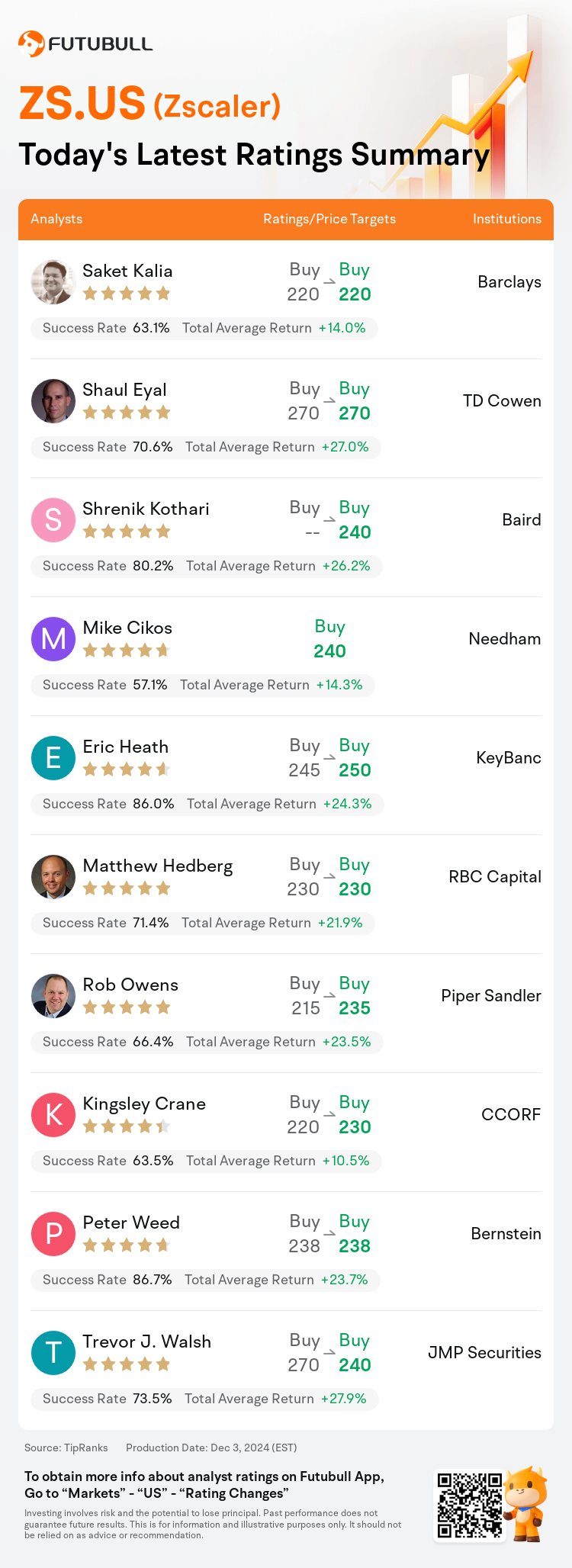

On Dec 03, major Wall Street analysts update their ratings for $Zscaler (ZS.US)$, with price targets ranging from $220 to $270.

Barclays analyst Saket Kalia maintains with a buy rating, and maintains the target price at $220.

TD Cowen analyst Shaul Eyal maintains with a buy rating, and maintains the target price at $270.

Baird analyst Shrenik Kothari maintains with a buy rating, and sets the target price at $240.

Baird analyst Shrenik Kothari maintains with a buy rating, and sets the target price at $240.

Needham analyst Mike Cikos initiates coverage with a buy rating, and sets the target price at $240.

KeyBanc analyst Eric Heath maintains with a buy rating, and adjusts the target price from $245 to $250.

