Returns At Packaging Corporation of America (NYSE:PKG) Appear To Be Weighed Down

Returns At Packaging Corporation of America (NYSE:PKG) Appear To Be Weighed Down

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Having said that, from a first glance at Packaging Corporation of America (NYSE:PKG) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

如果我們想找到潛在的多倍回報的股票,通常會有一些潛在的趨勢可以提供線索。理想情況下,一個業務會顯示出兩個趨勢:首先是資本回報率 (ROCE) 的增長,其次是投入資本的增加。如果你看到這些,通常意味着這是一家擁有良好商業模式和衆多盈利再投資機會的公司。說了這麼多,從初步觀察美國包裝公司 (紐交所:PKG) 的情況來看,我們對收益的趨勢並沒有感到驚豔,但我們還是深入看看吧。

Understanding Return On Capital Employed (ROCE)

理解已投資資本回報率(ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Packaging Corporation of America is:

對於那些不知道的人來說,ROCE 是公司年度稅前利潤(其回報)相對於業務投入資本的一個衡量標準。美國包裝公司的計算公式是:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

資本利用率 = 利息和稅前利潤(EBIT) ÷ (總資產 - 流動負債)

0.15 = US$1.1b ÷ (US$8.8b - US$1.1b) (Based on the trailing twelve months to September 2024).

0.15 = 11億美元 ÷ (88億美元 - 11億美元)(基於截至2024年9月的過去十二個月數據)。

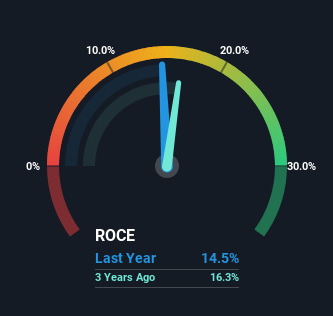

So, Packaging Corporation of America has an ROCE of 15%. On its own, that's a standard return, however it's much better than the 9.6% generated by the Packaging industry.

所以,美國包裝公司的資本回報率爲15%。單看這個數字,這是一個標準回報,然而比起包裝行業的9.6%要好得多。

Above you can see how the current ROCE for Packaging Corporation of America compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Packaging Corporation of America .

在上面,你可以看到美國包裝公司的當前資本回報率與其之前的資本回報率的比較,但從過去所能得出的信息有限。如果你想看看分析師未來的預測,你應該查看我們關於美國包裝公司的免費的分析師報告。

What Can We Tell From Packaging Corporation of America's ROCE Trend?

我們能從美國包裝公司的資本回報率趨勢中得出什麼結論?

There hasn't been much to report for Packaging Corporation of America's returns and its level of capital employed because both metrics have been steady for the past five years. It's not uncommon to see this when looking at a mature and stable business that isn't re-investing its earnings because it has likely passed that phase of the business cycle. So don't be surprised if Packaging Corporation of America doesn't end up being a multi-bagger in a few years time. With fewer investment opportunities, it makes sense that Packaging Corporation of America has been paying out a decent 44% of its earnings to shareholders. Given the business isn't reinvesting in itself, it makes sense to distribute a portion of earnings among shareholders.

過去五年,關於美國包裝公司的回報和資本使用水平並沒有太多值得報告的,因爲這兩個指標都保持穩定。當觀察一家成熟且穩定的企業時,這種情況並不罕見,因爲它可能已經度過了再投資收益的階段。因此,不要驚訝於美國包裝公司在未來幾年不會成爲多倍收益股。由於投資機會較少,美國包裝公司向股東支付了44%的可觀收益。鑑於該業務沒有進行自我再投資,因此向股東分配一部分收益是合理的。

The Bottom Line On Packaging Corporation of America's ROCE

關於美國包裝公司的資本回報率,底線是

We can conclude that in regards to Packaging Corporation of America's returns on capital employed and the trends, there isn't much change to report on. Yet to long term shareholders the stock has gifted them an incredible 150% return in the last five years, so the market appears to be rosy about its future. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

我們可以得出結論,關於美國包裝公司的資本回報和趨勢,報告的變化不大。然而,對於長期股東來說,這隻股票在過去五年中爲他們提供了驚人的150%的回報,因此市場對其未來似乎持樂觀態度。最終,如果潛在的趨勢持續下去,我們不會期待它在未來成爲多倍收益股。

On a final note, we've found 1 warning sign for Packaging Corporation of America that we think you should be aware of.

最後,我們發現了美國包裝公司有1個警示信號,我們認爲你應該注意。

While Packaging Corporation of America isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

雖然美國包裝公司的回報並不是最高的,但請查看這個免費的公司名單,這些公司在資產負債表上具有穩健的資本回報率。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?對內容有疑慮?請直接與我們聯繫。或者,發送電子郵件至 editorial-team (at) simplywallst.com。

這篇來自Simply Wall St的文章是一般性的。我們根據歷史數據和分析師預測提供評論,採用無偏見的方法,我們的文章並不旨在提供財務建議。它不構成對任何股票的買入或賣出建議,也未考慮到您的目標或財務狀況。我們旨在爲您提供以基本數據驅動的長期分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St在提到的任何股票中均沒有持倉。

譯文內容由第三人軟體翻譯。

0.15 = US$1.1b ÷ (US$8.8b - US$1.1b)

0.15 = US$1.1b ÷ (US$8.8b - US$1.1b)