Looking At Lam Research's Recent Unusual Options Activity

Looking At Lam Research's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Lam Research.

擁有大量資金的鯨魚對拉姆研究採取了明顯看好的立場。

Looking at options history for Lam Research (NASDAQ:LRCX) we detected 17 trades.

查看拉姆研究(納斯達克:LRCX)期權歷史,我們發現了17筆交易。

If we consider the specifics of each trade, it is accurate to state that 70% of the investors opened trades with bullish expectations and 17% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,70%的投資者以看漲的預期開展了交易,而17%的投資者以看跌方式開展了交易。

From the overall spotted trades, 9 are puts, for a total amount of $453,104 and 8, calls, for a total amount of $321,700.

從所有已發現的交易中,有9筆是看跌期權,總額爲$453,104,而有8筆是看漲期權,總額爲$321,700。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $104.0 for Lam Research over the last 3 months.

考慮到這些合約的成交量和未平倉合約量,看起來鯨魚一直將拉姆研究股票的目標價區間定在了$55.0至$104.0之間,以遺留的最後3個月爲週期。

Insights into Volume & Open Interest

成交量和持倉量分析

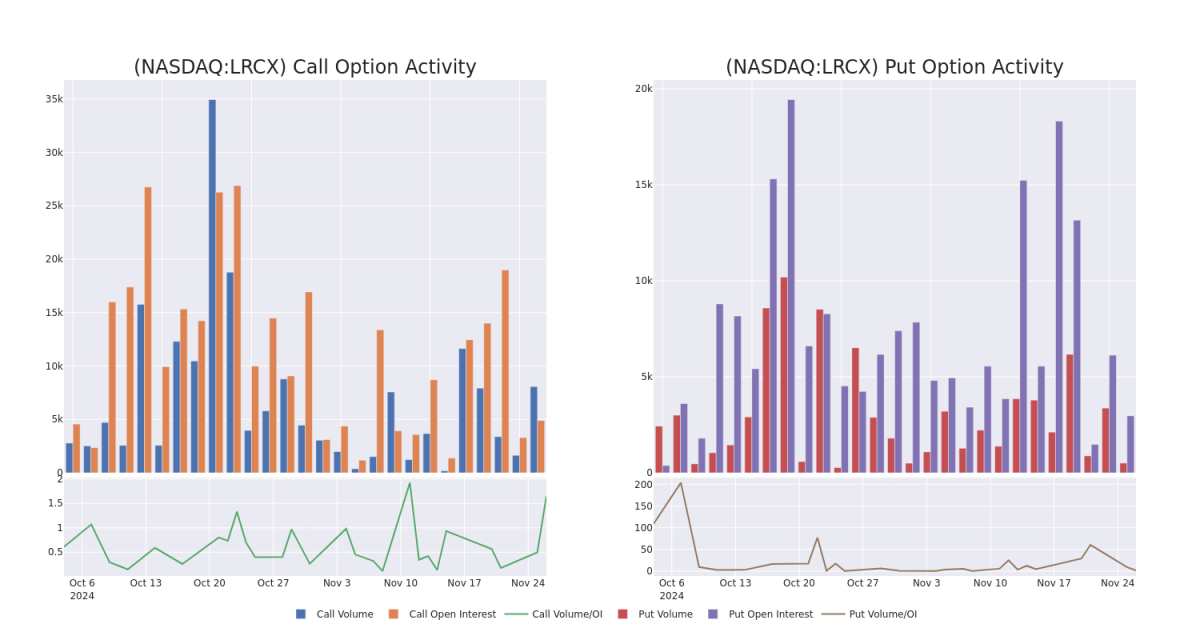

In today's trading context, the average open interest for options of Lam Research stands at 1634.3, with a total volume reaching 6,030.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lam Research, situated within the strike price corridor from $55.0 to $104.0, throughout the last 30 days.