Furthermore, according to the comprehensive report, the opinions of $Zscaler (ZS.US)$'s main analysts recently are as follows:

Zscaler's fiscal Q1 outcomes were highlighted by numerous positives such as a 30% year-over-year acceleration in bookings, though billing growth fell short at 13%, which was below the buy-side expectations of mid-teens. Furthermore, the sudden retirement of CFO Remo Canessa introduces uncertainty concerning the anticipated acceleration in the second half of the fiscal year. Nonetheless, comments from Zscaler indicate that recent changes in sales leadership are leading to stabilization, potentially enhancing the company's ability to market its broader platform solutions.

Fiscal Q1 results were deemed 'fine,' though the beat on billings was not as substantial as anticipated. The fiscal year outlook continues to project a significant acceleration in the latter half. This expectation persists despite ongoing transitions within the sales organization and recent changes in the CFO position.

Ahead of the company's upcoming earnings report, expectations among investors have shown mixed signals. Initial guidance was considered "conservative" and the benchmark for Q1 billings growth is relatively "low". Nonetheless, demand continues to be robust and billings are well-positioned to improve. This scenario provides a compelling outlook for the remainder of its fiscal year. Expectations of an upward trend through FY25 are also suggested by comparisons with higher peer multiples.

Zscaler's solid Q1 results surpassed consensus estimates, bolstered by increased customer interest in emerging products and significant engagement from large customers. These results have reinforced confidence that ZScaler is well-prepared for a strong recovery in the second half of 2025 and is poised to capitalize on fiscal year 2026 as the sales approach matures and new products facilitate growth. Despite this, the unaltered guidance for the remainder of FY25 and uncertainties arising from the CFO transition might lead investors to adopt a cautious 'wait-and-see' stance. Purchasing during periods of weakness could be advisable.

Despite similar economic challenges faced by its industry peers, and significant adjustments to its sales strategies, the company maintains steady performance. The firm's billings, particularly around new sales and opportunistic renewals, have seen a growth rate of 20%. However, there are concerns about the ongoing transition in its market approach, necessitating a restructuring of its sales framework to more effectively engage and expand within its existing customer base.

Here are the latest investment ratings and price targets for $Zscaler (ZS.US)$ from 10 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

