Top 3 Consumer Stocks That Could Lead To Your Biggest Gains In Q4

Top 3 Consumer Stocks That Could Lead To Your Biggest Gains In Q4

The most oversold stocks in the consumer discretionary sector presents an opportunity to buy into undervalued companies.

消費品可選板塊中被嚴重超賣的股票爲買入被低估公司提供了機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

相對強弱指數(RSI)是一個動量指標,它比較股票在價格上漲天數的強度與價格下跌天數的強度。與股票的價格走勢相比,它可以讓交易者更好地了解股票在開空期的表現。當RSI低於30時,通常認爲資產被超賣,依據Benzinga Pro的說法。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是該板塊中最新的主要被低估的股票名單,它們的RSI接近或低於30。

Lotus Technology Inc – ADR (NASDAQ:LOT)

路特斯科技公司 – ADR (納斯達克:LOT)

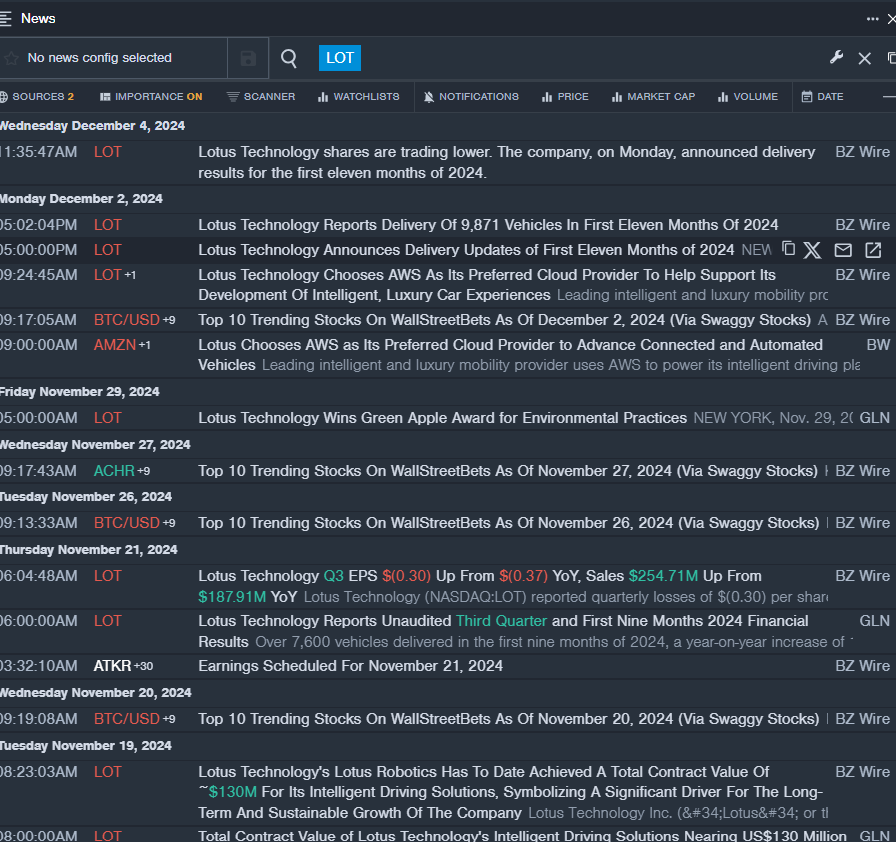

- On Dec. 2, Lotus Technology reported delivery of 9,871 vehicles in the first eleven months of 2024. The company's stock fell around 16% over the past month and has a 52-week low of $3.35.

- RSI Value: 26.97

- LOT Price Action: Shares of Lotus Technology fell 0.6% to close at $3.64 on Wednesday.

- Benzinga Pro's real-time newsfeed alerted to latest LOT news.

- 在12月2日,路特斯科技報告稱在2024年前11個月交付了9,871輛汽車。該公司的股票在過去一個月下跌了約16%,52周低點爲3.35美元。

- RSI值:26.97

- 路特斯價格走勢:路特斯科技的股票在週三下跌了0.6%,收於3.64美元。

- Benzinga Pro的實時資訊流提醒了最新的路特斯新聞。

Hamilton Beach Brands Holding Co (NYSE:HBB)

Hamilton Beach Brands Holding Co (紐交所:HBB)

- On Oct.30, Hamilton Beach Brands posted third-quarter earnings of 14 cents per share, down from 74 cents per share in the year-ago period. The company's stock fell around 11% over the past five days and has a 52-week low of $14.34.

- RSI Value: 29.54

- HBB Price Action: Shares of Hamilton Beach Brands fell 0.8% to close at $17.66 on Wednesday.

