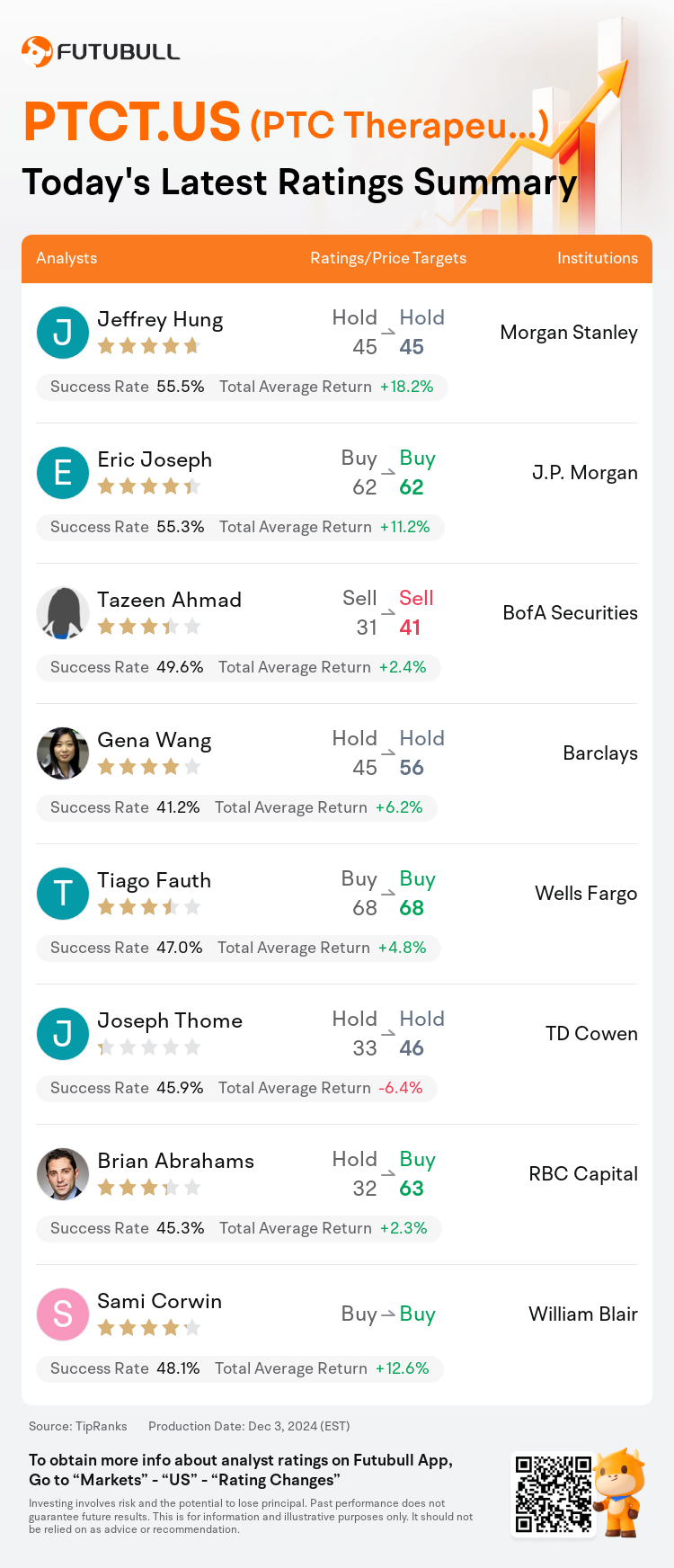

On Dec 03, major Wall Street analysts update their ratings for $PTC Therapeutics (PTCT.US)$, with price targets ranging from $41 to $68.

Morgan Stanley analyst Jeffrey Hung maintains with a hold rating, and maintains the target price at $45.

J.P. Morgan analyst Eric Joseph maintains with a buy rating, and maintains the target price at $62.

BofA Securities analyst Tazeen Ahmad maintains with a sell rating, and adjusts the target price from $31 to $41.

BofA Securities analyst Tazeen Ahmad maintains with a sell rating, and adjusts the target price from $31 to $41.

Barclays analyst Gena Wang maintains with a hold rating, and adjusts the target price from $45 to $56.