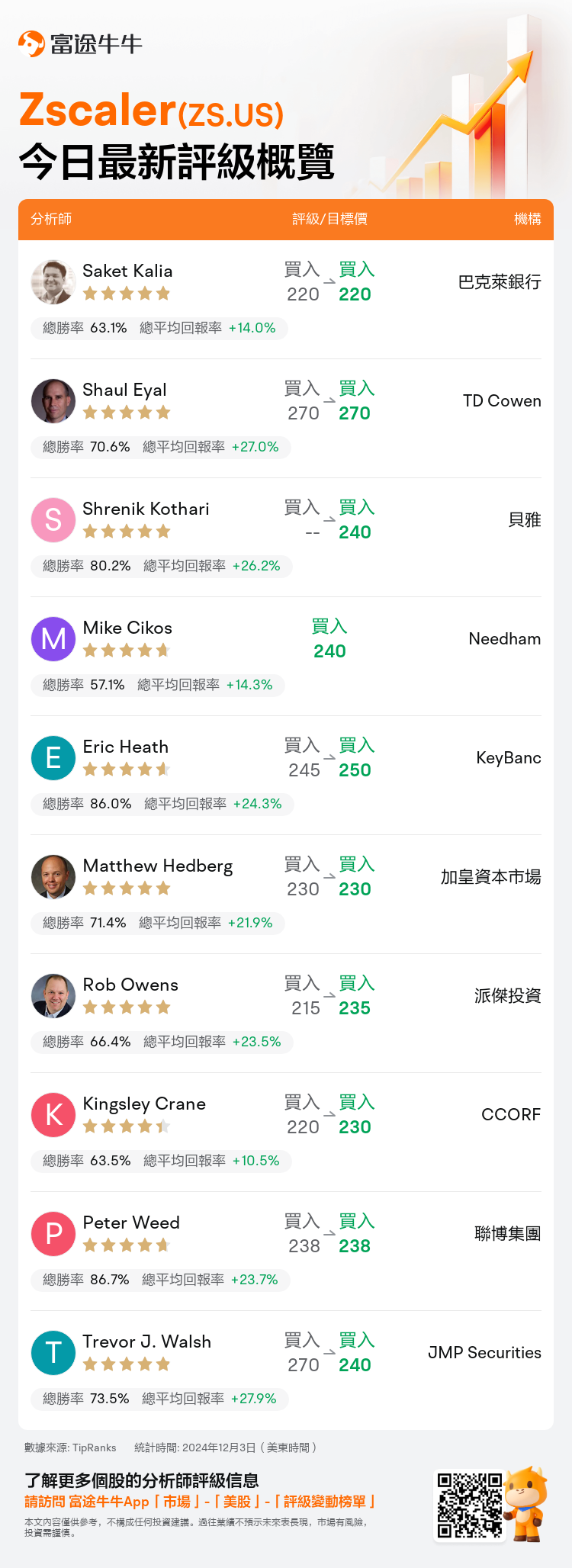

美東時間12月3日,多家華爾街大行更新了$Zscaler (ZS.US)$的評級,目標價介於220美元至270美元。

巴克萊銀行分析師Saket Kalia維持買入評級,維持目標價220美元。

TD Cowen分析師Shaul Eyal維持買入評級,維持目標價270美元。

貝雅分析師Shrenik Kothari維持買入評級,目標價240美元。

貝雅分析師Shrenik Kothari維持買入評級,目標價240美元。

Needham分析師Mike Cikos首次給予買入評級,目標價240美元。

KeyBanc分析師Eric Heath維持買入評級,並將目標價從245美元上調至250美元。

此外,綜合報道,$Zscaler (ZS.US)$近期主要分析師觀點如下:

zscaler的財政第一季度結果受到了多個積極因素的提振,例如訂單額同比增長30%,儘管計費增長在13%略顯不足,低於買方對中後部的預期。此外,CFO Remo Canessa的突然退休帶來了對財政年度下半年預期加速的不確定性。然而,zscaler的評論表明,最近的銷售領導層變動正在帶來穩定,可能提升公司推廣更廣泛平台解決方案的能力。

財政第一季度的結果被認爲「不錯」,儘管計費超出預期並不顯著。財政年度展望繼續預計在後半年有明顯加速。儘管銷售組織內部持續轉型和CFO職位最近的變動,但這一預期仍然存在。

在公司即將發佈的收益報告前,投資者對市場表現出了交叉信號。最初的指導被認爲是「保守」的,第一季度計費增長的基準相對「低」。儘管如此,需求持續強勁,計費有望改善。這種情況爲其財政年度的餘下時間提供了引人注目的展望。通過與更高同行倍數的比較,也暗示着到2025財年結束的上升趨勢的預期。

zscaler的出色第一季度業績超出了一致預期,得益於客戶對新興產品的增加興趣和大客戶的重要參與。這些結果加強了對Zscaler已經爲在2025年下半年的強勁復甦做好準備,並準備利用2026財年的信心,隨着銷售方式的成熟和新產品促進增長。儘管如此,對於2025財年餘下時間的未更改展望以及由CFO過渡引起的不確定性,可能會導致投資者採取謹慎的「觀望」立場。在疲軟期間買入可能是明智之舉。

儘管其行業同行面臨着相似的經濟挑戰,並對其銷售策略進行了重大調整,該公司仍保持穩健的業績。公司的賬單,特別是圍繞新銷售和機會性續訂,增長率達到20%。然而,人們對其市場策略持續轉變的擔憂,需要重組其銷售框架以更有效地吸引並擴大現有客戶群。

以下爲今日10位分析師對$Zscaler (ZS.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

貝雅分析師Shrenik Kothari維持買入評級,目標價240美元。

貝雅分析師Shrenik Kothari維持買入評級,目標價240美元。

Baird analyst Shrenik Kothari maintains with a buy rating, and sets the target price at $240.

Baird analyst Shrenik Kothari maintains with a buy rating, and sets the target price at $240.