Super Micro Shares Jump 7% In Premarket As Special Committee Clears It Of 'Misconduct' Allegations, But Top Investment Bank Flags 2 Key Aspects To Watch

Super Micro Shares Jump 7% In Premarket As Special Committee Clears It Of 'Misconduct' Allegations, But Top Investment Bank Flags 2 Key Aspects To Watch

Super Micro Computer Inc. (NASDAQ:SMCI) announced the completion of an independent review on Monday. The review, conducted by an Independent Special Committee, found no "evidence of misconduct" by the company's management or board.

超微電腦有限公司(納斯達克:SMCI)宣佈獨立審查於週一完成。由一個獨立特別委員會進行的審查發現公司管理層或董事會沒有"違規行爲"的證據。

What Happened: The review was initiated in response to allegations of misconduct. Following the report, the company shares popped over 30% on Monday and gained 7% during Tuesday's premarket session.

事件經過:該審查是爲了應對違規指控而發起的。在報告發布後,公司股價週一暴漲超過30%,在週二盤前交易中上漲了7%。

Despite acknowledging "modest lapses," JPMorgan analysts have highlighted two crucial aspects to watch in the aftermath of the review. The first is whether Super Micro's newly appointed independent auditors, BDO, will accept the committee's findings.

儘管承認存在"輕微失誤",摩根大通分析師強調審查結束後需要關注的兩個關鍵方面。第一個是超微電腦新任的獨立核數師BDO是否會接受委員會的調查結果。

The server manufacturer had brought BDO on board in mid-November due to consistent delays in submitting its 2024 year-end report to the SEC, Investing.com reported.

由於持續拖延向證交所提交2024年年報,服務器製造商於11月中旬引入了BDO, Investing.com報道。

The second aspect emphasized by JPMorgan is whether Nasdaq will grant Super Micro's request for an extension to regain compliance with listing rules. The company had previously announced in November its plan to file its 2024 financials.

摩根大通強調的第二個方面是納斯達克是否會批准超微電腦延長恢復符合上市規則的申請。該公司此前曾在11月宣佈計劃提交其2024年財務報告。

The independent committee's recommendations included replacing the Chief Financial Officer, appointing a Chief Accounting Officer and a Compliance Officer, and bolstering its legal department and compliance-related training.

獨立委員會的建議包括更換首席財務官、任命首席會計官和合規主管,加強其法律部門和合規相關培訓。

Why It Matters: Despite a substantial dip from their annual highs due to repeated delays in filing annual reports and allegations of accounting malpractice by short-seller Hindenburg Research, Super Micro shares have seen an increase of about 47% in 2024.

重要性:儘管由於反覆延遲提交年度報告和空頭機構Hindenburg Research的會計失當指控,超微電腦股價較年度高點大幅下跌,但2024年股價上漲約47%。

The company, a provider of servers for advanced AI programs, has reaped the benefits of its exposure to the rapidly expanding artificial industry.

該公司是爲愛文思控股計劃提供服務器的供應商,受益於其與迅速擴大的人工智能行業的接觸。

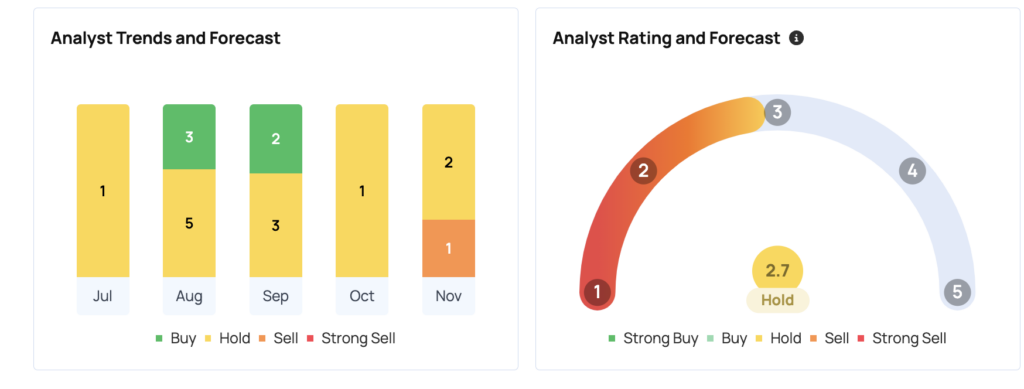

According to Benzinga Pro, based on an average price target of $27.67 between Goldman Sachs, JP Morgan, and Wedbush, there's an implied 34% downside for Super Micro Computer. The consensus rating forecast on Benzinga, suggests a score of 2.7 out of 5 points, which implies holding the stock.

根據Benzinga Pro的數據,根據高盛、摩根大通和Wedbush的平均目標價27.67美元,超微電腦存在34%的下行潛力。根據Benzinga的共識評級預測,預測得分爲5分中的2.7分,這意味着持有該股。

- Ark Invest's Cathie Wood Says Stock Market Will 'Broaden Out' Under Trump, But Growth Won't Be Linear: 'Nothing Goes Up In A Straight Line'

- ark的凱西·伍德表示,在特朗普的領導下,股市將會"擴展",但增長不會是線性的:"沒有什麼是筆直上升的。"

Image via Shutterstock

圖片來源:shutterstock

譯文內容由第三人軟體翻譯。

The server manufacturer had brought BDO on board in mid-November due to consistent delays in submitting its 2024 year-end report to the SEC, Investing.com reported.

The server manufacturer had brought BDO on board in mid-November due to consistent delays in submitting its 2024 year-end report to the SEC, Investing.com reported.