Advanced Micro Devices's Options Frenzy: What You Need to Know

Advanced Micro Devices's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bearish move on Advanced Micro Devices. Our analysis of options history for Advanced Micro Devices (NASDAQ:AMD) revealed 40 unusual trades.

金融巨頭對先進微設備採取了明顯的看跌舉動。我們對先進微設備(納斯達克股票代碼:AMD)期權歷史的分析顯示了40筆不尋常的交易。

Delving into the details, we found 37% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $561,778, and 31 were calls, valued at $8,526,816.

深入研究細節,我們發現37%的交易者看漲,而40%的交易者表現出看跌的趨勢。在我們發現的所有交易中,有9筆是看跌期權,價值爲561,778美元,31筆是看漲期權,價值8,526,816美元。

Expected Price Movements

預期的價格走勢

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $200.0 for Advanced Micro Devices over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將Advanced Micro Devices的價格區間從25.0美元擴大到200.0美元。

Volume & Open Interest Development

交易量和未平倉合約的發展

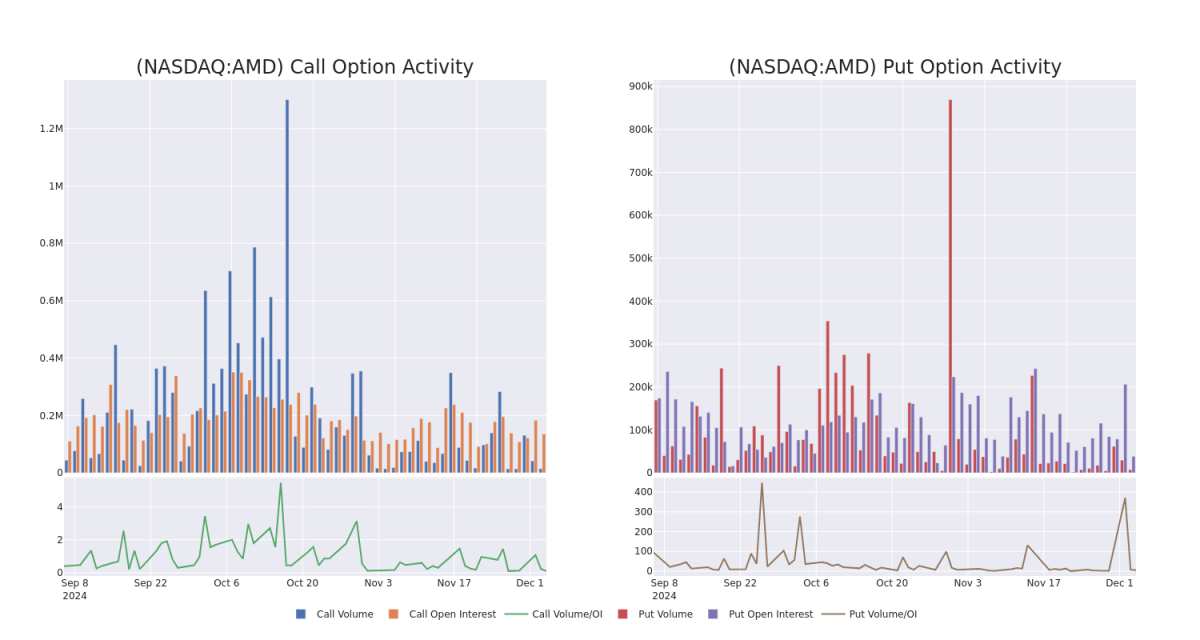

In today's trading context, the average open interest for options of Advanced Micro Devices stands at 5608.1, with a total volume reaching 21,867.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Advanced Micro Devices, situated within the strike price corridor from $25.0 to $200.0, throughout the last 30 days.

