price Actions: ANSS stock closed higher by 1.27% at $344.00 at Wednesday. SNPS closed higher by 1.33%.

價格行動:ANSS股票在週三上漲1.27%,收於344.00美元。SNPS上漲1.33%。

Also Read:

另請閱讀:

- E2open Faces Organic Growth Challenges, Debt Overhang: Goldman Sachs Downgrades Stock

- E2open面臨有機增長挑戰和債務壓力:高盛下調股票評級

Photo: Shutterstock

Photo: shutterstock

譯文內容由第三人軟體翻譯。

Responses are due by Dec.16.

Responses are due by Dec.16.