在今天的交易環境下,拉姆研究期權的平均未平倉合約量爲1634.3,總成交量達到6030.00。附帶的圖表詳細描述了過去30天內拉姆研究高價值交易的看漲和看跌期權的成交量和未平倉合約量的變化情況,這些交易都位於$55.0至$104.0的行權價格走廊範圍內。

Lam Research 30-Day Option Volume & Interest Snapshot

Lam Research 30天期權成交量和持倉量快照

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | PUT | SWEEP | BULLISH | 01/16/26 | $3.4 | $3.35 | $3.35 | $55.00 | $100.6K | 1.5K | 300 |

| LRCX | PUT | SWEEP | NEUTRAL | 06/20/25 | $2.58 | $2.5 | $2.5 | $60.00 | $75.0K | 681 | 300 |

| LRCX | PUT | SWEEP | BULLISH | 06/20/25 | $7.2 | $6.8 | $6.9 | $72.00 | $51.7K | 690 | 962 |

| LRCX | PUT | TRADE | BULLISH | 12/06/24 | $10.0 | $9.55 | $9.62 | $85.00 | $48.0K | 0 | 150 |

| LRCX | CALL | TRADE | BEARISH | 01/15/27 | $25.3 | $23.1 | $23.1 | $70.00 | $46.2K | 137 | 20 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | 看跌 | SWEEP | BULLISH | 01/16/26 | $3.4 | $3.35 | $3.35 | $55.00 | $100.6千 | 1.5千 | 300 |

| LRCX | 看跌 | SWEEP | 中立 | 06/20/25 | $2.58 | $2.5 | $2.5 | $60.00 | $75.0K | 681 | 300 |

| LRCX | 看跌 | SWEEP | BULLISH | 06/20/25 | $7.2 | $6.8 | $6.9 | $72.00 | $51.7K | 690 | 962 |

| LRCX | 看跌 | 交易 | BULLISH | 12/06/24 | $10.0 | $9.55 | $9.62 | $85.00 | $48.0千 | 0 | 150 |

| LRCX | 看漲 | 交易 | 看淡 | 01/15/27 | $25.3 | $23.1 | $23.1 | $70.00 | $46.2千 | 137 | 20 |

About Lam Research

關於拉姆研究

Lam Research is one of the largest semiconductor wafer fabrication equipment manufacturers in the world. It specializes in deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

拉姆研究是全球最大的半導體硅片製造設備製造商之一。它專注於沉積和蝕刻,涉及在半導體上構建各層並隨後選擇性地從每一層中去除圖案。拉姆在蝕刻領域佔據着最大的市場份額,並在沉積方面佔據明確的第二份額。它與DRAm和NAND芯片的存儲芯片製造商接觸更多。其頂級客戶包括全球最大的芯片製造商,包括台積電、三星、英特爾和美光。

Current Position of Lam Research

Lam Research當前持倉

- Trading volume stands at 4,175,509, with LRCX's price up by 5.38%, positioned at $75.42.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 54 days.

- 交易量爲4,175,509,LRCX的價格上漲5.38%,位於75.42美元。

- RSI指標顯示該股票可能接近超買。

- 預計將在54天內宣佈盈利。

What The Experts Say On Lam Research

專家對Lam Research的評價

In the last month, 1 experts released ratings on this stock with an average target price of $85.0.

在過去的一個月裏,有1位專家發佈了對該股票的評級,平均目標價爲$85.0。

Unusual Options Activity Detected: Smart Money on the Move

檢測到期權異動:智慧資金在行動。

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* Consistent in their evaluation, an analyst from Bernstein keeps a Market Perform rating on Lam Research with a target price of $85.

Benzinga Edge的期權異動板塊在市場走勢發生之前就發現潛在的市場推動者。查看大資金對您喜愛股票的持倉情況。點擊此處獲取.* Bernestein的一位分析師在評估中始終如一,給予拉姆研究Market Perform評級,目標價爲$85。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

譯文內容由第三人軟體翻譯。

From the overall spotted trades, 9 are puts, for a total amount of $453,104 and 8, calls, for a total amount of $321,700.

From the overall spotted trades, 9 are puts, for a total amount of $453,104 and 8, calls, for a total amount of $321,700.