在當今的交易背景下,先進微設備期權的平均未平倉合約爲5608.1,總交易量達到21,867.00。隨附的圖表描繪了過去30天中Advanced Micro Devices高價值交易的看漲和看跌期權交易量以及未平倉合約的變化,行使價走勢從25.0美元到200.0美元不等。

Advanced Micro Devices Call and Put Volume: 30-Day Overview

高級微設備看漲和看跌交易量:30 天概述

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | CALL | TRADE | BULLISH | 05/16/25 | $119.05 | $118.5 | $118.83 | $25.00 | $1.1M | 2.5K | 1.6K |

| AMD | CALL | TRADE | NEUTRAL | 05/16/25 | $118.75 | $118.2 | $118.52 | $25.00 | $1.1M | 2.5K | 1.3K |

| AMD | CALL | TRADE | NEUTRAL | 05/16/25 | $118.7 | $117.8 | $118.23 | $25.00 | $1.1M | 2.5K | 948 |

| AMD | CALL | TRADE | BULLISH | 05/16/25 | $118.35 | $117.75 | $118.13 | $25.00 | $1.1M | 2.5K | 1.1K |

| AMD | CALL | TRADE | BULLISH | 05/16/25 | $118.05 | $117.45 | $117.85 | $25.00 | $1.1M | 2.5K | 255 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMD | 打電話 | 貿易 | 看漲 | 05/16/25 | 119.05 美元 | 118.5 美元 | 118.83 美元 | 25.00 美元 | 110 萬美元 | 2.5K | 1.6K |

| AMD | 打電話 | 貿易 | 中立 | 05/16/25 | 118.75 美元 | 118.2 美元 | 118.52 美元 | 25.00 美元 | 110 萬美元 | 2.5K | 1.3K |

| AMD | 打電話 | 貿易 | 中立 | 05/16/25 | 118.7 美元 | 117.8 美元 | 118.23 美元 | 25.00 美元 | 110 萬美元 | 2.5K | 948 |

| AMD | 打電話 | 貿易 | 看漲 | 05/16/25 | 118.35 美元 | 117.75 美元 | 118.13 美元 | 25.00 美元 | 110 萬美元 | 2.5K | 1.1K |

| AMD | 打電話 | 貿易 | 看漲 | 05/16/25 | 118.05 美元 | 117.45 美元 | 117.85 美元 | 25.00 美元 | 110 萬美元 | 2.5K | 255 |

About Advanced Micro Devices

關於高級微設備

Advanced Micro Devices designs a variety of digital semiconductors for markets such as PCs, gaming consoles, data centers, industrial, and automotive applications. AMD's traditional strength was in central processing units and graphics processing units used in PCs and data centers. Additionally, the firm supplies the chips found in prominent game consoles such as the Sony PlayStation and Microsoft Xbox. In 2022, the firm acquired field-programmable gate array leader Xilinx to diversify its business and augment its opportunities in key end markets such as data center and automotive.

Advanced Micro Devices 爲 PC、遊戲機、數據中心、工業和汽車應用等市場設計了各種數字半導體。AMD 的傳統優勢在於個人電腦和數據中心中使用的中央處理單元和圖形處理單元。此外,該公司還提供索尼PlayStation和微軟Xbox等知名遊戲機中的芯片。2022年,該公司收購了現場可編程門陣列領導者賽靈思,以實現業務多元化並增加其在數據中心和汽車等關鍵終端市場的機會。

Following our analysis of the options activities associated with Advanced Micro Devices, we pivot to a closer look at the company's own performance.

在分析了與Advanced Micro Devices相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Advanced Micro Devices's Current Market Status

先進微設備的當前市場狀況

- Trading volume stands at 12,485,887, with AMD's price up by 0.51%, positioned at $142.7.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 55 days.

- 交易量爲12,485,887美元,其中AMD的價格上漲了0.51%,爲142.7美元。

- RSI指標顯示,該股目前在超買和超賣之間處於中立狀態。

- 預計將在55天后公佈業績。

Unusual Options Activity Detected: Smart Money on the Move

檢測到不尋常的期權活動:智能貨幣在移動

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Benzinga Edge的不尋常期權委員會在潛在的市場推動者發生之前就發現了它們。看看大筆資金對你最喜歡的股票持有哪些頭寸。點擊此處訪問。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

In today's trading context, the average open interest for options of Advanced Micro Devices stands at 5608.1, with a total volume reaching 21,867.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Advanced Micro Devices, situated within the strike price corridor from $25.0 to $200.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Advanced Micro Devices stands at 5608.1, with a total volume reaching 21,867.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Advanced Micro Devices, situated within the strike price corridor from $25.0 to $200.0, throughout the last 30 days.