SMCI Stock Receives Harshest Price Target Among 17 Tracked Analysts As JPMorgan Maintains Underweight Rating On Super Micro: 'No Significant Movement Of Orders'

SMCI Stock Receives Harshest Price Target Among 17 Tracked Analysts As JPMorgan Maintains Underweight Rating On Super Micro: 'No Significant Movement Of Orders'

JPMorgan Chase & Co maintained its 'Underweight' rating on Super Micro Computer, Inc (NASDAQ:SMCI) and reaffirmed its $23 price target following a recent meeting with company management.

摩根大通維持對超微電腦公司的「減持」評級,並在與公司管理層最近會晤後重申其23美元的目標價。

What Happened: Despite market rumors suggesting potential shifts in customer orders, Super Micro management assured investors that its customer base remains solid, with no substantial changes to order allocations, reported Tipranks.

發生了什麼:儘管市場上有關於客戶訂單可能變動的傳聞,但超微管理層向投資者保證,客戶基礎依然穩固,訂單分配沒有實質性變化,Tipranks報道。

The company's customer base "remains robust with no significant movement of orders," the analyst tells investors in a research note.

分析師在研究報告中告訴投資者,公司客戶基礎「依然強勁,訂單沒有顯著移動」。

Why It Matters: The company also expressed confidence in its capacity to fulfill orders and is actively preparing for the launch of new products in the second half of fiscal 2025.

這意味着什麼:公司還表達了對其履行訂單能力的信心,並積極準備在2025財年下半年推出新產品。

The note by Samik Chatterjee also addressed concerns about the company's Malaysian operations, confirming that the plant is on track to ramp up production in the first half of 2025. Additionally, Super Micro believes that its working capital requirements will sustain a quarterly revenue range of $5.5 billion to $6 billion.

Samik Chatterjee的報告還提到對公司馬來西亞運營的擔憂,確認該工廠將按計劃在2025年上半年增加產量。此外,超微相信,其營運資金需求將維持季度營業收入區間爲55億到60億。

The firm further highlighted Nvidia's Blackwell product line, which is anticipated to experience significant growth in the second half of fiscal 2025. Super Micro is well-positioned to capitalize on this trend with its strong presence in customized versions of the product.

該公司進一步強調了英偉達的Blackwell產品線,預計在2025財年下半年將實現顯著增長。超微在這種趨勢中處於有利位置,因其在定製版本產品方面具有強大的市場存在。

What's Happening With SMCI: Super Micro Computer Inc. (SMCI) is teetering on the brink of losing its spot in the prestigious Nasdaq 100 Index during its annual December reshuffle. The company finds itself alongside other underperformers like Moderna and Biogen due to a recent market cap plunge.

SMCI的現狀:超微電腦公司(SMCI)在每年12月的重新評估中搖搖欲墜,面臨失去在納斯達克100指數中的位置。由於最近市場市值的驟降,該公司與其他表現不佳的企業,如Moderna和渤健公司,並列在一起。

A recent auditing scandal by Ernst & Young, which flagged governance issues, sent shockwaves through the company and the auditor resigned. The company has appointed a new auditor and Nasdaq has given an extension to the company for submitting its financial reports by February 2025.

安永的一起審計醜聞揭示了治理問題,對公司造成了震盪,核數師已辭職。公司已任命新核數師,納斯達克已給予公司延期至2025年2月提交財務報告。

This significant drop in market capitalization puts Super Micro at risk of being excluded from the particular Nasdaq 100 Index, a blow that could further erode investor confidence. The company will need to demonstrate a strong recovery to regain its footing and secure its place in the coveted index.

這一下市場市值的顯著下降使得超微電腦面臨被排除在納斯達克100指數之外的風險,這對投資者信心可能造成進一步 erosion。公司需要展示出強勁的復甦來重新站穩腳跟並確保在這個受歡迎的指數中的位置。

Price Action: Shares of SMCI were 1.62% up at $38.91 per share in premarket on Thursday. This compares to the Nasdaq 100 futures, which were down by 0.4%.

價格走勢:在週四的盤前交易中,SMCI的股價上漲了1.62%,達到每股38.91美元。這與納斯達克100期貨下跌0.4%相對比。

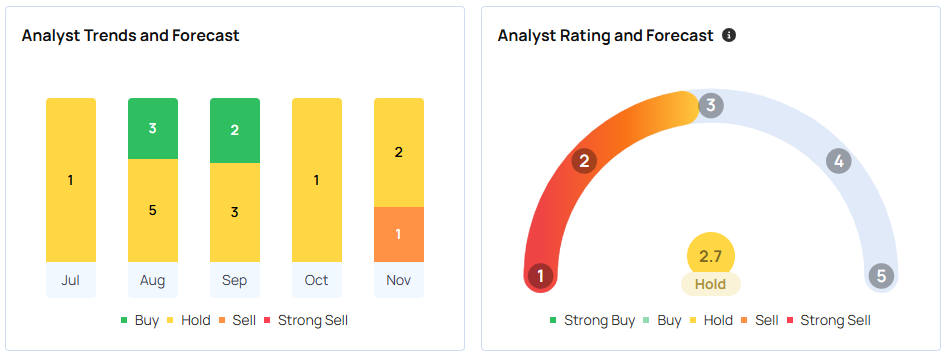

Analyst Views: According to Benzinga, SMCI has a consensus price target of $531.47 based on the ratings of 17 analysts. The highest price target out of all the analysts tracked by Benzinga is $1300 issued by Rosenblatt as of Aug. 7. The lowest target price is $23 issued by JPMorgan on Nov. 6.

分析師觀點:根據Benzinga的數據,SMCI的共識目標價爲531.47美元,基於17位分析師的評級。在Benzinga追蹤的所有分析師中,最高目標價爲1300美元,由Rosenblatt於8月7日發佈。最低目標價爲23美元,由摩根大通於11月6日發佈。

The average price target of $27.67 between Goldman Sachs, JP Morgan, and Wedbush implies a 29.15% downside for SMCI.

高盛、摩根大通和Wedbush的平均目標價爲27.67美元,這意味着SMCI有29.15%的下行空間。

Photo via Shutterstock

圖片來自shutterstock

譯文內容由第三人軟體翻譯。