- Benzinga Pro's charting tool helped identify the trend in HBB stock.

- 在10月30日,Hamilton Beach Brands公佈了第三季度每股收益爲14美分,較去年同期的74美分下降。該公司的股票在過去五天內下跌了約11%,並且52周低點爲14.34美元。

- RSI值: 29.54

- HBb價格走勢: Hamilton Beach Brands的股票在週三下跌了0.8%,收盤價爲17.66美元。

- Benzinga Pro的圖表工具幫助識別HBb股票的趨勢。

Krispy Kreme Inc (NASDAQ:DNUT)

Krispy Kreme Inc (納斯達克:DNUT)

- On Nov. 7, the company reported third-quarter adjusted earnings per share of a loss of one cent, missing the analyst consensus of one cent earnings. Krispy Kreme continues to project FY24 net revenue between $1.65 billion and $1.685 billion, compared with the street view of $1.675 billion. The company's stock fell around 11% over the past month and has a 52-week low of $9.18.

- RSI Value: 29.21

- DNUT Price Action: Shares of Krispy Kreme fell 0.8% to close at $10.03 on Wednesday.

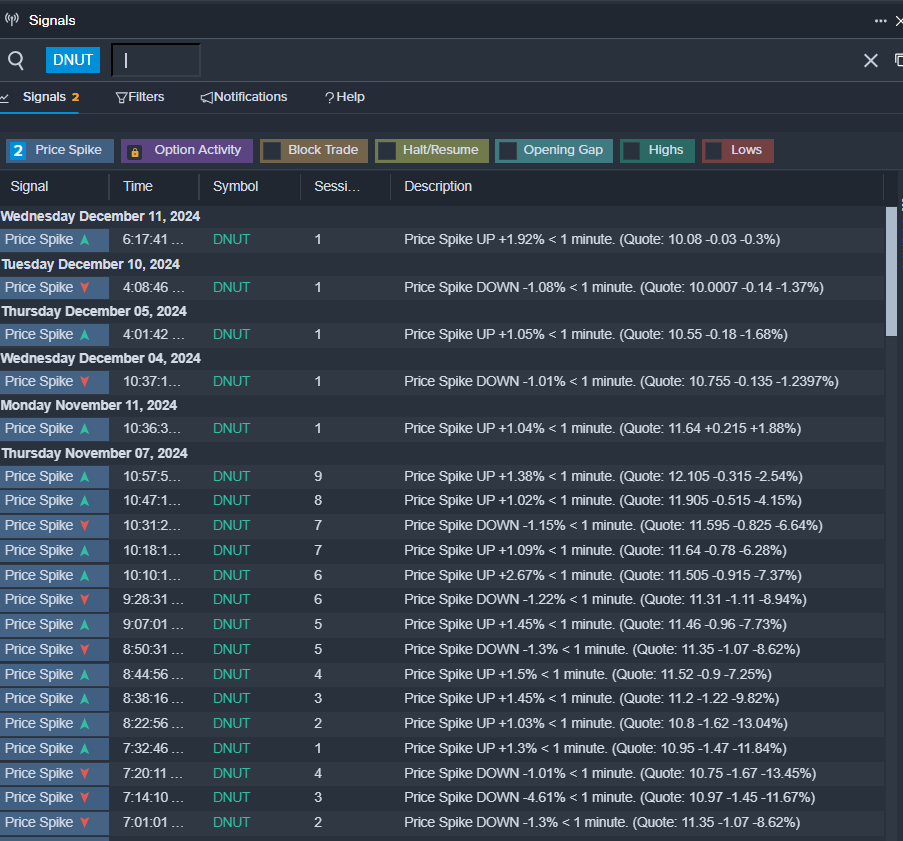

- Benzinga Pro's signals feature notified of a potential breakout in DNUT shares.

- 在11月7日,該公司報告第三季度的調整後每股收益爲虧損1美分,未能達到分析師一致預期的1美分盈利。Krispy Kreme繼續預計2024財年的淨營業收入將在16.5億到16.85億美之間,與市場預期的16.75億相比。該公司的股票在過去一個月下跌約11%,並且52周低點爲9.18美元。

- 相對強弱指數(RSI)值: 29.21

- DNUt價格走勢:Krispy Kreme的股票在週三下跌0.8%,收於10.03美元。

- Benzinga Pro的信號功能通知了DNUt股票潛在的突破。

Read This Next:

接下來請閱讀:

- Jim Cramer Says 'Keep Owning' This Energy Stock, Abbott Laboratories 'Legal Stuff' Is Behind Them

- 吉姆·克萊默表示「繼續持有」這隻能源股票,雅培的「法律問題」已經結束。

譯文內容由第三人軟體翻譯。