Wells Fargo analyst Tiago Fauth maintains with a buy rating, and maintains the target price at $68.

Furthermore, according to the comprehensive report, the opinions of $PTC Therapeutics (PTCT.US)$'s main analysts recently are as follows:

PTC Therapeutics recently disclosed a global licensing and collaboration pact with a major pharmaceutical company for its Huntington's Disease program. This deal comprises an immediate substantial payment to PTC and the potential for substantial additional funds contingent upon developmental, regulatory, and sales achievements. Analysts regard PTC as a robust investment proposition extending into 2025, supported by a broad rare disease portfolio with several significant upcoming events. This agreement with Novartis is viewed favorably, considering the significant upfront payment received by PTC, the retention of considerable economic interests, and the vast potential market upon successful development and approval of their program.

Following the announcement by PTC Therapeutics of a strategic license agreement with a global partner for the development in Huntington's disease, there is encouragement that this deal reduces the near-term demand for capital. Despite this development, there is emphasis on the need for regulatory alignment concerning an accelerated approval path after a promising phase 2 update, while further clarity is awaited regarding the future developmental strategies which are believed to still possess certain risks.

The company's agreement with Novartis, which includes a high upfront payment and milestones, is viewed favorably. This deal not only bolsters the company's financial position but also confirms the validity of its platform, though it also shifts development risks.

The firm believes that the new Huntington's disease collaboration with Novartis is not yet fully reflected in the stock's valuation.

Here are the latest investment ratings and price targets for $PTC Therapeutics (PTCT.US)$ from 8 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間12月3日,多家華爾街大行更新了$PTC Therapeutics (PTCT.US)$的評級,目標價介於41美元至68美元。

摩根士丹利分析師Jeffrey Hung維持持有評級,維持目標價45美元。

摩根大通分析師Eric Joseph維持買入評級,維持目標價62美元。

美銀證券分析師Tazeen Ahmad維持賣出評級,並將目標價從31美元上調至41美元。

美銀證券分析師Tazeen Ahmad維持賣出評級,並將目標價從31美元上調至41美元。

巴克萊銀行分析師Gena Wang維持持有評級,並將目標價從45美元上調至56美元。

富國集團分析師Tiago Fauth維持買入評級,維持目標價68美元。

此外,綜合報道,$PTC Therapeutics (PTCT.US)$近期主要分析師觀點如下:

ptc therapeutics最近披露了一項與一家主要藥品公司達成的全球許可和合作協議,用於其亨廷頓病項目。該協議包括對ptc的即期大額支付以及根據開發、監管和銷售成就可能獲得的大額額外所有基金類型。分析師認爲,ptc是一個強勁的投資選擇,直至2025年,支撐其擁有廣泛罕見疾病組合的投資前景,並有幾個重要的即將到來的事件。考慮到ptc獲得的重要即期支付、保留的可觀經濟利益以及在成功開發和獲批其項目後的巨大潛在市場,這項與諾華的協議被認爲是積極的。

在ptc therapeutics宣佈與一家全球合作伙伴達成戰略許可協議,用於亨廷頓病的開發後,人們鼓舞於這項協議減少了對資金的近期需求。儘管有這一進展,但對於需要在有了有前景的第2階段更新後就加速批准途徑的監管協調強調,同時,還在等待關於未來開發戰略的進一步澄清,人們認爲這些戰略仍然存在一定風險。

公司與諾華達成的協議包括高額的即期支付和里程碑,被認爲是積極的。這項交易不僅加強了公司的財務狀況,還證實了其平台的有效性,儘管也轉移了開發風險。

該公司認爲與諾華的新型亨廷頓病合作尚未完全反映在股價估值中。

以下爲今日8位分析師對$PTC Therapeutics (PTCT.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

美銀證券分析師Tazeen Ahmad維持賣出評級,並將目標價從31美元上調至41美元。

美銀證券分析師Tazeen Ahmad維持賣出評級,並將目標價從31美元上調至41美元。

BofA Securities analyst Tazeen Ahmad maintains with a sell rating, and adjusts the target price from $31 to $41.

BofA Securities analyst Tazeen Ahmad maintains with a sell rating, and adjusts the target price from $31 to $41.