We Ran A Stock Scan For Earnings Growth And Alarm.com Holdings (NASDAQ:ALRM) Passed With Ease

We Ran A Stock Scan For Earnings Growth And Alarm.com Holdings (NASDAQ:ALRM) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

很多投資者,尤其是那些缺乏經驗的投資者,常常會購買那些有好故事的公司的股票,即使這些公司在虧損。有時候這些故事會影響投資者的判斷,導致他們根據情感而非良好的公司基本面投資。儘管一個充分資金的公司可能會持續虧損數年,卻仍必須最終實現盈利,否則投資者將會撤離,公司將會衰落。

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Alarm.com Holdings (NASDAQ:ALRM). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

儘管身處科技股藍天投資時代,許多投資者仍然採用更傳統的策略;購買像Alarm.com Holdings (納斯達克:ALRM)這樣盈利的公司股票。在投資時,利潤並非唯一應考慮的指標,但值得認識到那些能夠持續產生利潤的企業。

How Fast Is Alarm.com Holdings Growing?

Alarm.com Holdings 的增長速度有多快?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Alarm.com Holdings' EPS has grown 29% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

如果您認爲市場即使稍有效率,那麼從長期看,您會期望公司的股價跟隨其每股收益(EPS)的結果。這意味着EPS的增長被大多數成功的長期投資者視爲真正的正面因素。股東們會開心地得知,Alarm.com Holdings 的EPS在過去三年裏以每年29%的複合增長。如果公司能維持這種增長,我們預計股東們會感到滿意。

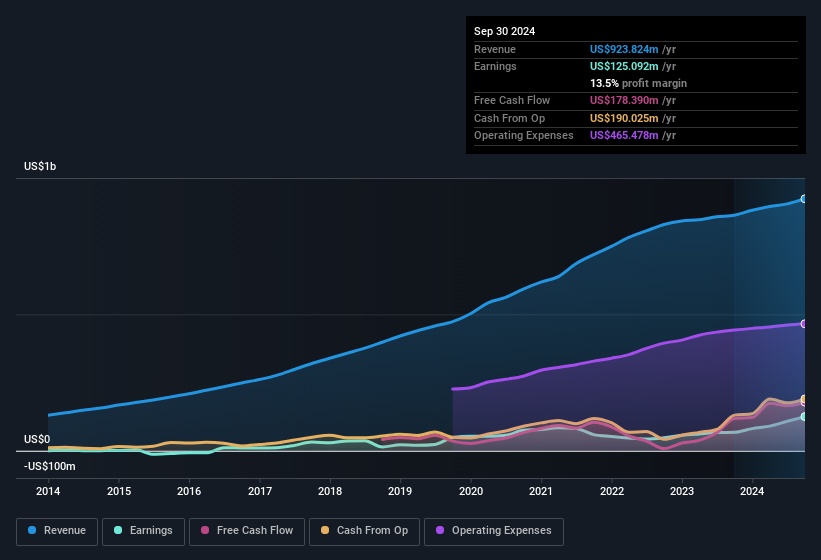

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Alarm.com Holdings shareholders is that EBIT margins have grown from 7.7% to 11% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

通常有助於查看利息前稅前利潤(EBIT)毛利率以及營業收入增長,以另一個角度評估公司的增長質量。令Alarm.com Holdings 的股東們欣喜的是,EBIT毛利從過去12個月的7.7%增長至11%,而營業收入也呈上升趨勢。在我們看來,實現了這兩點是增長的一個好跡象。

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

下面的圖表顯示了公司的營業收入和收益是如何隨時間變化的。要查看實際數字,請單擊圖表。

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Alarm.com Holdings?

儘管我們生活在當下,但在投資決策過程中,未來無疑最爲重要。那麼,不妨查看這個互動圖表,展示了Alarm.com Holdings的未來每股收益預期。

Are Alarm.com Holdings Insiders Aligned With All Shareholders?

Alarm.com Holdings股東和所有股東是否保持一致?

It's a necessity that company leaders act in the best interest of shareholders and so insider investment always comes as a reassurance to the market. Shareholders will be pleased by the fact that insiders own Alarm.com Holdings shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$147m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

公司領導者必須秉持股東的最佳利益行事,因此內部投資始終讓市場感到安心。股東們將對內部人員持有價值可觀的Alarm.com Holdings股份感到滿意。事實上,他們在公司投入了相當可觀的財富,目前價值14700萬美元。投資者會讚賞管理層投入這麼大金額表示他們對公司未來的承諾。

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations between US$2.0b and US$6.4b, like Alarm.com Holdings, the median CEO pay is around US$6.5m.

儘管看到內部人員通過大額投資表現出對公司的強烈信念總是好的,但股東也應該問問管理層的薪酬政策是否合理。我們快速分析CEO的薪酬似乎表明是合理的。對於類似Alarm.com Holdings市值在20億美元至64億美元之間的公司,CEO的薪酬中位數約爲650萬美元。

The Alarm.com Holdings CEO received total compensation of just US$2.4m in the year to December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

在截至2023年12月的一年中,Alarm.com Holdings的CEO總薪酬僅爲240萬美元。第一印象似乎表明薪酬政策對股東有利。CEO的薪酬水平並非投資者最重要的指標,但當薪酬較低時,這支持CEO與普通股東之間的增強一致性。一般而言,可以認爲合理的薪酬水平證明了良好的決策能力。

Should You Add Alarm.com Holdings To Your Watchlist?

你是否應該將Alarm.com Holdings添加到你的自選中?

You can't deny that Alarm.com Holdings has grown its earnings per share at a very impressive rate. That's attractive. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. Everyone has their own preferences when it comes to investing but it definitely makes Alarm.com Holdings look rather interesting indeed. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of Alarm.com Holdings. You might benefit from giving it a glance today.

你不能否認,Alarm.com Holdings的每股收益增長速度非常引人注目。這很吸引人。如果你仍然有疑慮,也請記住,公司內部人士已經投資了相當可觀的金額與股東和CEO的薪酬相比,相當適度,與同等規模的公司相比。在投資時,每個人都有自己的偏好,但Alarm.com Holdings確實看起來相當有趣。一旦你找到喜歡的公司,下一步就是考慮你認爲它值多少錢。現在正是您查看我們專屬的Alarm.com Holdings折現現金流估值的機會。今天看一眼可能會對您有所幫助。

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by significant insider holdings.

總是有可能買入未增長收益並且內部人員不買入股票的股票表現良好。但是對於那些認爲這些重要指數的人,我們鼓勵您查看具有這些功能的公司。您可以訪問定製列表,其中列出了已經展示出增長並得到內幕人員認可的公司。

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

請注意,本文討論的內部交易是指在相關司法管轄區中報告的交易。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂嗎?請直接與我們聯繫。或者,發送電子郵件至editorial-team @ simplywallst.com。

Simply Wall St的這篇文章是一般性質的。我們僅基於歷史數據和分析師預測提供評論,使用公正的方法,我們的文章並非意在提供財務建議。這並不構成買入或賣出任何股票的建議,並且不考慮您的目標或財務狀況。我們旨在爲您帶來基於基礎數據驅動的長期聚焦分析。請注意,我們的分析可能未考慮最新的價格敏感公司公告或定性材料。Simply Wall St對提及的任何股票都沒有持倉。

譯文內容由第三人軟體翻譯。

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Alarm.com Holdings shareholders is that EBIT margins have grown from 7.7% to 11% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Alarm.com Holdings shareholders is that EBIT margins have grown from 7.7% to 11% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.