These Analysts Slash Their Forecasts On Applied Materials Following Q4 Earnings

These Analysts Slash Their Forecasts On Applied Materials Following Q4 Earnings

Applied Materials, Inc. (NASDAQ:AMAT) reported better-than-expected fourth-quarter results after Thursday's closing bell.

應用材料公司(納斯達克股票代碼:AMAT)在週四收盤後發佈了好於預期的第四季度業績報告。

Applied Materials reported quarterly earnings of $2.32 per share, which beat the analyst consensus estimate of $2.19. Quarterly revenue clocked in at $7.05 billion, which beat the analyst consensus estimate of $6.95 billion and is an increase over sales of $6.72 billion from the same period last year.

應用材料報告的季度每股收益爲2.32美元,超過了分析師共識預期的2.19美元。季度營業收入達到70.5億元,超出了分析師共識預期的69.5億元,並且相比去年同期的67.2億元有所增長。

"Applied Materials' technology leadership and strong execution drove record Q4 and fiscal 2024 performance, our fifth consecutive year of growth," said Gary Dickerson, president and CEO.

"應用材料的技術領先地位和強大執行力推動了Q4和2024財年的創紀錄表現,這是我們連續第五個增長年," 總裁兼首席執行官Gary Dickerson說。

For the first quarter of fiscal 2025, Applied expects net revenue to be approximately $7.15 billion, plus or minus $400 million. Non-GAAP diluted EPS is expected to be approximately $2.29, plus or minus 18 cents.

對於2025財年第一季度,應用材料公司預計淨營業收入約爲71.5億美元,加減40000萬美元。預計非通用會計原則下的攤薄後每股收益約爲2.29美元,加減18美分。

Applied shares gained 1.8% to close at $186.00 on Thursday.

應用材料的股價於週四上漲1.8%,收於186.00美元。

These analysts made changes to their price targets on Applied Materials following earnings announcement.

這些分析師在應用材料發佈業績公告後調整了他們的價格目標。

- Needham analyst Charles Shi maintained the stock with a Buy and lowered the price target from $240 to $225.

- Deutsche Bank analyst Sidney Ho maintained the stock with a Hold and lowered the price target from $220 to $200.

- Morgan Stanley analyst Joseph Moore maintained Applied Materials with an Equal-Weight rating and cut the price target from $185 to $179.

- B of A Securities analyst Vivek Arya maintained the stock with a Buy and lowered the price target from $220 to $210.

- Wells Fargo analyst Joseph Quatrochi maintained the stock with an Overweight and lowered the price target from $235 to $220.

- Needham分析師Charles Shi維持了該股的買入評級,並將價格目標從240美元降至225美元。

- 德意志銀行分析師Sidney Ho維持了該股的持有評級,並將價格目標從220美元降至200美元。

- 摩根士丹利分析師Joseph Moore維持對應用材料的等權評級,並將價格目標從185美元下調至179美元。

- 美國銀行證券分析師Vivek Arya維持買入的股票評級,並將價格目標從220美元降低到210美元。

- 富國銀行分析師Joseph Quatrochi保持股票的超重評級,並將價格目標從235美元下調至220美元。

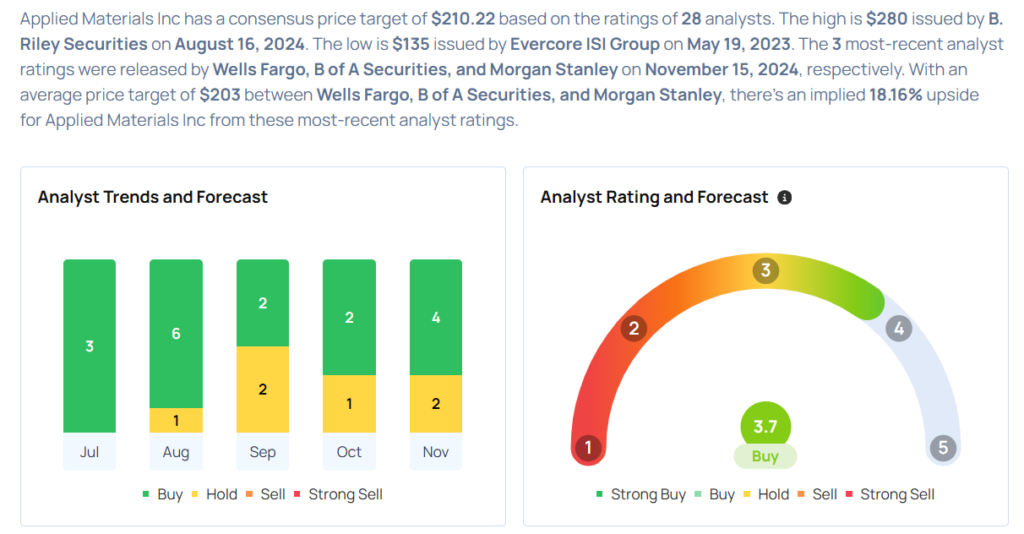

Considering buying AMAT stock? Here's what analysts think:

考慮購買應用材料股票?以下是分析師的看法:

Read More:

閱讀更多:

- Dow Dips Over 200 Points Following Economic Reports, Tesla Tumbles On Potential Removal Of EV Tax Credit: Fear Index Remains In 'Greed' Zone

- 道瓊斯指數因經濟報告下跌逾200點,特斯拉因可能取消電動車稅收優惠而跌至'貪婪'區域

譯文內容由第三人軟體翻譯。

For the first quarter of fiscal 2025, Applied expects net revenue to be approximately $7.15 billion, plus or minus $400 million. Non-GAAP diluted EPS is expected to be approximately $2.29, plus or minus 18 cents.

For the first quarter of fiscal 2025, Applied expects net revenue to be approximately $7.15 billion, plus or minus $400 million. Non-GAAP diluted EPS is expected to be approximately $2.29, plus or minus 18 cents.