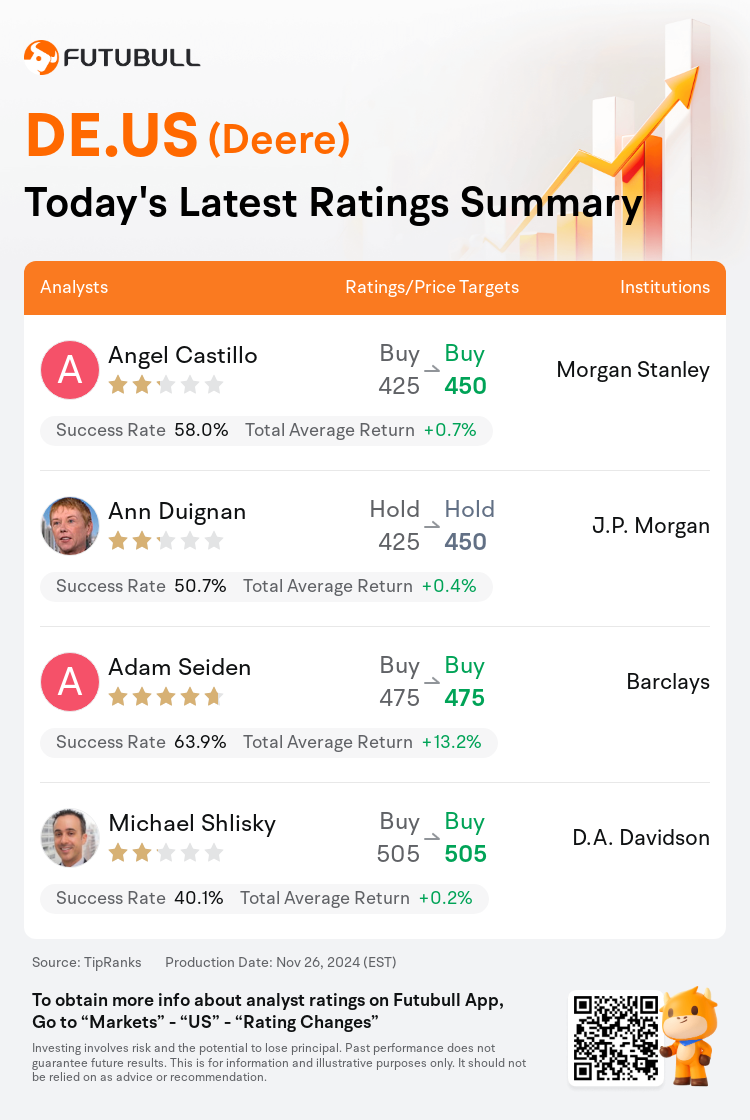

On Nov 26, major Wall Street analysts update their ratings for $Deere (DE.US)$, with price targets ranging from $450 to $505.

Morgan Stanley analyst Angel Castillo maintains with a buy rating, and adjusts the target price from $425 to $450.

J.P. Morgan analyst Ann Duignan maintains with a hold rating, and adjusts the target price from $425 to $450.

Barclays analyst Adam Seiden maintains with a buy rating, and maintains the target price at $475.

Barclays analyst Adam Seiden maintains with a buy rating, and maintains the target price at $475.

D.A. Davidson analyst Michael Shlisky maintains with a buy rating, and maintains the target price at $505.

Furthermore, according to the comprehensive report, the opinions of $Deere (DE.US)$'s main analysts recently are as follows:

Despite Deere's FY25 implied EPS guidance of $18-$20 not meeting consensus, it matches buyside expectations and accounts for global agricultural market challenges. The Q4 results and guidance suggest that normalized EPS may reach the mid-20s, reinforcing a positive outlook.

Following the Q4 earnings, the risk-reward appears balanced with few surprises in the quarter and the guidance. Despite ongoing challenges as FY25 begins, Deere has effectively positioned itself to meet retail demand in rapidly evolving markets.

Post fiscal Q4 report, Deere's shares are expected to potentially command a premium over core market valuations as the clarity on the lowest expected values ('trough' math) emerges. However, there appears to be some downside risk associated with Deere's guidance for the latter half of fiscal 2025, which may challenge it being surpassed.

The analyst notes that the cyclical framework is in alignment with Deere's guidance, with Brazil showing signs of stabilization and a positive pricing outlook for 2025.

Deere is approaching FY25 from a strong footing after successfully implementing its targeted underproduction strategy in Q4. Although the future projections aren't entirely positive, the guidance includes an expectation for production pacing to align with demand. This outlook is seen as conservative, likely representing the 'last major reduction,' which aids in the cyclical adjustment of its valuation.

Here are the latest investment ratings and price targets for $Deere (DE.US)$ from 4 analysts:

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

美東時間11月26日,多家華爾街大行更新了$迪爾股份 (DE.US)$的評級,目標價介於450美元至505美元。

摩根士丹利分析師Angel Castillo維持買入評級,並將目標價從425美元上調至450美元。

摩根大通分析師Ann Duignan維持持有評級,並將目標價從425美元上調至450美元。

巴克萊銀行分析師Adam Seiden維持買入評級,維持目標價475美元。

巴克萊銀行分析師Adam Seiden維持買入評級,維持目標價475美元。

戴維森信託分析師Michael Shlisky維持買入評級,維持目標價505美元。

此外,綜合報道,$迪爾股份 (DE.US)$近期主要分析師觀點如下:

儘管迪爾股份的2025財年隱含每股收益指引爲18-20美元未達到市場一致預期,但符合買方的期望,並考慮到全球農產品市場的挑戰。第四季度的結果和指引表明,正常化的每股收益可能達到中20美元,這強化了積極的前景。

在第四季度收益公佈後,風險與回報的平衡看起來相對合理,本季度及指導中沒有太多驚喜。儘管隨着2025財年的開始仍面臨持續挑戰,迪爾股份已有效地定位自身以滿足快速變化市場中的零售需求。

在財年第四季度報告之後,預計迪爾股份的股票可能會在覈心市場估值之上具有溢價,因爲有關於最低預期值(「谷底」數學)的清晰度逐漸顯現。然而,迪爾股份針對2025財年後半段的指引似乎伴隨着一些下行風險,這可能會挑戰超越其指引的可能性。

分析師指出,週期性框架與迪爾股份的指引一致,巴西出現了穩定跡象,並對2025年的定價前景持積極態度。

迪爾股份在第四季度成功實施其目標性減產策略後,正以強有力的基礎接近2025財年。儘管未來的預測並不是完全樂觀,但指引中包含了生產節奏與需求相匹配的預期。這一前景被視爲保守,可能代表着「最後一次重大減產」,這有助於其估值的週期性調整。

以下爲今日4位分析師對$迪爾股份 (DE.US)$的最新投資評級及目標價:

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

巴克萊銀行分析師Adam Seiden維持買入評級,維持目標價475美元。

巴克萊銀行分析師Adam Seiden維持買入評級,維持目標價475美元。

Barclays analyst Adam Seiden maintains with a buy rating, and maintains the target price at $475.

Barclays analyst Adam Seiden maintains with a buy rating, and maintains the target price at $475.